Commodities trading

-

Range of markets

Gain exposure to geopolitical events through 20+ different commodity markets

-

Competitive pricing

We’re lowering the cost of trading, with spreads from just 0.06pts

-

Non-expiry spot contracts

Simplify your trading experience with our exclusive spot contracts

Why trade commodities with us?

-

Stay informed

Stay abreast of breaking stories impacting global commodity prices through our exclusive Reuters feed delivered in-platform. -

Plan your trades

Take advantage of the industry-leading TradingView charting package to trade global commodity markets, with 80+ indicators and one-click trading. -

40 years in financial services

Trade with a trusted market leader that's backed by StoneX Group, a NASDAQ listed company.

Popular commodity markets

Live pricing

What are spot commodities?

Spot commodity markets are non-expiring and are not subject to an expiry date or rollover charges. These markets are priced based on futures contracts and so offer the opportunity to trade commodities long-term without the need to roll your position.

Continuous charting is available on these markets. This allows you to apply deeper levels of technical analysis to your commodity trading compared with traditional commodity market charting.

To discover how we price spot commodity markets, click below:

Major commodity market news

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

City Index offers spread betting and CFD trading on commodities. Whilst similar, typically UK investors choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*.

City Index offers spread betting and CFD trading on commodities. Whilst similar, typically UK investors choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*.

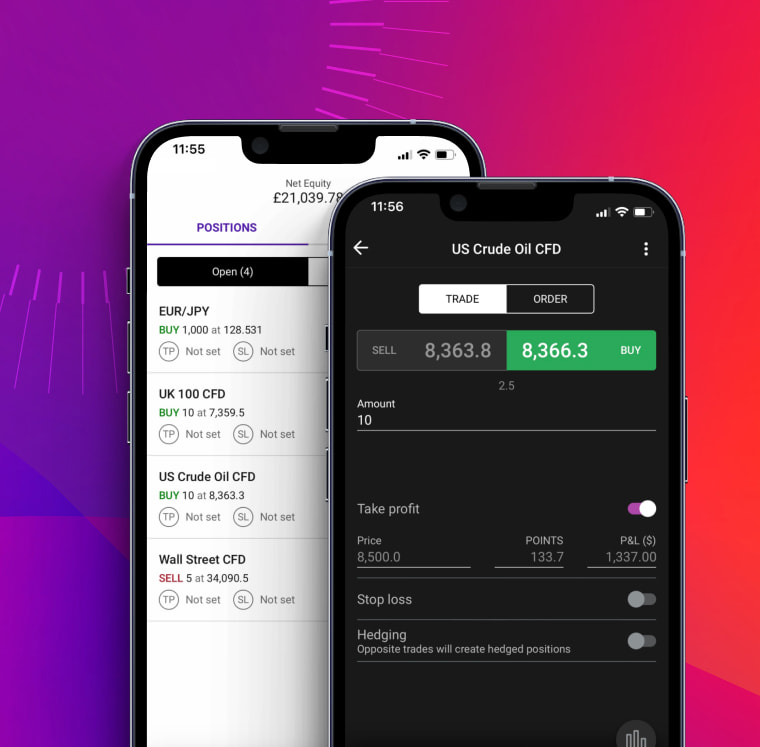

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

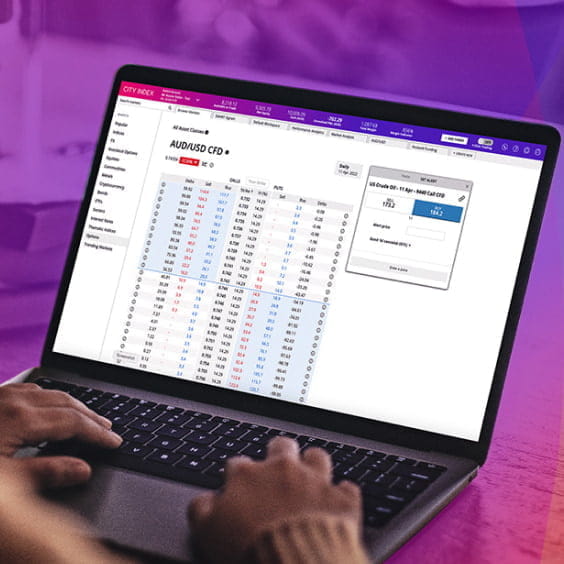

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade commodities

Discover everything you need to know about commodity markets, such as gold, oil and natural gas, including both hard and soft commodities.

Commodities market hours

Most commodity trading takes place on futures exchanges. Unlike stock exchanges, though, futures can be bought and sold almost 24-hours a day.

Commodity spot prices vs futures

Learn how to trade a range of commodity markets by spread betting or CFD trading, and choose from spot markets or futures contracts.

Commodities FAQ

How do I calculate how much margin I need to trade a commodity?

To work out how much margin you need to trade a commodity market, you divide the full value of your position by its margin requirement. Say, for example, that you want to open an oil position worth £5,000 and oil has a margin requirement of 10%. You’d need (10% of £5,000) £500 as margin.

How you calculate the full value of your trade depends on how you’re trading the commodity. With spread betting, for example, you multiply your stake by the market’s current price. With CFDs, it’s the number of contracts you’re trading and the value of each individual contract.

Learn more about how to trade commodities.

How are Non-Expiring Commodities (NEC) priced?

To price non-expiring markets, we use two sufficiently liquid futures contracts on the underlying commodity. These are usually the two with the nearest expiry dates.

The contract with the closest expiry date is called the front month contract and the second-nearest expiry date is called the far month contract.

Throughout the duration of the front month contract, while we use this price to drive our own, the price of the NEC will gradually move towards the price of the far month. We may use further months should the near, far or both months become unsuitable for trading.

There is an adjustment to the NEC Market price every day to move towards the far future. Your account will be subject to an adjustment in the form of a credit/debit to offset this price adjustment. For example, if the NEC contract is adjusted by +2 points, clients with long positions will be debited 2 x stake and clients with short positions will be credited 2 x stake. See further explanation and video below.

In our video, the front month is labelled ‘A’ and the far month ‘B’.

NEC contract market prices move towards the price of market ‘B’ as the expiry date of ‘A’ becomes closer. The price of market ‘B’ may be higher or lower, depending on the commodity, than that of market ‘A’.

Daily adjustments for NEC contract markets reflect a day’s movement from the current price towards ‘B’.

There is also a separate ‘cost of carry’ which is an adjustment in the price to reflect the holding cost of the asset and make the market a true cash asset. This amount recognises the reduction in the days to expiry between the cash and futures.This cost of carry is always positive, and a naturally offset by the financing cost paid or received daily on longs and shorts respectively.

If you have more questions visit the FAQ section or start a chat with our support.

Commodities explained

What are commodities?

Commodities are natural products that are generally consumed by people, animals or industry such as oil, sugar and wheat. Commodities have been traded for thousands of years and have always had an important economic impact on people and nations throughout history.

Commodity trading is just as important today, with commodities playing a crucial role in global economics. Commodity markets can be easier to understand than other financial markets because prices are influenced by more obvious contributing factors. They reflect the fortunes of industries like the oil business or farming. Prices are informed by supply and demand issues that are easy to grasp.

The majority of commodities traded today can be split into three main areas:

Energy

Energy commodities are pumped out of the ground. They have a particularly strong influence over the global economy, and are also in turn influenced by demand from the global economy. Examples include:

- US Crude Oil

- UK Crude Oil

- Natural Gas

Agricultural - ‘Soft Commodities’

Soft commodities are generally agricultural commodities that are grown or bred for human consumption, as opposed to commodities that are mined. Soft commodities are important in futures markets where people speculate on price fluctuations as supply and demand changes. They are also used by the farmers who produce these commodities to lock in the future price of their produce, and by commercial consumers and resellers of these goods. Examples of soft commodities include:

- Coffee

- Corn

- Cotton

- Orange Juice

- Soybean Oil

- Wheat

Metals - ‘Hard Commodities’

Hard commodities are resources that are generally extracted through mining, specifically metals. Metals that are traded can either be precious metals such as gold, silver or platinum, or industrial metals such as aluminium, lead or copper. Examples of hard commodities include:

- Gold

- Iron ore

- Palladium

- Platinum

- Silver

How are commodities traded?

Commodity trading often takes place on exchanges as futures and options. Exchanges usually become hubs for a few commodities that it specialises in, for example:

Chicago Board of Trade (CBOT)

Commodities that trade on CBOT include gold, corn, silver, wheat and rice

Chicago Mercantile Exchange (CME)

Commodities that trade on the CME include milk, cattle, pork bellies and lean hogs

NYMEX

Known for being the most liquid market place for the trading of West Texas Intermediate Oil futures.

What drives commodity markets?

Commodity markets exist to provide more efficient prices and security for consumers of those commodities. Airlines, for example, want to be able to protect themselves from sudden and unpredictable changes in the oil price, while farmers will be looking for the best price for their products. A food manufacturer will want to ensure that the price it pays for wheat will be steadily consistent.

The growth of interest in commodity trading represents the growth in interest in global trade and delivering an internationally-recognised price for a product.

Commodity markets can be influenced by a range of factors, including:

- Interruptions of supply, such as bad harvests, miners’ strikes or stockpiling

- Seasonal demand, for example from consumers of heating oil and natural gas in the winter, or people buying gold during periods of political uncertainty

- General economic slowdowns, which can impact demand. Oil, for example, is sensitive to this

- It is worth doing more research on a market you are interested in, as each has its own characteristics

Did you know? There are two oil commodity markets, Brent Crude and West Texas Intermediate. These reflect the prices of US and non-US oil. To make things simpler, at City Index we call them US Crude Oil and UK Crude Oil. While the prices of both will be similar, they are not exactly the same.

Trading commodities with City Index

- City Index offers spread betting and CFD trading on commodities

- You can trade over 20 energy, agricultural and metal commodities, as well as multiple futures for the same market and options for a select number of commodities