Trade bonds with City Index

-

Range of markets

Speculate on UK Long Gilt, US T-note and Euro Bund markets.

-

No commissions on CFD trading

Trade bonds commission-free and trade with margin from just 20% on bonds markets.

-

Go long or short

Profit from both rising and falling bonds

Bonds explained

-

Trade on leverageTake advantage of leveraged trading products to speculate on the future price of bonds.

-

Diversify your portfolioTrading on price movements in bonds allows you to diversify your investment portfolio.

-

A regulated providerCity Index is regulated by the Australian Securities & Investment Commission

Latest bonds market news and analysis

Latest research

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

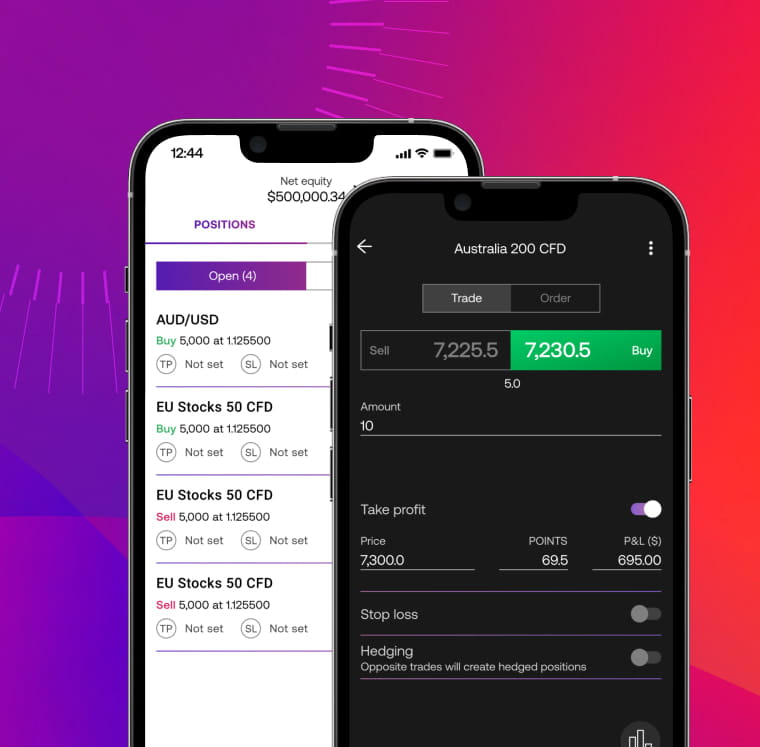

Mobile trading app

Seize trading opportunities with our easy-t-use mobile apps, with simple one-swipe trading, advanced charting, and seamless execution. Available on Android and iOS.

Portable TradingView charts

Access the industry leading TradingView charting package, complete with 80+ custom technical indicators, drawing tools and trading through charts.

Multi-device dealing

Manage your trading account across desktop, mobile and tablet without interruption.

Actionable market analysis

Receive all the latest market news and expert commentary direct from Reuters in-app.

Frequently asked questions

What makes bond markets move?

The main mover of bond markets is interest rates. Interest rates impact the value of bonds heavily, even though the instalments paid back to the bond buyer never actually change.

If interest rates are high and the interest rate of the bond is significantly lower, it’s going to make buying that bond less attractive to investors. If interest rates are lower than bond rates, buying a bond look more profitable for investors.

What should you know before investing in bonds?

Before you invest in bonds, you’ll want to make sure you fully understand how the bond market works, and the key information for your chosen investment – including its coupon rate, when it matures and its credit rating.

It’s also worth checking current interest rates, and guidance on where rates might head next, to ensure that your bond is a good investment. Remember, bonds involve lending your capital to a government or company until a set date that may be in the long-term future – so it’s worth doing your homework now.

With City Index, you can trade on bond prices over the short term instead of investing in them directly. Learn more about how bond trading works.

What are the types of bonds?

There are two main types of bonds: corporate and government. As the names suggest, corporate bonds are sold by companies and government bonds are sold by countries. There are other categories – such as municipal bonds and agency bonds – but these are the most common.

In general, corporate bonds are seen as the riskier option as it is more likely that a company will default on its loans than a country. However, government bonds can also be risky, so it’s always worth checking the credit rating of the market you’re planning on trading.