The US dollar was broadly weaker on Wednesday after Jerome Powell said it was unlikely their next move would be a hike. Markets were clearly positioned for the worst after Tuesday’s stronger labour cost and wage figures sent the dollar rallying on concerns the meeting could be hawkish. But with the door firmly closed for further tightening, the US dollar index handed back all of Tuesday’s gains – even though the Fed acknowledged a lack of progress on inflation and stopped short of confirming of a cut could arrive this year.

The Fed held rates at 5.25-5.5% as widely expected and announced it will slow the pace of quantitative tightening from June. The dollar was also weaker heading into the event on the back of weaker PMI data and lower job openings.

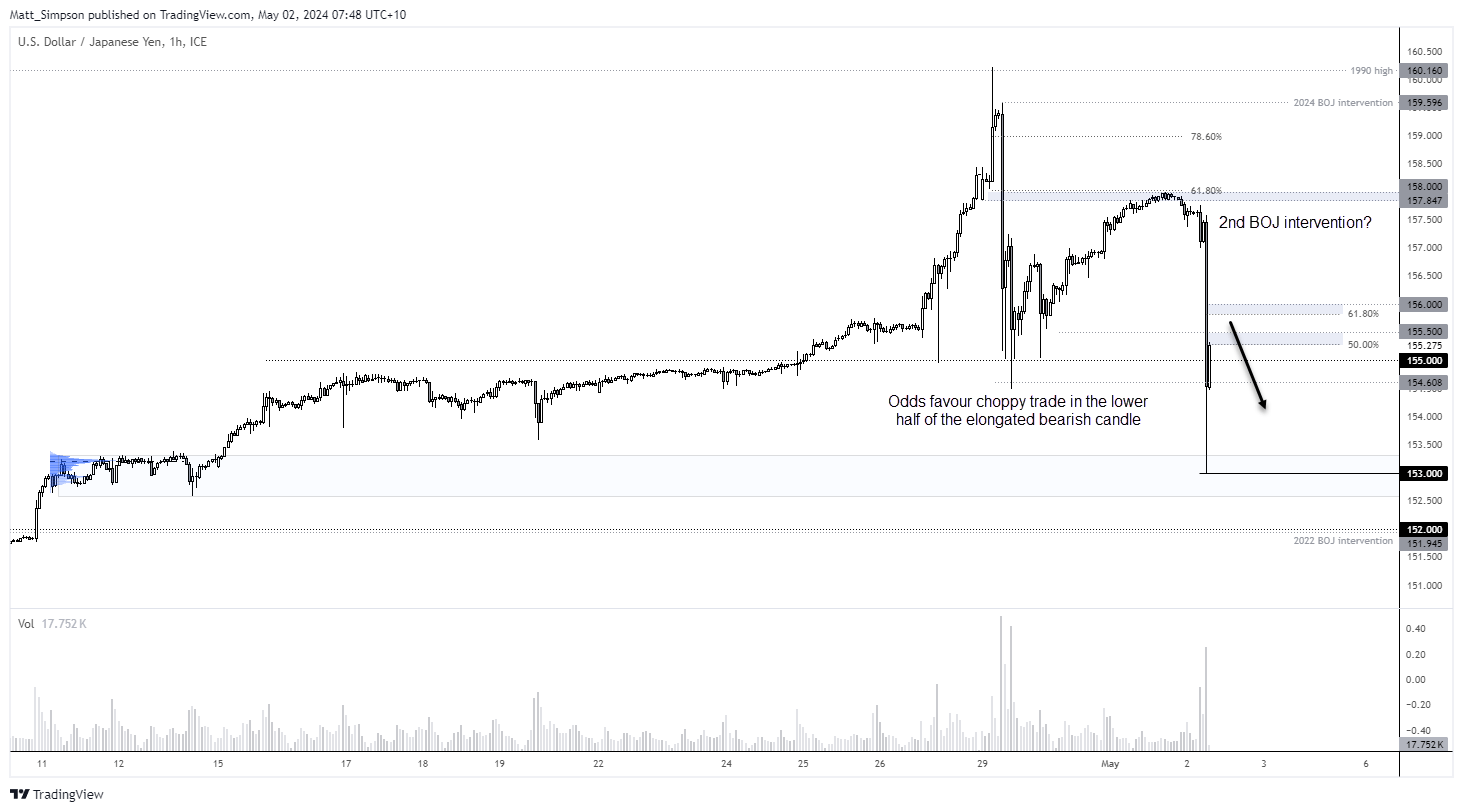

Yet it was the Japanese yen which stole the show after Jerome Powell’s press conference, with USD/JPY falling over 450 pips. The severity of the move smells of another BOJ intervention, and one that seems well timed if it wanted to capitalise on a weaker US dollar. The daily high-to-low range spanned nearly 500 pips with prices falling from the 158 handle before finding support just above 153. If history is to be repeated, we may find price action to enter another shell-shocked state in today’s Asian session and trade in smaller, fickle ranges in the lower half of Wednesday’s range.

- USD/JPY fell ~450 pips before finding support around 153

- A bearish outside / engulfing day formed on the US dollar index, which also forms part of a double top ~106.40

- This allowed EUR/USD to form a bullish outside day, although the monthly picot point and 20-day EMA are capping as resistance

- Wall Street futures initially posted strong gains after the Fed statement before swiftly handing them back during the press conference, sending cash indices slightly lower on the day

- Gold rallied from 2080 and closed firmly back above 2300, after managing to recoup around ¾ of Tuesday’s losses

- Hopes of an Israel-Hamas ceasefire and a build of US stockpiles saw crude oil prices fall to $79 during its worst day in three months

Economic events (times in AEST)

- Public holiday in China

- 08:45 – New Zealand building consents

- 09:50 – BOJ monetary policy minutes, Japan foreigner bond, stock purchases, money supply

- 11:30 – Australian building approvals, trade balance

- 22:30 – US jobless claims, trade balance

- 22:30 – Canadian trade balance

US dollar technical analysis:

Since the late December low, the US dollar manage to rise just over 6% as it approached the Fed meeting. Yet its inability to hold above 106 suggests it may now be in need of a pullback. A bearish engulfing day formed on high volume to warn of a ‘change in hands’ at these highs from bulls to bears. And the engulfing candle also forms part of a double top which coincides with a bearish divergence with RSI (2).

105 makes a viable target for bears, but they may want to see prices retrace higher within Wednesday’s range to increase the potential reward to risk ratio – and seek evidence of a swing high on a lower timeframe, beneath the 106 handle.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade