US futures

Dow future -0.25% at 39062

S&P futures -0.37% at 5454

Nasdaq futures -0.40% at 19726

In Europe

FTSE -0.60% at 8128

Dax -1.28% at 18078

- Stocks fall with Fed Powell & JOLTS job openings in focus

- Treasury yields are elevated on the prospect of a Trump victory

- Tesla falls as China sales fall 24.2% YoY in June

- Oil rises to a 2-month high

Stocks falls ahead of Powell, job openings data

U.S. stocks are pointing to a lower open on Tuesday, amid elevated treasury yields and in cautious trade ahead of a speech by Federal Reserve chair Jerome Powell later today.

The Nasdaq100 briefly spiked over 20k again yesterday, boosted by gains in technology stocks; today, buyers are pausing for breath in cautious trade ahead of Powell's speech at the ECB conference.

The market will be watching whether the chief of the central bank addresses recent data showing a cooling in US inflation and the US economy. If he does, stocks could rise. However, recent speeches by policymakers have reiterated the need to see more signs of inflation cooling before cutting rates.

The speech comes ahead of the minutes of the June Fed meeting, which will be released on Wednesday and after the Fed forecast just one rate cut in 2024

Even so, the market is pricing in two rate cuts this year, with the first cut potentially as soon as September after recent weakness in U.S. data.

Attention is now on May job openings, which are due later today and will come ahead of Friday's nonfarm payroll report.

Elevated treasury yields could limit stocks' upside as the market becomes wary of a Trump victory in November’s elections. Another Trump Presidency could mean higher tariffs and spending.

Corporate news

Boeing is set to fall after reports that the US Justice Department has been waiting for the plane maker to accept a plea deal to settle for charges relating to two crashes of its 737 Max planes.

Tesla is set to open over 1% lower after the EV makers’ June sales of China-made electric vehicles fell 24.2% to 71,007, according to data from the China Passenger Car Association.

Paramount is set to open 4% higher on reports that billionaire Barry Diller is considering a bid for the firm.

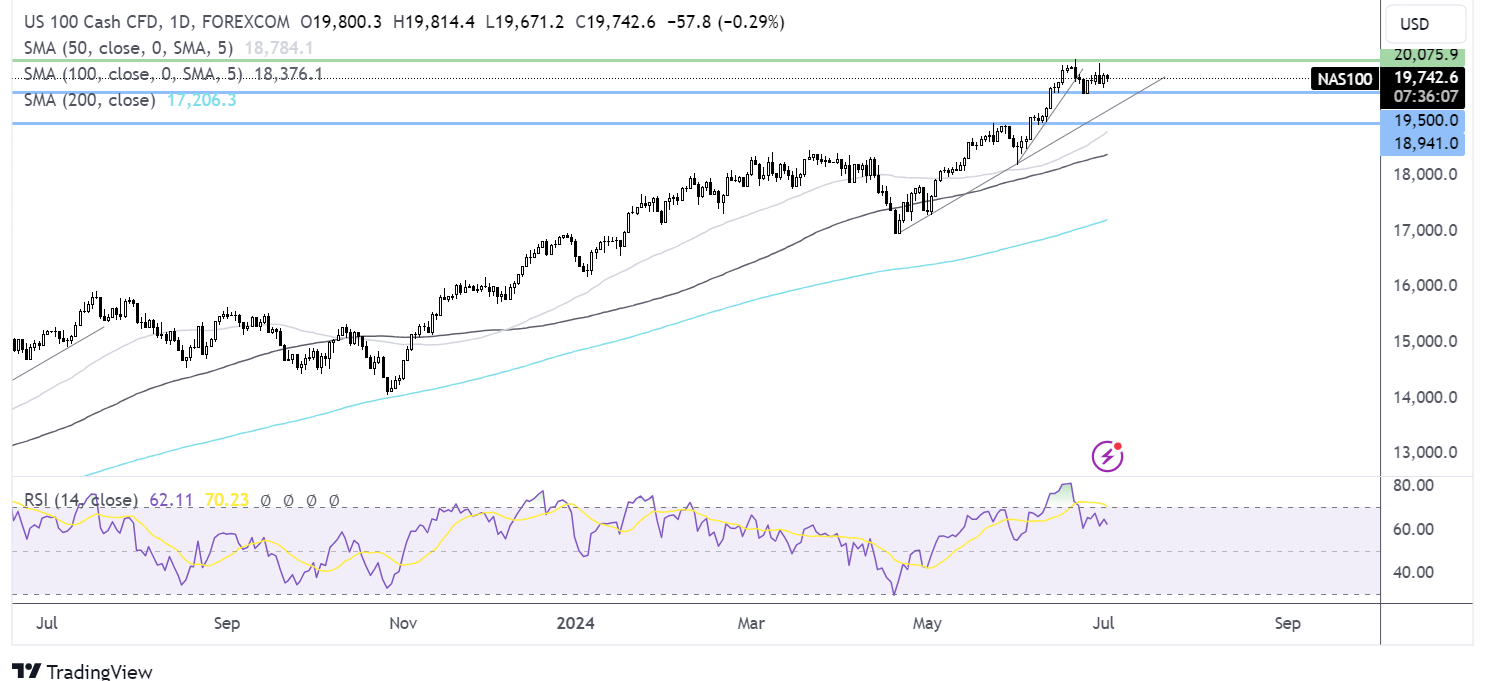

Nasdaq 100 forecast – technical analysis.

The Nasdaq 100 consolidates below 20k, bringing the RSI out of the overbought territory. Buyers will look for a rise above 20k to extend gains to fresh ATHS. Sellers will need to take out support at 19500 to extend losses towards 18900, the May high. A break below here could negate the uptrend.

FX markets – USD rises, EUR/USD falls

The USD is rising ahead of Fed Chair Jerome Powell’s speech, which could provide further clues about the timing of this year's first-rate cut. JOLTS job openings are expected to fall, which could drag on the USD.

EUR/USD is falling after eurozone inflation cooled in line with forecasts. Eurozone CPI eased to 2.5%, down from 2.6% after an acceleration in May. However, service sector inflation remains sticky at 4.1%. The data means the ECB is likely to leave rates unchanged at the July meeting, with ECB president Christine Lagarde saying yesterday that policymakers need more evidence that inflation is cooling to the 2% target before cutting further. Another rate cut from the ECB could come in September.

GBP/USD rising despite data from the BRC shows that UK shop inflation rose at its weakest level since October 2021. The BRC showed that annual shop price inflation rose 0.2% in June from 0.6% in May, marking the smallest increase in just under three years. The data comes as the Bank of England is assessing whether to start cutting interest rates for the first time since 2020. While CPI has eased to 2%, service sector inflation is still hot at 6%. The market is pricing in a 60% probability of a rate cut on the 1st of August.

Oil rises on demand optimism.

Oil prices rose to two-month highs on Tuesday, fueled by expectations of rising demand during the summer driving season and possible disruptions from hurricane Beryl.

Oil prices gained over 2% in the previous session and are extending those gains as the market expects US gasoline demands to ramp up as the summer travel season picks up with the Independence Day holiday this week. According to the American Automobile Association (AAA), travel in this holiday period is expected to be up 5.2% compared to 2023.

Meanwhile, markets are also eyeing possible disruptions to US refining and offshore production as Hurricane Beryl hits the Caribbean as a category 4 storm. As the hurricane approaches, concerns are rising surrounding the supply side of the oil equation.

Finally, expectations that the US central bank could start cutting interest rates as soon as September with two 25 basis points point rate cuts priced in helping to lift prices.