US futures

Dow futures -0.08% at 37782

S&P futures -0.19% at 5025

Nasdaq futures -0.30% at 17385

In Europe

FTSE -0.09% at 8138

Dax -0.78% at 17874

- Stocks fall after stronger-than-forecast ADP payrolls

- FOMC rate decision in focus

- Amazon beats forecasts

- Oil falls for a third straight day

ADP payrolls remain resilient, Fed decision in focus

US stocks are pointing to a weaker open as investors digest the latest ADP payroll report and weak consumer sentiment and look ahead to the Federal Reserve interest rate decision later today.

ADP private payrolls were stronger than expected at 192k, down from an upwardly revised 208k in March and ahead of forecasts of 175k. The data highlighted the ongoing resilience of the labour market.

Yesterday, data showed that U.S. consumer confidence slumped in April to its lowest level in two years. Consumers are increasingly concerned about the outlook for the jobs market, business conditions, and income. The deterioration in confidence comes as inflation has ticked higher in recent months.

Inflation rose over the first quarter and came in hotter than expected, and labour costs rose in the first three months of the year, adding to inflationary pressures. This, combined with the solid jobs market, supports the view that the Fed can be patient about raising interest rates.

The Fed is widely expected to leave interest rates unchanged at 5.25 to 5.5% 23. Given that no change is expected, the focus will be on Federal Reserve chair Jerome Powell's tone in the press conference and any guidance over when the Fed may start to cut rates.

The market is now pricing in just one rate cut of 25 basis points this year, down considerably from the 150 basis points of cuts expected at the start of the year. Meanwhile, the first rate cut is expected in November, whereas previously, the markets had been considering that the Fed could even start cutting rates in June.

Ahead of the interest rate decision, ISM manufacturing PMI data will be in focus. They are expected to show that growth slowed in the sector. The PMI jumped into expansion last month after 16 months of contraction.

Corporate news

Amazon is set to open 1.5% higher after the tech giant released quarterly earnings that beat expectations. Q1 sales rose 13% to $143.3 billion, ahead of the $142.5 billion expected, while net income tripled to $10.4 billion. The key Amazon Web Services cloud revenue segment grew 17% to $25 billion, well ahead of the 14.7% growth forecast. AWS AI capabilities are accelerating the growth rate in that business unit.

CVS Health is falling as earnings and guidance came in below expectations. The healthcare giant posted an EPS of $1.33, which is well below the expected $1.71, and revenue for the quarter was $88.41 billion, which was also short of estimates of $89.33 billion.

Estee Lauder beat quarterly expectations thanks to solid performance in the Asian market, particularly Asia travel retail, but the shares are falling pre-market as guidance was weaker than expected. EPS was $0.97 ahead of $0.49, and revenue for the quarter was $3.94 billion, up 5% year on year.

AMD and Super Micro Computer are falling on Wednesday, sparking a selloff in chip stocks amid disappointing earnings. AMD is down over 6% in premarket trading and on course to lose more than $16 billion in market value. AMD forecasts $4 billion in AI chip sales in 2024, which is well short of Wall Street's lofty expectations.

Super Micro Computer stock has risen almost 200% this year but is tumbling 11% after key through revenue missed forecasts. Executives from both firms said that supply constraints were hampering efforts to capitalize on the strong demand. Other AI stocks were falling.

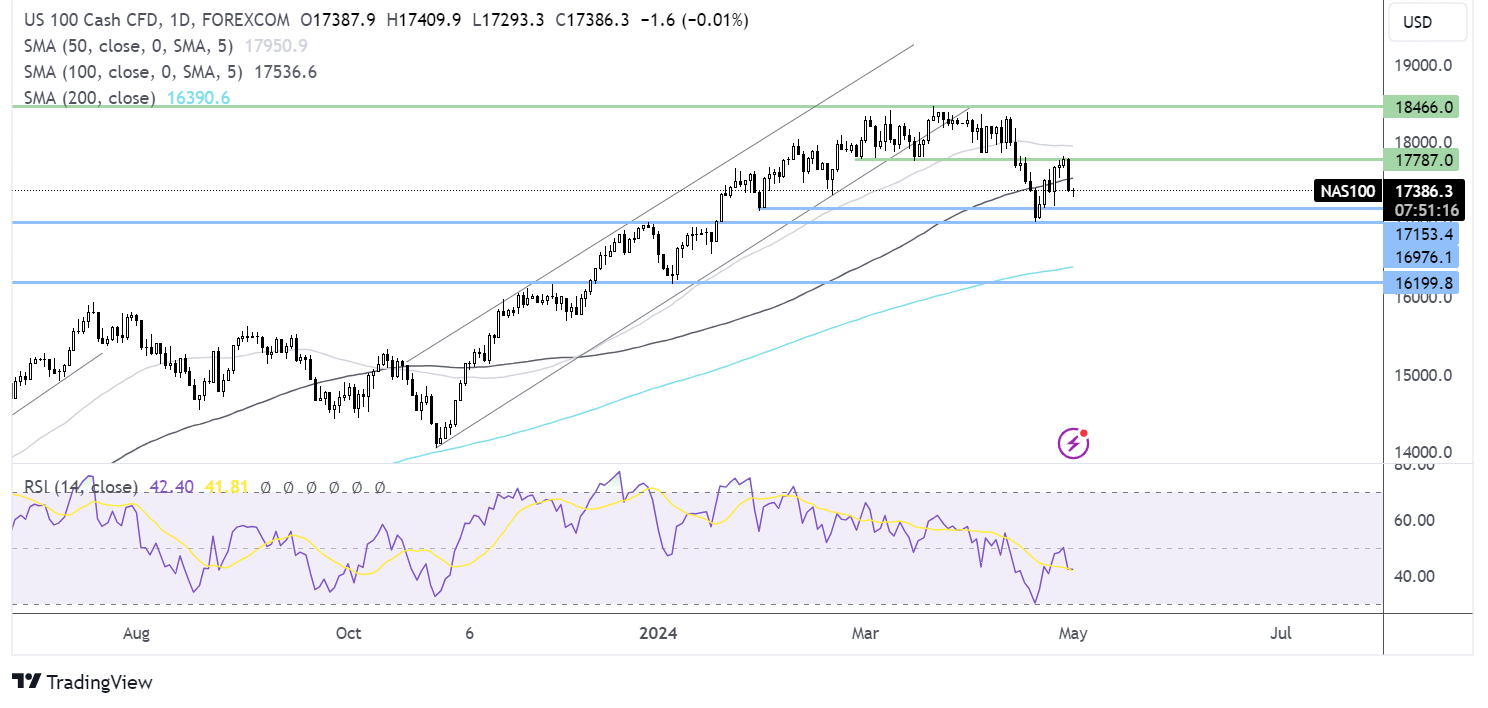

Nasdaq 100 forecast – technical analysis.

After facing rejection at 17800, the price rebounded lower, breaking below the 100. Should selling momentum continue a test of 17160, the February low could be on the cards, ahead of the 16950-17000 zone. A break below here extends the bearish trend, exposing the 200 SMA. Meanwhile, any recovery would need to retake the 100 SMA at 17500 to extend gains towards 18000.

FX markets – USD slips, EUR/USD rises

The USD is edging lower in cautious trade ahead of the Fed rate decision and despite stronger-than-expected ADP payrolls.

EUR/USD is trading quietly, given the Labour Day public holiday in much of Europe. The price is edging higher towards the 1.07 level amid an improving economic outlook. However, the EUR remains pressurised by expectations that the ECB could be one of the first central banks to cut rates, potentially making a move in June. Data yesterday showed that the inflation in the region held steady at 2.4%, just above the 2% target level.

GBP/USD is holding steady ahead of the Fed's rate decision. Data showing that UK manufacturing PMI was upwardly had little impact on sterling as the figures confirm that the manufacturing sector returned to contraction after modest growth in March. The pound continued to trade towards its lower range for the year on expectations that the Bank of England could cut interest rates ahead of the Federal Reserve.

Oil weighs up cease-fire talks and Fed jitters.

Oil prices Falling for a third straight day one hopes of a ceasefire agreement in the Middle East and red rising crude oil inventory data.

A ceasefire agreement between Israel and Hamas is moving in the right direction, pulling the risk premium off oil.

In addition to developments in the Middle East, the prospect of the Federal Reserve keeping interest rates high for longer is weighing on the outlook for oil demand. Higher interest rates restrict gross and, therefore, oil demand.

On Tuesday, crude oil inventories rose 4.9 million barrels in the week ending April 26, defying expectations of a 1.1 million barrel decline.

Attention will now turn to the EIA inventory numbers expected at 1430 GMT.