AUD/USD Key Points

- Chinese PMI figures were softer than expected over the weekend, weighing on AUD/USD.

- The pair remains within its relatively tight consolidation zone below 0.6700, but…

- The confluence of fundamental events in the coming weeks sets the stage for a potential breakout.

Traders throughout the Asian-Pacific region have grown used to looking to Chinese economic data as the primary driver for volatility, and this week has been no different for AUD/USD traders.

While we did see a minor economic report out of Australia itself – the Melbourne Institute’s inflation survey came out at +0.3%, in-line with last month’s reading – the more impactful releases came in the form of China’s PMI surveys. The official PMIs came in a tick below expectations at 49.5 and 50.5 for the Manufacturing and Non-Manufacturing surveys respectfully, though the alternative manufacturing reading from Caixin/S&P Global beat expectations at 51.8.

Regardless, the official reading tends to hold more weight for traders as it accounts for large and state-owned companies that play an outsized role in China’s economic growth, leaving the overall interpretation of the data as a slight negative for the world’s second-largest economy…and by extension, the AUD/USD.

Looking ahead, the RBA minutes are on tap in tonight’s Asian session, followed by Australian Retail Sales figures and the Caixin Services PMI reading out of China.

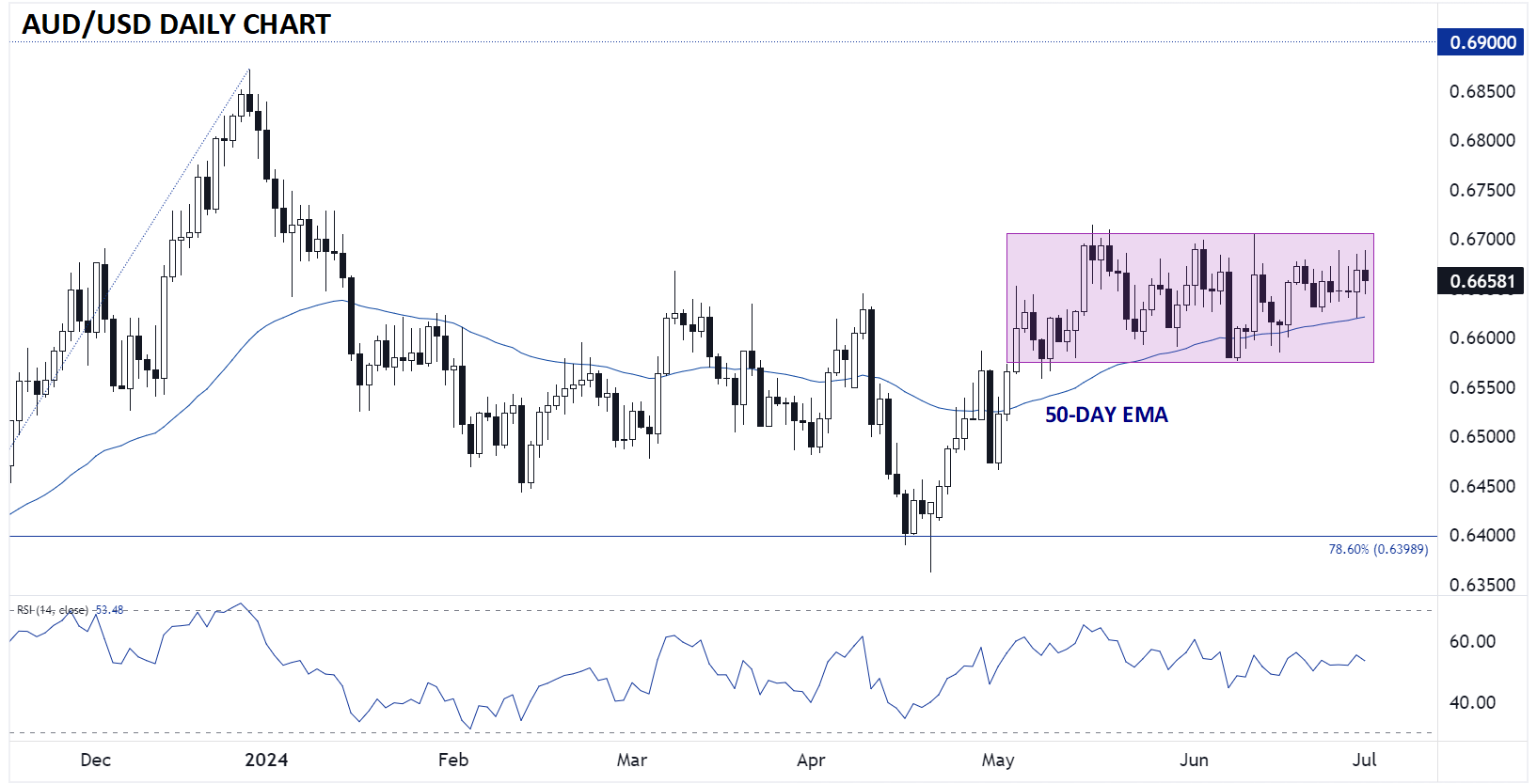

Australian Dollar Technical Analysis: AUD/USD Daily Chart

Source: StoneX, TradingView

As the chart above shows, AUD/USD remains near the middle of its year-to-date range in the mid-0.6600s as we go to press. Indeed, the pair is trading within a tight 120-pip consolidation zone from 0.6575 to 0.6700 dating back to the start of May, presenting little in the way of tradeable trends for anything but the shortest of short-term traders.

Despite the recent lack of a directional trend, the pieces are in place for a potentially higher-volatility breakout. With key central bank meetings from both the Fed and (especially) the RBA as we move through the summer, to say nothing of key jobs and inflation figures on both sides of the Pacific in the interim, it’s unlikely that the current consolidation range below 0.6700 will hold for too much longer. A bearish breakdown at this point would likely expose the 2024 lows near 0.6400, whereas a clean breakout above 0.6700 could have traders eyeing the 1.5-year highs near 0.6900 in short order.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX