What is a CFD?

A CFD is a contract for difference, an agreement between two parties to exchange the difference in a market’s price from when the contract is opened to when it is closed.

You buy and sell these contracts in the same way that you'd buy and sell in the underlying market. The main difference is that you’ll never take ownership of the underlying asset, which means that you can take a position on both rising and falling markets.

What are CFD instruments?

CFD instruments are contracts for assets that have a monetary value. CFDs themselves are instruments, as they can be traded between two parties, and have a monetary value assigned to them.

But the term is commonly used interchangeably with ‘markets’ to describe what you’ll be taking a position on. Examples are:

- Cash instruments, such as shares and bonds

- Other derivatives, such as forwards, futures and options

- Forex instruments, such as spot contracts and swaps

When you trade CFDs with City Index, you’ll be able to trade more than 6,300 global markets – including indices, shares, commodities and bonds – without taking ownership of any physical assets.

What is a CFD trade?

A CFD trade is the speculative position taken on an asset using a contract for difference. There are two types of CFD trades you can open: a long position or a short position.

Long CFD position

A long CFD position involves buying an instrument in the belief that it will rise in value so you can close the trade later on at a higher price. It’s similar to the more traditional buy-and-hold investment strategies, except a CFD position is generally taken on a much smaller timeframe.

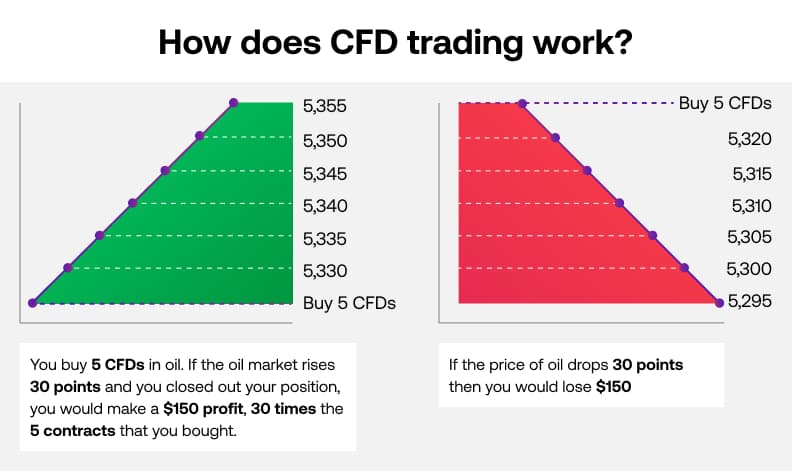

Long CFD position example

You think the price of oil is going to go up, so you place a buy trade of five oil CFDs for $53.25.

The market rises 30 points to $53.55, so you close out your position by selling your five contracts. When you close a CFD position, your profit (or loss) is the difference in the asset's price from when you opened it to when you closed it.

In this example, you opened at $53.25 and closed at $53.55, so you would make $30 for each contract you bought: a $150 profit (5 x $30).

However, if the market moved against you by 30 points and the price of oil dropped to $52.95, you would lose $150.

Short CFD position

In traditional investing, you’re buying an asset, so will only profit if the price goes up. However a key difference between CFDs and stock trading, is that with CFDs you can sell an asset if you think it will fall in value. This is known as going short and enables you to make a profit from falling prices.

Shorting with CFDs works in the same fundamental way as going long. But instead of buying contracts to open your position, you sell them. In doing so, you’ll open a trade that earns a profit if the underlying market drops in price – but a loss if it rises.

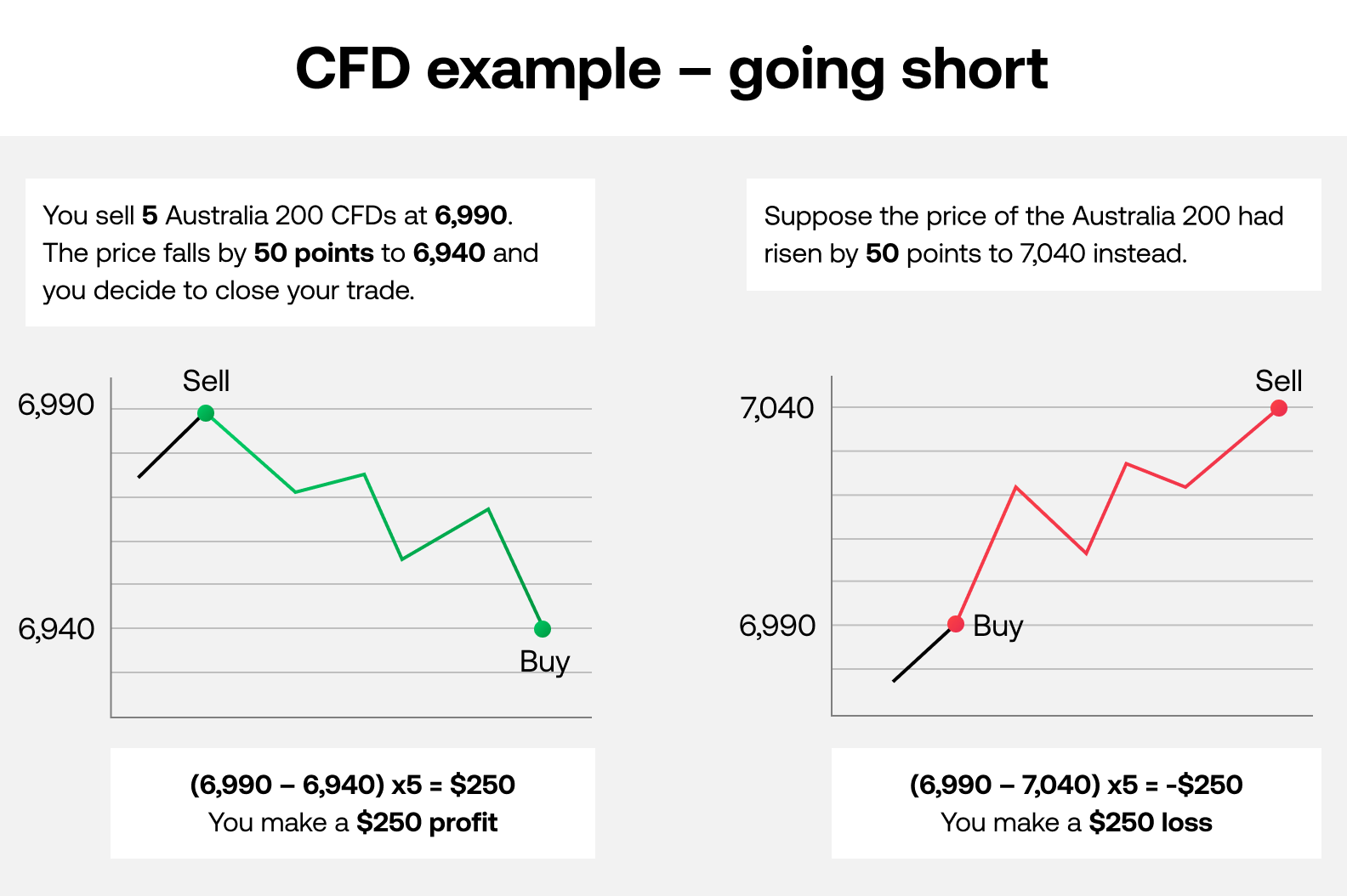

Short CFD position example

The Australia 200 (our market on the ASX 200) is at 6,990, but you believe that it is about to fall as you expect the upcoming earnings season to disappoint.

So, you sell five Australia 200 CFDs at 6,990.

Your prediction is correct, and the Australia 200 falls to 6,940. When you sell CFDs, you’re still agreeing to exchange the difference in an asset’s price, but you earn a profit if the market falls and a loss if it rises.

The Australia 200 has fallen 50 points, so you earn $50 for each of your five contracts – a profit of $250.

But what would have happened if the index had risen 50 points instead? You would lose $50 for each of your five CFDs, a total loss of $250.

What is a CFD position size?

You set the size of a CFD position by choosing the number of contracts you want to buy or sell.

The size of a single CFD will change depending on your asset class. For example, in spot forex 100,000 units are the equivalent of a standard lot.

The greater your position, the more capital you’ll need to pay to open the trade.

CFD prices explained

You’ll see two prices listed for every CFD market: the buy (or ask) price and the sell (or bid) price. To open a long position, you trade at the buy price. To go short, you trade at the sell price.

When you want to close, you do the opposite of when you opened. So, if you’d bought, you would sell. If you’d sold, you would buy.

The buy price will always be slightly higher than the market’s current level, while the sell price will be a bit below. The difference is called the spread.

What are CFD spreads?

The spread is one of the key costs involved in trading CFDs. It’s the difference between the 'buy' and 'sell' price of a financial instrument, collected by a broker.

For example, if a buy price is $1.50 and a sell price is $1.40, the spread is $0.10.

It’s important to understand what spread you’re being quoted, as it directly relates to your trading costs.

What are CFD fees?

There are a few other CFD fees you’ll pay beside the spread. Some of the main fees you’ll pay are:

- Commission – for standard accounts, commission is only charged on share CFDs and is based on the overall trade value.

- Overnight financing – is a charge to cover the cost of holding a leveraged position open overnight

- Rolling CFD futures – is a way of holding a futures position open beyond expiry by carrying it into the following contract, but incurs a charge

- Guaranteed stop loss orders – is a type of stop loss order that is free to attach but incurs a fee if triggered

See our full list of trading costs

What is leverage in CFD trading?

CFDs are a leveraged product, which means you can open a trade by paying just a small fraction of its total value.

In other words, you can invest a smaller amount of money to trade a position higher in value. This will magnify your return on investment, but it will also magnify your losses. So, you should make sure to manage your trading risk accordingly.

Let’s return to our oil example above to see how this works in practice. Buying five oil CFDs at $53.25 would give you a total position size of $266.25 (5 x $53.25). Because CFD trading is leveraged, you would only have to put up a fraction of that, known as your margin.

If oil requires a 10% margin, then you’d only need to pay 10% of $266.25 to open your trade: $26.63.

Find out more about CFD leverage.

Australia CFD regulation

You can trade CFDs in Australia, but there are some regulations to be aware of.

There are limits on how much leverage a broker can offer a retail trader. These are :

- 30:1 for major currency pairs

- 20:1 on minor pairs, gold and major stock indices

- 10:1 on commodities (other than gold) and minor indices

- 5:1 on shares and other assets

- 2:1 on cryptocurrencies

There are restrictions prohibiting CFD brokers in Australia from offering promotional inducements such as rewards or gifts to retail clients (information services and educational tools are excluded from this).

Brokers must also provide certain risk management measures as default on all retail accounts. So, if the funds in your CFD account are less than 50% of the margin required to cover all your open positions, one or more of your positions will be closed. Plus, your account will have negative balance protection applied, meaning that your losses cannot exceed your deposits.

This is why it’s always important to ensure you’re trading with a trusted Australian CFD provider. City Index is fully authorised and regulated in Australia since 2006.

CFD trading for beginners in Australia

To start CFD trading as a beginner in Australia you need to:

- Make sure you know how to trade CFDs properly, and look at some CFD example trades

- Have a detailed trading plan and strategy in place

- Research the markets you want to trade

- Understand the risk management tools at your disposal

- Practice trading in a demo account first

You should only start trading using a live account if you’re confident putting real capital at risk.