UK bank earnings

-

Competitive pricing

Trade UK shares with commissions from just 0.08%.

-

Range of markets

Access over 4,700 global shares including IPO markets

-

Tax-free trading

Pay no UK Capital Gains Tax or Stamp Duty when spread betting

What to expect from UK banks this earnings season

Banks are set to report earnings in a complex landscape, with the UK seeing the highest inflation rates in the G7 since June 2024. While greater government and consumer spending will drive growth this year, investors will watch out for signs of resilience as an undetermined number of interest rate cuts loom on the horizon for 2025.

How do I trade earnings season?

To trade bank earnings, you can decide whether you think a bank's share price is going to move up or down when it releases its quarterly report – and open a position accordingly. Open a City Index account to get started, or try a demo to trade with no risk to your capital.

Key Earnings release dates

| Date | Company |

|---|---|

| 13th February | Barclays |

| 14th February | NatWest |

| 19th February | HSBC |

| 20th February | Lloyds |

Track the latest bank stocks with our live pricing ticker. Go long or short and plan your bank stock trading strategy.

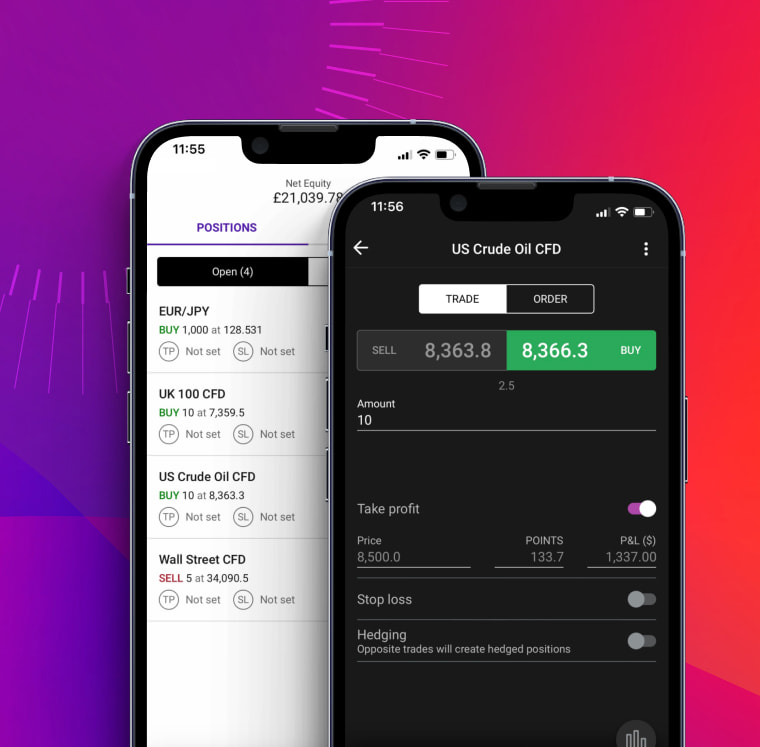

Mobile trading app

Seize trading opportunities with our easy-to-use trading app, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

Portable TradingView charts

Access the industry-leading TradingView charting package, complete with 80+ custom indicators, drawing tools and the ability to trade through charts.

Multi-device dealing

Manage your trading account across desktop or mobile, without interruption.

Actionable market analysis

Receive all the latest market news and expert commentary direct from Reuters in your trading app.

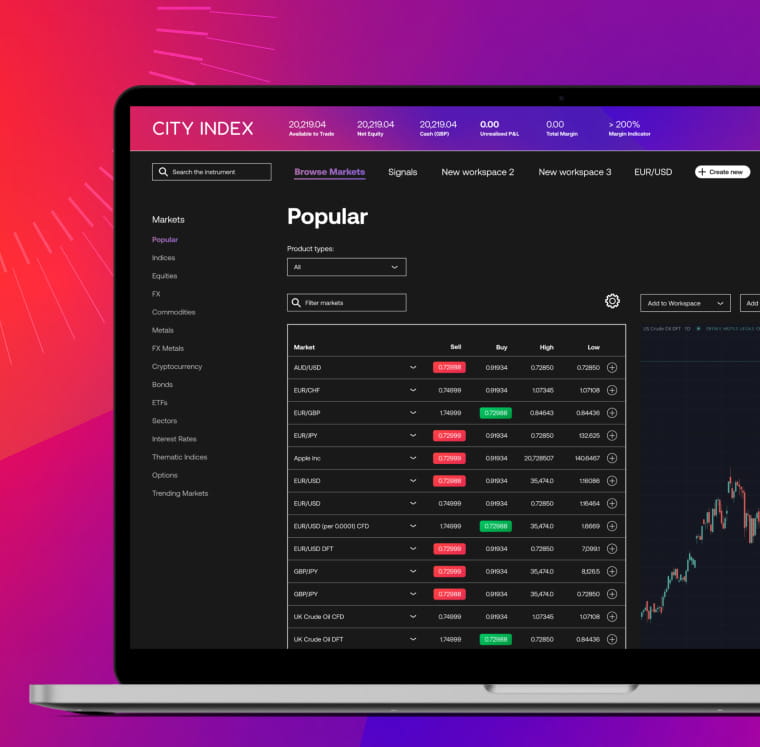

Online trading platform

Access over 13,500 global markets on our browser-based trading platform, Web Trader. Complete with customisable workspaces, fast and reliable execution, plus advanced charts.

Simplicity and speed

Simplify your deal ticket with our exclusive ‘one-click trading’ mode, so you don’t miss out on potential opportunities in fast-moving markets.

Performance Analytics

Gain deeper insight into your trading behaviour with the new Performance Analytics tool, designed to help you improve your trading across four key metrics.

One-click trading

Seize opportunity instantly by enabling one-click trading – input your preferred trade parameters and execute faster than ever.

Open an account today

-

Registerto open an account

-

Depositsafely and securely

-

Start tradingon web, mobile & desktop

Open an account today

Latest bank insights

- All

- Shares

Sort by:

- Newest

Dow Jones forecast: How will JPMorgan earnings impact JPM stock?

Can JPMorgan keep outperforming in a tough environment for big banks?

S&P 500 analysis: US banks Q3 earnings preview

Bleaker economic prospects are weighing on the outlook for US banks, but have markets already priced this in?

Dow Jones analysis: Where next for Goldman Sachs stock ahead of Q2 earnings?

Analysts agree this will be another tough quarter for Goldman Sachs, but they disagree on how tough it will be…

Frequently asked questions

What documentation do I need when opening an account?

Typically, we will require a valid Government Issued Photo ID and a valid Address Verification Document; however, this is subject to change depending on the review of your application by our Account Services department.

Acceptable documents for identity verification include but are not limited to:

- Valid, current passports (national or international)

- Valid, current driver's license

- Valid, current national ID Card

Other types of ID may be acceptable on a case-by-case basis after review. Birth certificates, marriage licenses and insurance cards are not accepted.

Proof of residence must show your name and address as indicated on the application.

Acceptable forms of proof of residence include but are not limited to:

- Utility bill

- Bank, building society, credit or debit card statement

- Council tax bill

- Local government address registration certificates

- Valid driving license if issued within the last six months

Utility bills and statements must be dated within the last six months. Confidential information such as account numbers may be removed at your discretion.

In accordance with our regulatory obligations, additional documentation may be required at any time for internal periodical reviews.

How do I fund my account?

You can easily fund your account by logging into MyAccount and visiting the Funding page.

For more information on payment method regulations, processing times and fees, visit our funding & withdrawals FAQ.

How much money do I need to open an account?

The minimum initial deposit required is at least 100 of your selected base currency. However, we recommend you deposit at least 2,500 to allow you more flexibility and better risk management when trading your account.

If you have more questions visit the FAQ section or start a chat with our support.