- The Nikkei 225 has fallen to lows not seen since June

- It sits on a major support, making near-term price action potentially important for its longer-term trajectory

- Unless the macroeconomic environment improves, bias remains to sell-on-rallies

Nikkei 225 tumbles as macro headwinds blow

Bond yields ripping higher. Volatility lifting across multiple asset classes. Global growth and policy error concerns flaring. The Japanese yen strengthening suddenly, creating a potential new headwind for export earnings. It’s exactly the type of environment in which you’d expect the Nikkei 225 to struggle, explaining why Japan’s benchmark index has suddenly hit the skids on the charts. And what happens near-term could easily determine its longer-term trajectory with technical signals joining fundamentals in turning bearish.

Near-term price action may determine Nikkei 225 longer-term trajectory

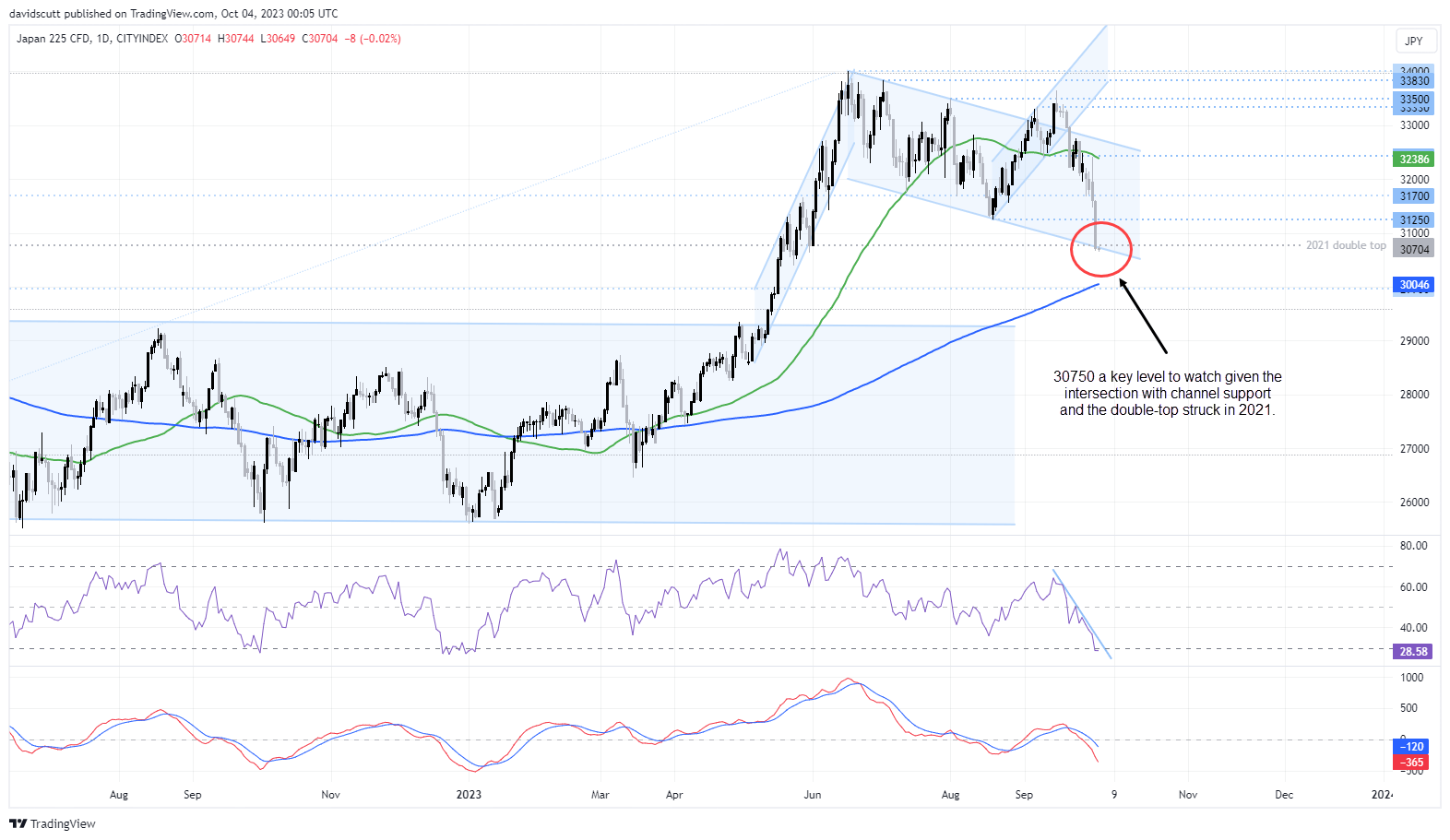

Looking at the daily, the index sits on a major level where channel support intersects with the double-top of 2011, falling to the lowest level since June on Tuesday. While marginally oversold looking at RSI, momentum is entirely to the downside, threatening to unravel the substantial gains seen for the Nikkei 225 over recent years.

A break of 30750 would see shorts targeting a move towards 30000, coinciding with prior resistance seen in late 2021. It’s also around where the 200-day MA resides, although the index has not paid significant attention to that level in recent years. Should the index find buyers around current levels, upside levels to watch include 31250 and 31700.

Depending on the near-term price action, a stop either side of 30750 would provide protection against the trade turning against you. The bias remains to sell-on-rallies until the macroeconomic climate becomes friendlier, which seems unlikely right now given trends in FX and bond markets.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade