CFD commission vs the spread

There are two ways you can pay to open or close a CFD trade, either a commission or through the spread. Which method you’ll use depends on the asset class you’re trading:

- Indices, currencies, commodities, and bonds are commission free. You only pay the spread on these markets

- Share CFDs are subject to commission charges. This commission charge is based on the overall value of the trade

Learn more about how to trade CFDs.

What is CFD commission?

CFD commission is the fee you’ll pay when opening and closing a contract for difference (CFD) position on equities. The amount of commission you’ll pay depends on where your share is listed. There is also a minimum CFD commission charge in place. For most equities, the charges are as follows:

| Country | Rate | Minimum |

|---|---|---|

| USA | USD 0.02 per share | $8 USD |

| Australia | 0.09% | AU$ 5.00 |

| New Zealand | 0.10% | NZ$ 10 |

| Hong Kong | 0.15% | HK$ 15 |

| Singapore | 0.08% | S$ 10* |

| Japan | 0.05% | ¥ 1,000 |

| United Kingdom | 0.10% | £ 10 |

| Europe | 0.10% | € 10 |

You can also find commission details for any asset on the Market 360 tab in the City Index platform. Don’t have an account? You can access the platform for free with a CFD demo trading account.

For UK, European and Asian stocks, your commission is charged as a percentage of the total size of your position. For US stocks, you’ll pay a set number of cents for every CFD you purchase.

CFD commission example

Say, for instance, that you want to buy 100 CBA CFDs when the stock is at $101. The total value of your position is (100 * $101) $10,100, and CBA has a CFD trading commission of 0.09%, so you’d pay (0.09% of 10,100) - $9.09.

You buy 100 CFDs in CBA at $101 |

|

|---|---|

| Trade value: 100 x 101 =$10,100 | Commission charge @ 0.09% = $9.09 |

If you only wanted to trade 50 CBA CFDs, meanwhile, then you’d pay the minimum commission of $5.

But what if you were trading a US share CFD? As we covered above, your commission here is calculated based on how many shares you’re trading. For example, if you wanted to sell 1,000 Amazon CFDs, you’d pay (2c * 1,000) $20.

US equity CFDs have a minimum commission of $8. If you sold 300 Amazon CFDs instead, you’d pay $8.

Spreads in CFDs

City Index quotes a two-way price on all our markets, a bid price and an offer price.

- You trade at the bid to sell a market

- You trade at the offer to buy a market

The spread is the difference between the sell and the buy prices. On commission-free asset classes, the spread is in effect your cost of trading the market. The tighter the spread, the quicker the trade can potentially move into profit-earning territory.

On share and ETF CFDs, the spread simply reflects the difference between the buy and sell prices of the underlying market.

Other CFD fees

CFD commissions aren’t the only cost you may encounter on your trading journey. Let’s examine a few other key CFD fees, including overnight funding, guaranteed stops, rollovers and more.

CFD overnight fee

CFDs have an overnight fee that you pay if you hold a position open for more than a single day. Essentially, it is an interest payment to cover the cost of the CFD leverage that you use overnight. You may also see this referred to as your cost of carry, overnight funding, rollover fees or CFD holding costs.

There is no financing charge for CFDs with expiry dates (forwards). Instead, these contracts have wider spreads as the cost of carry has been incorporated into the price.

The CFD overnight fee is charged at the equivalent base rate of your instrument +2.5% on long positions. You will alternatively ‘receive’ the rate benchmark -2.5% on short positions. The percentage will be calculated based on the size of your trade at end of the day, and divided by 365 to get a daily rate.

These are the rate benchmarks for markets in priced EUR, GBP, JPY, SGD and USD:

| CURRENCY | NEW BENCHMARK |

|---|---|

| EUR | €STR |

| GBP | SONIA |

| JPY | TONAR |

| SGD | SORA |

| USD | SOFR |

| AUD | LIBOR |

However, when underlying interest rates are low a daily financing fee is charged rather than paid to you on short positions.

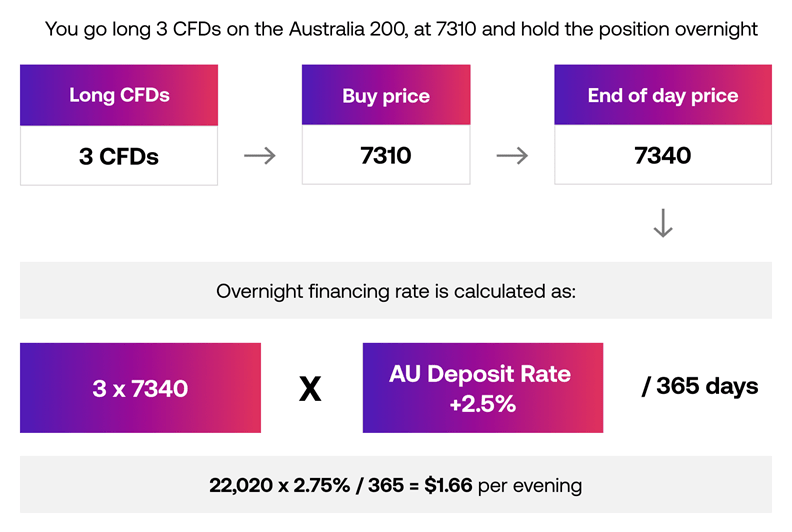

CFD holding costs example

You decide to buy three CFDs on the Australia 200 at 7,310. The trade is doing well and its price has increased to 7340 by the end of the day. However, it is still some way from your target price of 7,380. You decide to keep the position open overnight.

The value of your position at close is (7,340 * 3) 22,020. To calculate your overnight financing, you add 2.5% to the current AU Deposit rate, multiply that percentage by 22,020, then divide that figure by 365.

If the AU deposit rate is 0.25%, then:

- 0.25% + 2.5% is 2.75%

- 2.75% * 22,020 is 605.55

- 605.55/365 is $1.66

- Your overnight financing charge is $1.66

You can see full financing charges for any market on its Market360 on the City Index platform.

Financing on a long CFD position

You must have sufficient funds in your account to cover both your open positions and any financing charges you may incur, or your position could be closed out.

The daily financing fee will be applied to your account each day that you hold an open position (including weekend days).

Learn more about overnight finance.

Guaranteed stop loss orders (GSLO)

There is no charge for placing standard orders such as stops and limits. There is, however, a charge for using a guaranteed stop loss order (GSLO).

These are charged if your GSLO triggers and are non-refundable.

CFD futures contract rollover

When CFD futures contracts are near to expiry, you can, if you wish, roll your trade into the following contract. You can do this by selecting the auto–-roll tick box in the order ticket. You’ll pay half the spread to carry out this transaction.

- If you’re going long, your position will be closed at the mid-price and re-opened in the next contract at the buy price

- If you’re going short, your position will be closed at the mid-price and opened again at the sell price in the following month

It’s cheaper to roll over to the next contract than to close the trade yourself and then reopen it. This is because when closing and opening a trade manually, you pay the full spread, whereas by "rolling over" you only pay half.

For example, you have decided to roll over your long March CFD position in Company XYZ into the next contract.

Automatic rollover

| June contract | Close at mid-price | August contract |

|---|---|---|

| 1938/1942 | 1940 | 1946/1948 |

| Open price | Spread paid |

|---|---|

| 1948 | 8 |

Manual close & re-open

| June contract | Close price | August contract |

|---|---|---|

| 1938/1942 | 1938 | 1946/1948 |

| Open price | Spread paid |

|---|---|

| 1948 | 10 |

At the time of the rollover June price is 1938 / 1942 and the August price is 1946 / 1948. Your long CFD position is closed at the June mid-price of 1940.

Any P&L as a result of a Futures contract trade is registered on your account automatically.

Had you closed the trade yourself, you would have closed at 1938, before reopening at 1948, therefore paying a wider spread.

Ready to start trading CFDs? Open a live account here, or try a free demo.