IPO trading

What is an IPO?

An IPO stands for initial public offering, which is the first time a private company sells shares of its stock to the public. The process is often referred to as ‘going public’.

For companies, listing their shares on a stock exchange gives them the chance to raise capital for growth initiatives and to raise their profile. For traders and investors, an IPO is an opportunity to get in on the ground floor of growing companies or take a position on volatility. However, trading IPO shares can be riskier than gaining exposure to established stocks, due to the unpredictability of the new listing.

Learn more about what an IPO is and how the process works.

What is a SPAC?

During 2020 and 2021, we saw an increase in companies choosing to go public via a SPAC – or special purpose acquisition company. By merging with another company, private firms can ‘go public’ without the need for a traditional IPO. SPACs became popular as they’re quicker and less regulated than the normal IPO process. However, due to several factors including reduced interest for high-risk investments and tougher rules, the popularity of SPACs fell off heavily in 2023 and early 2024.

Find out more about SPACs.

How to trade IPOs

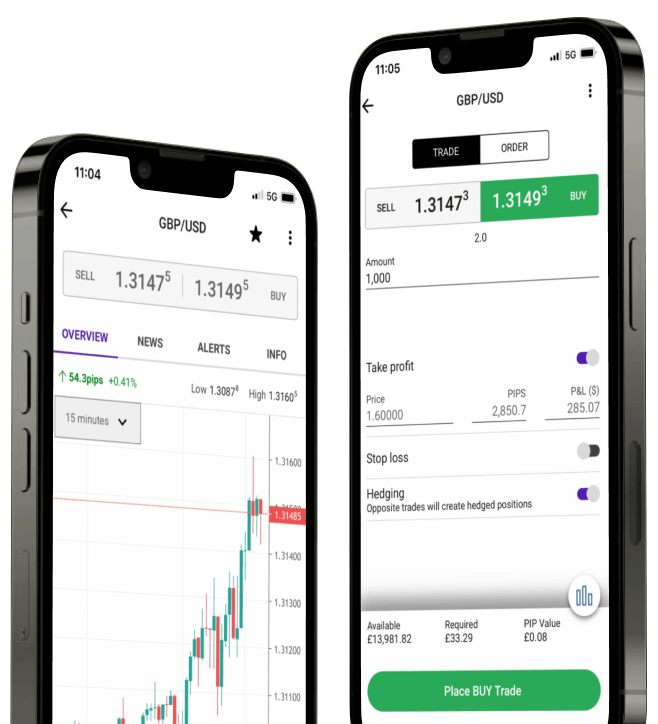

Take a position on popular IPOs as soon as the shares list in four simple steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade

- Choose your position and size, and your stop and limit levels

- Place the trade and monitor the market

Learn more about how to trade IPOs.

Upcoming IPOs

Following a challenging period of geopolitical uncertainty and raised interest rates, 2024’s IPO market looks promising. Here are some of the most anticipated listings for traders to keep an eye on.

Past IPOs

The past two years have been challenging for IPOs and SPACs. However, investors and companies are hoping that improving conditions will help them gather momentum for the year ahead. Take a look at some previous IPOs and start speculating on the shares.

Leverage our experts

Our global research team identifies the information that drives markets so you have the insight to make informed trading decisions.

Want to test your trading strategies in a risk-free environment?

- £10,000 virtual funds on our award-winning platform

- Get the same access as full account holders to research and analysis

- Available on desktop, web, mobile or tablet