A softer-than-expected ISM services report was the gift that Fed doves have been waiting for ahead of a key Nonfarm payroll report on Friday. It also made for a lively session on the eve of Independence Day, with liquidity expected to be much lower today heading into tomorrow’s employment data.

At 48.8, the headline ISM figure was its fastest pace of contraction since the pandemic in May 2020. New orders also slumped to 47.3, its lowest point since the pandemic, employment contracted a slightly faster pace of 46.1 and prices were a touch lower at 56.3. With signs that the employment sector is deteriorating elsewhere for the US, the places greater emphasis on tomorrow's nonfarm payroll report. And more specifically, the unemployment number will garner more interest than usual given that Powell said on Tuesday that 4% unemployment was still relatively low. And with the consensus estimate for unemployment to fall to 3.8%, markets will likely be very excited with a print of 4.1% or higher given the weak data have seen this week so far this week.

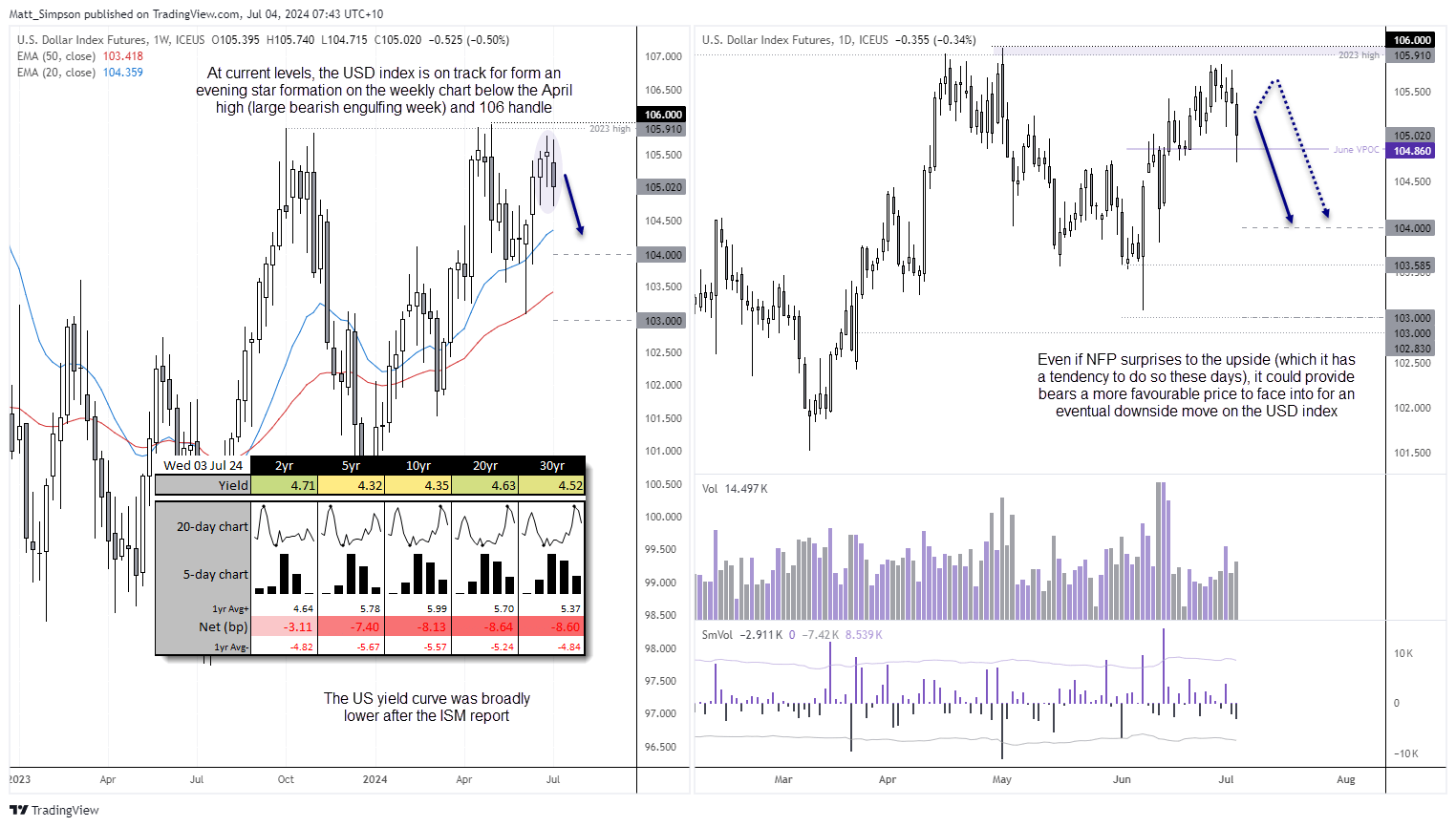

Naturally, this is exciting news for anyone seeking Fed cuts, even if it could suggest the Fed has finally broken something. Fed fund futures are now implying a 66.5% chance of a September cut, with a second cut in December implied with a 44.8% probability. Markets reacted accordingly: The US dollar index fell for the 5th consecutive time, during its worst session in three weeks. The US yield curve was broadly lower, with 10-year yields falling around 8 basis points. The two-year yield was three basis points lower. The 10-year yield now sits at 4.35%, which means it has now retraced around half of the gains made after Biden’s disastrous debate against Donald Trump.

USD Index technical analysis:

At current levels, the weekly chart is on track to break a four-week winning streak and complete a three-week bearish reversal pattern called an evening star formation. The fact that the market has failed to retest the large bearish engulfing candle high set in April, and therefore not retest 106, suggests that we could be looking at the early stages of a bearish reversal for the US dollar.

The daily chart shows momentum has clearly rolled over for the US dollar, even if the market rebounded back above the June VPOC (volume point of control). Given the bearish clues on the weekly chart, the US dollar index seems a market primed for bears to fade into rallies and seek moves down to the 104 or even 103 handles. We should factor in that NFP has a tendency to surprise to the upside these days, but even then, I doubt it will have the ability to simply smash 106. So, a hot NFP report tomorrow could provide a better entry for bears to fade into. Obviously, a weak NFP report could see downside momentum for the US accelerate.

Economic events (times in AEST)

- 11:00 – Australian trade balance, building approvals

- 15:45 – Swiss inflation

- 17:30 – German construction PMI

- 18:30 – UK construction PMI

- 19:00 – ECB Lane speaks

- 20:00 – UK General election

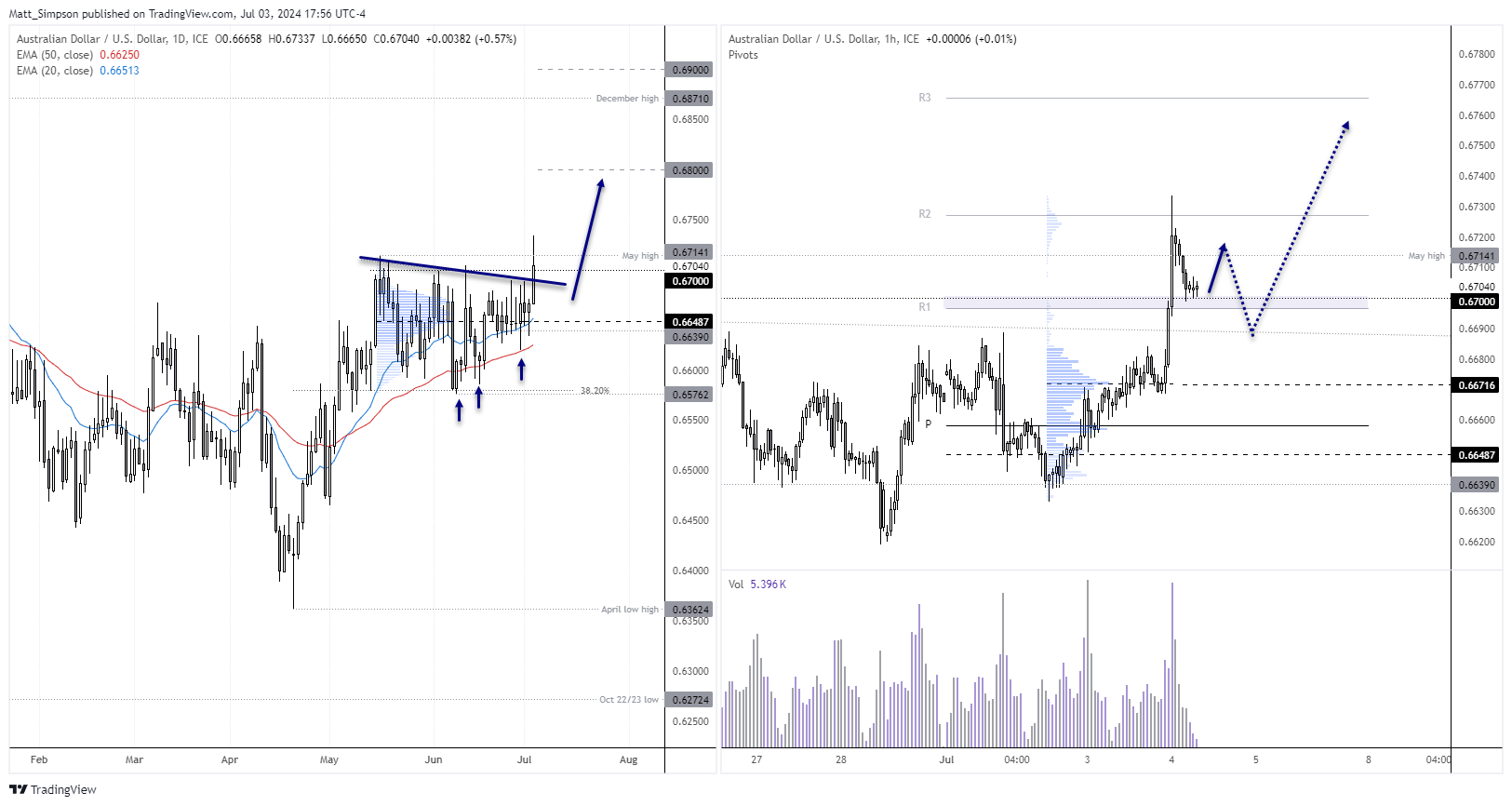

AUD/USD technical analysis:

The Australian dollar finally saw the upside break we've been anticipating. AUD/USD saw a clear break above 67c, although a higher wick has formed and price of now retraced very close to that level. Given US Independence Day holiday today and NFP tomorrow, we could find volatility on the lower side for now. But with the trend structure clearly pointing higher, the bias remains to buy dips the Aussie from move up to 68c or even 69c.

The one-hour chart shows that the acceleration higher was accompanied by very high volumes, which indicates that bulls were behind the move. The price retraced back to the monthly R1 pivot point and the 67 cents level, so perhaps we’ll get treated to a little bounce today. The question is whether we’ll see decent follow-through, given expectations of lower liquidity around the holiday period in the US. But with a strong bullish trend structure on the daily and one-hour timeframes, dips are likely to appear favourable to bullish swing traders.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade