Market-leading pricing

Competitive, transparent pricing

Competitive pricing on 6,300+ global markets

We offer both fixed and variable spreads depending on the market you wish to trade.

Fixed spreads don't change according to market conditions such as volatility or liquidity. Fixed spreads may either be offered for a defined period of the day, or throughout trading hours.

Variable spreads may fluctuate throughout the day according to different factors such as underlying liquidity or market volatility. With variable spreads, City Index will quote you the minimum spread it could be, plus an average spread for a defined historical period of time.

Visit our Help and Support section for more information.

Margin (Step margin)

Margin is the amount of money available in your trading account to open a position. Find out more about margin and leverage.

The larger the trade size, the higher the risk level associated with the trade. Therefore we may increase our margin requirements for larger size trades or any additional trades in that instrument. The table to the right shows an example of how this may work.

Please note margin requirements can vary depending on the risks associated with the underlying market. For details of the exact margin requirements on all of our markets, please view the market information sheet in the platform.

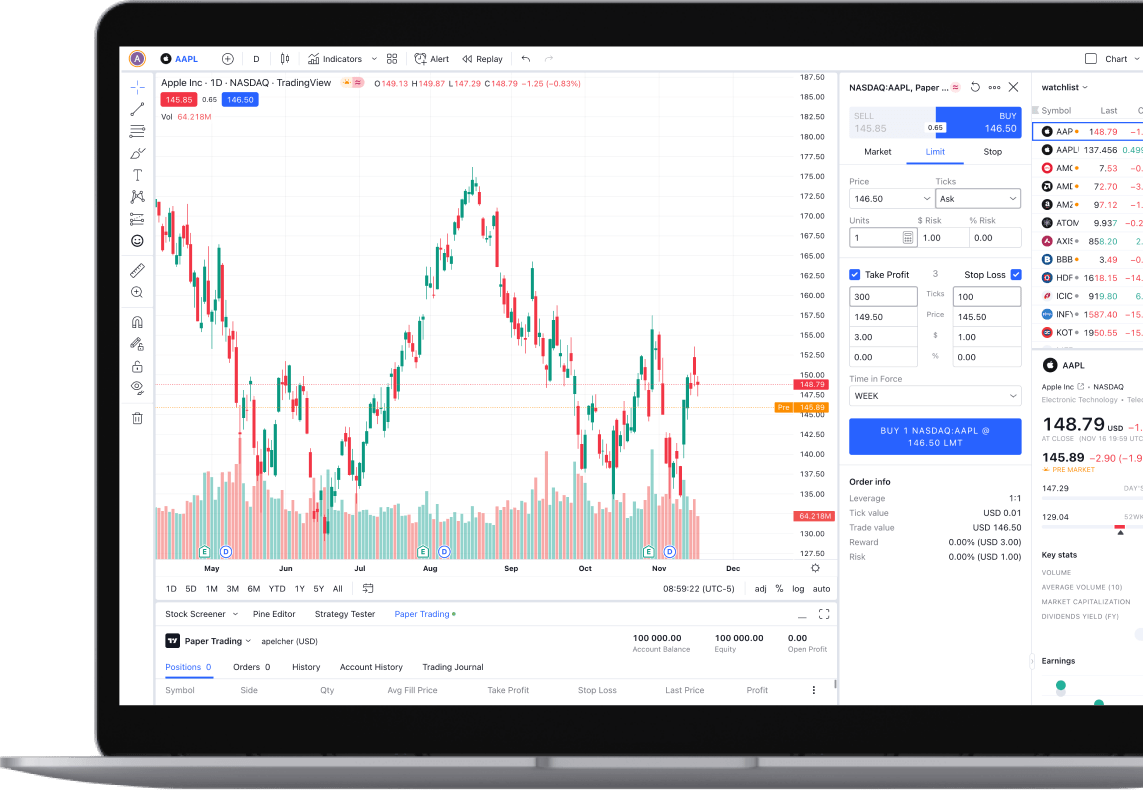

TradingView

If you’re using TradingView to place trades, then different spreads and pricing may apply to markets. Please refer to the Market Information Sheet for each market in the TradingView platform.

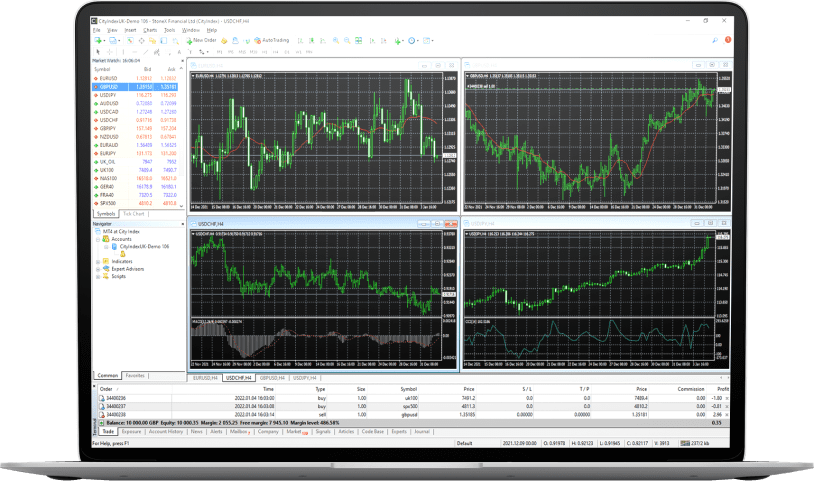

MT4

If you’re trading on the MetaTrader 4 platform, then different spreads and pricing may apply to markets. Please refer to the Market Information Sheet for each market in the MT4 platform.

FAQs

What is the spread?

The spread is the difference between the buy price and the sell price of a market and is in effect the cost of trading that market. We quote a two way price on all our markets, the bid price at which you can sell and the offer price at which you can buy. The tighter the spread between the two, the quicker the trade can move into profit earning territory.

What spreads does City Index charge?

City Index may offer both fixed and variable spreads, depending on the market you wish to trade.

Fixed spreads don't change according to market conditions such as volatility or liquidity. Fixed spreads may either be offered for a defined period of the day, or throughout specific trading hours. Spreads may be wider in less popular and during less liquid trading hours.

For example, the Australia 200 has a fixed spread of 1 point between 9.50am and 4.30pm. See Indices for details.

Variable spreads may fluctuate throughout the day according to different factors such as underlying liquidity or market volatility. With variable spreads, when City Index lists a spread we will quote you the minimum spread it could be, plus an average spread for a defined historical period of time.