FOMC Meeting Key Points

- There will be no change to the Fed’s current interest rate range of 5.25-5.50%, nor will there be updated economic forecasts, but that doesn’t mean that traders should ignore this month’s FOMC meeting.

- Fed Chairman Powell’s press conference and any decisions about the central bank’s balance sheet runoff are potential market-movers to watch

- The US Dollar Index (DXY) remains in a bullish technical setup for now.

When is the FOMC Meeting?

The two-day FOMC monetary policy meeting concludes on Wednesday, May 1 at 2:00 ET.

FOMC Chairman Powell’s press conference starts at 2:30 ET.

FOMC Meeting Expectations

Economists overwhelmingly expect the Federal Reserve to leave interest rates unchanged in the 5.25-5.50% range, with every single one of the 100 economists surveyed by Reuters expecting the central bank to stand pat this week. Indeed, only 4 expected a June rate cut, while 26 believe the Fed will start cutting interest rates in July.

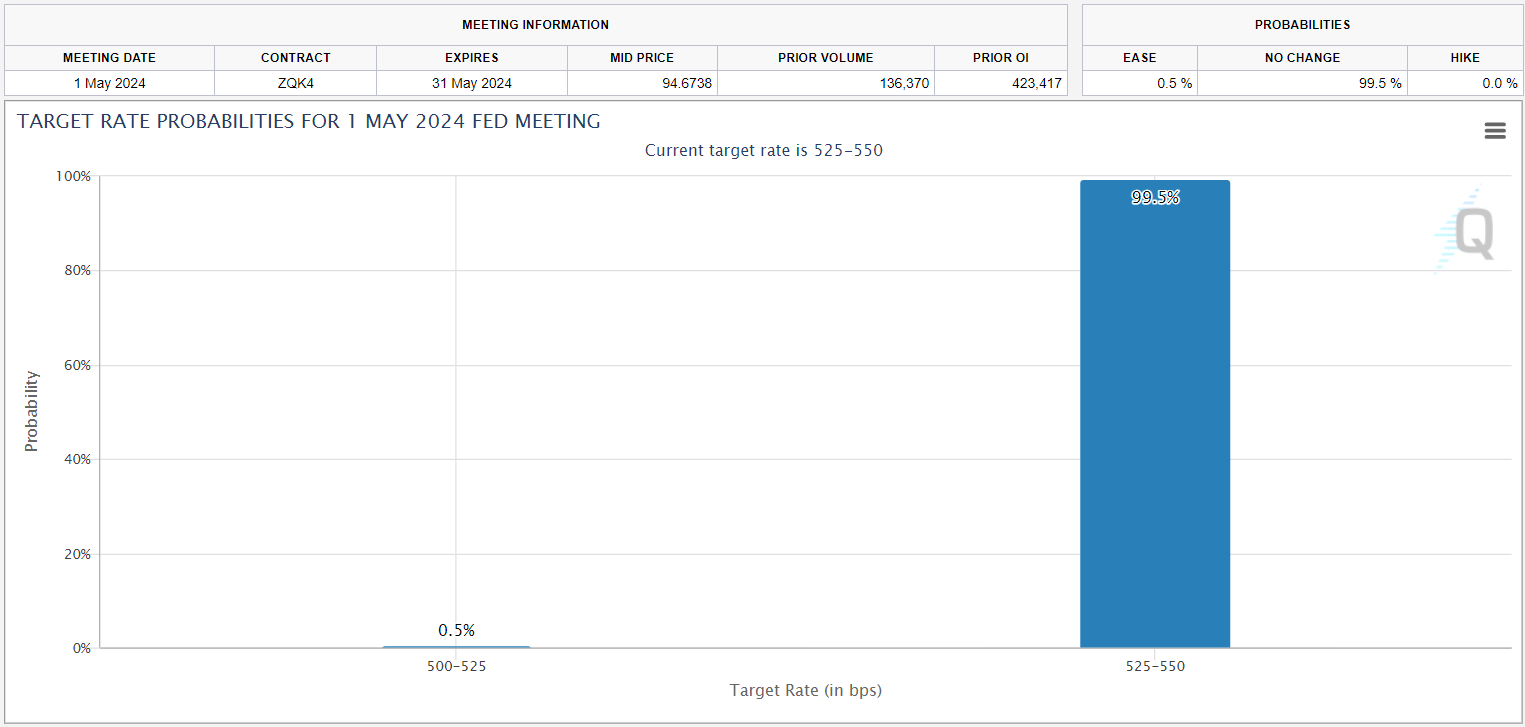

Traders are similarly discounting a vanishingly small chance of an interest rate cut this week, per the CME’s FedWatch tool:

Source: CME FedWatch

FOMC Meeting Preview

So with no changes expected to monetary policy and no updated economic forecasts, surely traders can safely ignore this month’s FOMC meeting, right?

Not in the slightest.

Heading into the Fed meeting, there is a tremendous amount of uncertainty over how Jerome Powell and company are viewing the economy and the projected future path of monetary policy. The first four months of the year have been rough for a central bank that expected inflation to keep moderating toward its 2% goal, only to see generally stronger-than-expected growth and CPI inflation accelerating from 3.1% to 3.5% earlier this month on the back of rising energy, shelter, and insurance prices.

Before the pre-meeting media blackout period, most officials were endorsing leaving rates unchanged for the next couple meetings while they gathered more economic data, but there was essentially no mention of the potential for additional rate hikes.

So, as it stands, it’s still a matter of when, not if, the FOMC will start cutting interest rates. The Wall Street Journal’s “Fed Whisperer,” Nick Timiraos, agrees with this view, noting in his FOMC preview article from earlier today that, “…a hawkish pivot, suggesting an increase in rates is more likely than a cut, appears unlikely, for now. Any such shift is likely to unfold over a longer period. It would require some combination of a new, nasty supply shock such as a significant increase in commodity prices; signs that wage growth was reaccelerating; and evidence the public was anticipating higher inflation to continue well into the future.”

One under-the-radar component of the FOMC meeting will be whether the Fed addresses its current balance sheet policy. At the last meeting in March, Powell noted that it would soon be time to discuss tapering the balance sheet runoff, so many traders are expecting an update at this week’s meeting or the next. In the absence of outright interest rate changes, a quicker or more aggressive taper of the runoff may be seen as a modest tightening of financial conditions, whereas no announced taper would be a more dovish development than many traders have priced in.

With no changes to interest rates anticipated and likely only minimal tweaks to the monetary policy statement, Fed Chairman Powell’s press conference will take on more significance than usual. The key question for Mr. Powell will be around whether inflation is reaccelerating or merely seeing a temporary bump in a long, gradual march back toward 2%. Ultimately, we would expect Powell to demur toward this question and emphasize the Fed’s “data dependent” outlook, but any hints on his current thinking could provide a major signal to an antsy market.

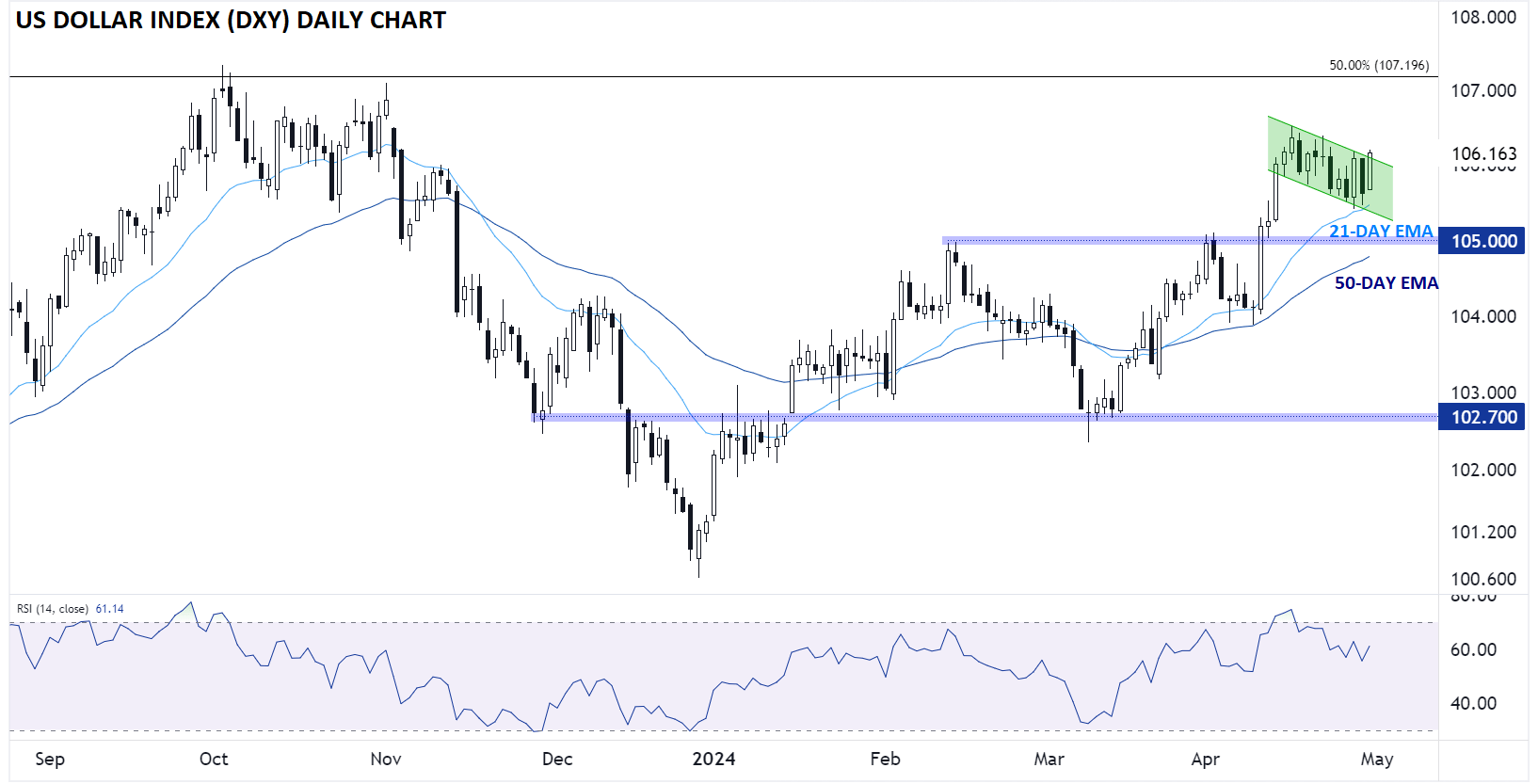

US Dollar Technical Analysis – US Dollar Index (DXY) Chart

Source: TradingView, StoneX

As the chart above shows, the US Dollar Index (DXY) is testing the top of a potential bullish flag pattern as we go to press. The world’s reserve currency has tacked on nearly 5% since the start of the year as traders have priced out the aggressive FOMC rate cuts that were expected at the end of last year, but the gains have been harder to come by over the last couple weeks.

Looking ahead, a bullish breakout (perhaps on the back of more-hawkish-than-expected comments by Fed Chairman Powell) would open the door for another leg up toward the 2023 high near 1.0720. Conversely, a break below key previous-resistance-turned-support at 105.00 would invalidate the potential bullish flag pattern and expose 104.00 next.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX