Market Summary:

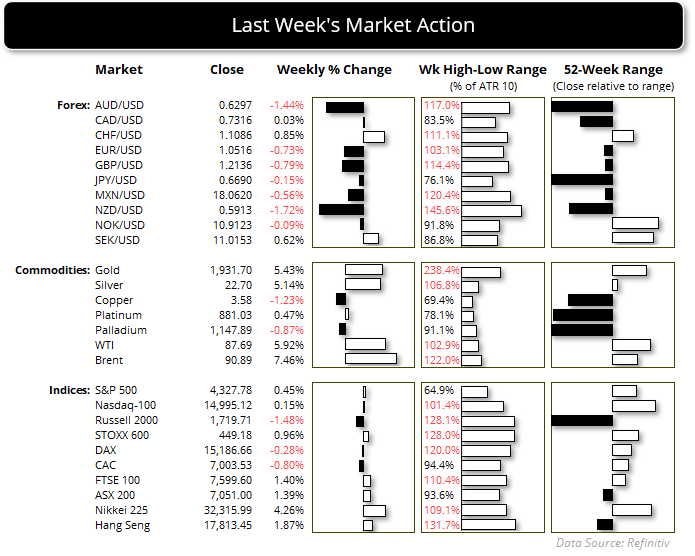

- The escalation of the Middle East conflict saw oil prices rally to a 7-day high on Friday, with WTI crude oil up 5.8% and closing comfortably above Monday’s opening gap

- The geopolitical risks outweighed earnings optimism ahead of earnings season, with a clear risk-off tone heading into the weekend and weighing on US indices

- Gold surged over 3.5% during its best day in seven months as it regained its safe-haven appeal among investors and traders further scaled back bets of another Fed hike this year

- The Fed Fund futures now imply just a 6% chance of a November hike, down form over 30% just two weeks ago

- Stronger-than-expected US inflation data helped the US dollar snap its one-week losing streak – and notch up an 11th winning week over the past 12, although the Midde East conflict seems to have bets of another Fed hike on the back burner

- The Australian dollar fell for a third week during its worst week in eight, and was the second worst performer among G10 currencies behind NZD/USD as geopolitics weighed on sentiment

Events in focus (AEDT):

Read the Week Ahead: Can bondcano stay on the backburner?- 08:30 – New Zealand PSI

- 10:30 – RBA assistant governor Jones speaks

- 15:30 – Japan capacity utilisation, industrial production

- 17:00 – German WPI

- 18:30 – ECB’s Enira speaks

- 19:00 – China’s foreign direct investment

- 19:30 – BOE deputy governor Woods speaks

- 19:30 – BOE MPC member Pill speaks

- 23:30 – NY empire state manufacturing sales

- 01:30 – BOE deputy governor Woods speaks

- 01:30 – FOMC member Harker speaks

- 01:30 – BOC business outlook survey

ASX 200 at a glance:

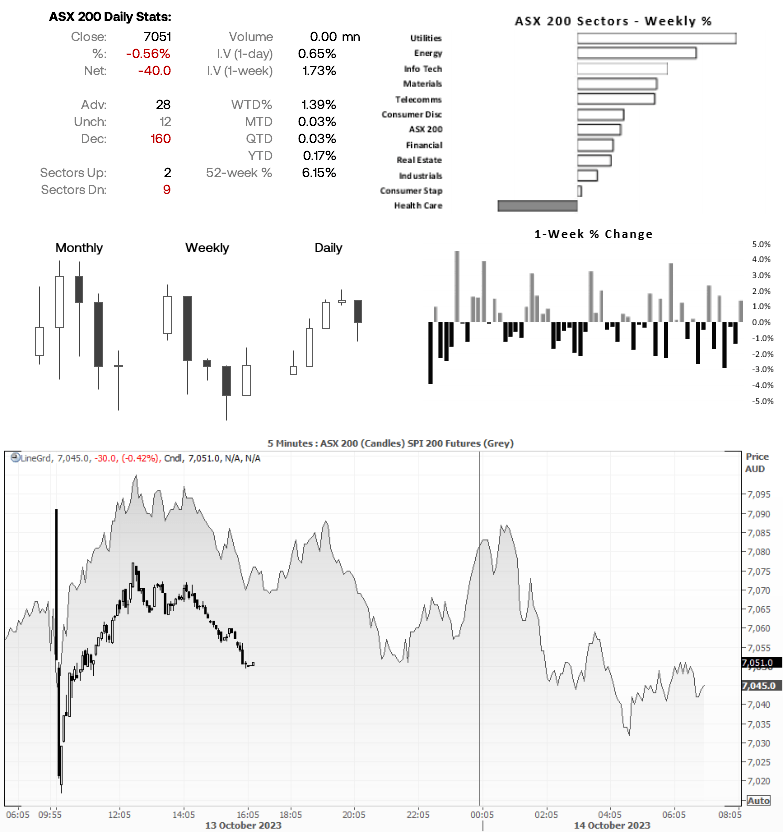

- The ASX 200 snapped a three-week losing streak, although it handed back over half a percent on Friday during risk-off trade (and initially fell over 1%)

- A small bullish pinbar formed on Thursday around 7100 resistance ahead of Friday’s selloff, and SPI 200 futures imply a softer open today

- It is expected to open above 7,000, and that will likely be a key area for bulls to defend today

- ASX traders would be wise to monitor risk appetite across other markets to help gauge sentiment, and the ability for the ASX 200 to hold or rise form 7,000

- For example, if risk-off it to take a breather then we’d likely need to see gold and WTI crude oil retrace lower, AUD/JPY and AUD/USD move higher from their cycle lows – otherwise the ASX may be vulnerable to further selling

Gold technical analysis (daily chart):

Gold’s strong rally on Friday opened at the low of the day and closed near its high, making it a bullish Marabuzo candle (an elongated engulfing candle with little or no wicks). Gold saw a clear break of 1900 and the bearish channel on the daily chart, and it looks like it now wants to head for 1950. The 50% retracement level of the Marabuzo candle can provide future support, but with momentum so strong from the bull camp it is hard to justify ‘waiting for a pullback’ to seek dips towards the level soon, unless we see the Middle East conflict come to an abrupt end. For now, traders may want to keep an eye on indices futures, yields ad JPY to help gauge sentiment and seek bullish setups on intraday timeframes with 1950 in focus.

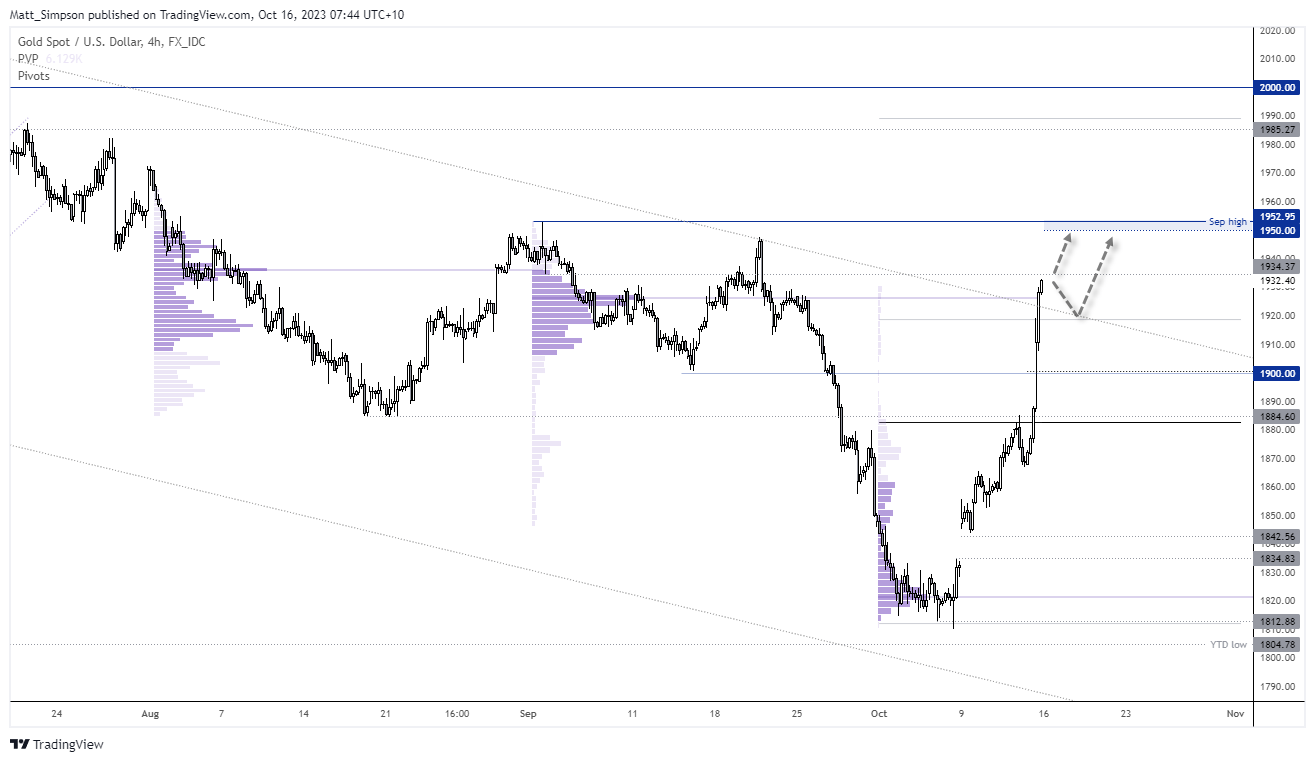

Gold technical analysis (4-hour chart):

The 4-hour chart shows that last week’s high stalled around the week’s VPOC (volume point of control). Monday trade can always be a little erratic on a Monday, so I have no clear bias out of the gate – although an eventual move to 1950 seems feasible. Perhaps we’ll be treated to a minor pullback towards the support closer around 1920, which could allow a better entry with improved reward to risk potential. Whereas a direct move to 1950 makes the entry trickier to manage and could leave some on the sidelines. But that is trading sometimes.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade