Other markets

-

Bonds

Take a position on bonds like UK Long Gilt, Euro Bund and US T-Bonds

-

ETFs

Trade a basket of assets – such as stocks – in a single position with our range of exchange traded funds.

-

Interest rates

Speculate on interest rates with tight spreads from 0.02pts

Why trade bonds and interest rates?

-

Trade other markets on leverage

Start trading bonds, rates and other markets with as little as 5% margin requirement, meaning you can open a position with just a fraction of the trade’s value. -

Profit from falling markets

Unlike traditional share dealing, with City Index you can profit from falling as well as rising markets. -

Diversification

Trade a range of alternative markets including government-issued debt and interest rates, to give your portfolio added diversity.

News and analysis

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

Ways to trade other markets

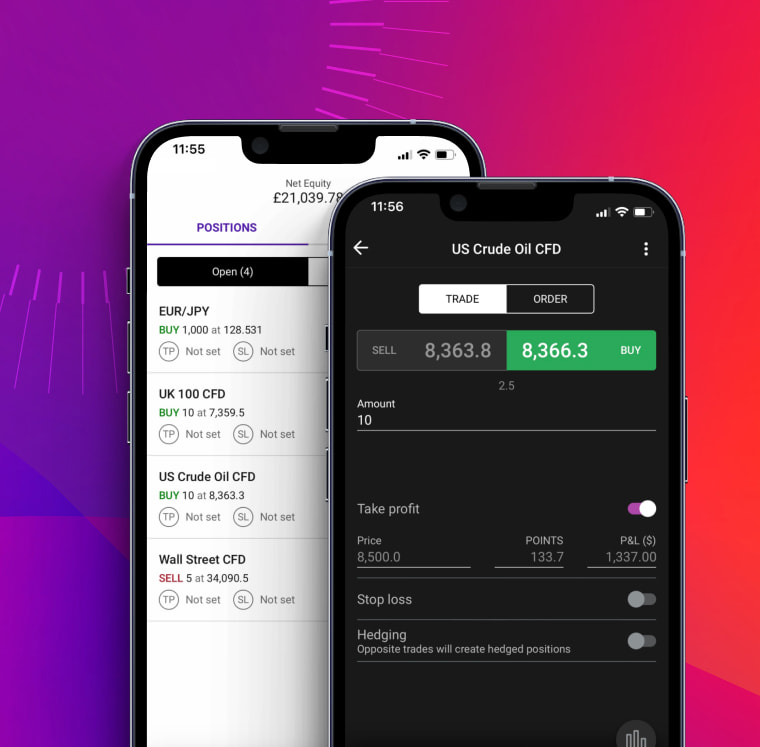

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

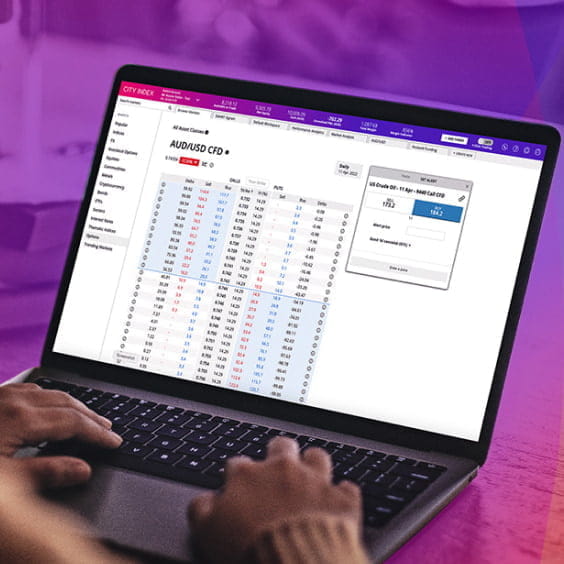

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade other markets with City Index

Whether you’re a new or experienced trader, it’s easy to open an account with City Index. All you have to do is complete our short, secure online form and you could be up and running on the live markets in minutes.

If you think a specific market is going to go up in value, you go long or ‘buy’. If you think a specific market is going to go down in value, you short or ‘sell’ it. Ready to start trading now? Get started with your application.

What are bonds?

Discover how to speculate on government-issued debt notes such as Euro Bund, UK Long Gilt and US T-Notes with our guide to bond trading.

What are interest rates?

Interest rates are one of the financial world's most trusted safe havens in times of volatility, with competitive spreads from just 0.02pts.

What are options?

Want to trade options but don’t know where to start? Discover what options are and how to open your first position with our complete guide to options trading.

Other markets FAQ

What moves interest rate markets?

Interest rate market prices reflect where traders think interest rates will be in the near future. For example, if Short Sterling is at 95 then it means that the markets expect the Bank of England base rate to be at 5%.

So, anything that makes it more likely that a central bank will move interest rates will usually play out on its relevant market. That can include guidance by central banks, economic health, inflation, employment and business confidence.

Why trade bonds?

Bonds are a hugely popular market among investors – can offer some powerful opportunities for traders too. Here are a few reasons to start trading bonds:

- The high number of trades means bond markets have deep liquidity

- With CFD trading and spread betting, you can short bonds if you think their prices will fall

- Take your position on economic performance and geopolitical risk

- Diversify your portfolio to spread out your overall risk

Ready to get started? Open your City Index account today.

Which market is best for trading?

There’s no best market for trading overall, it all depends on your unique preferences, skills and goals. If you want 24-hour trading with high liquidity, for example, forex might be the best option for you. If you want to trade some of the most-watched markets on the planet, you’d be better off with indices.

For an introduction to all the markets you can trade, head over to the City Index Academy.

If you have more questions visit the FAQ section or start a chat with our support.