The ultimate corporate trading experience

-

Open an accountRegister your details and open an account in minutes

-

DepositFund your account through our secure funding portal

-

Start tradingAccess over 13,500 markets on desktop or via the app

-

Open an accountRegister your details and open an account in minutes

-

DepositFund your account through our secure funding portal

-

Start tradingAccess over 13,500 markets on desktop or via the app

City Index corporate account

For retail and institutional investors, a City Index corporate account gives you access to over 13,500 markets, allows you to add funds through a corporate bank account or card, and enables multiple users to trade on one account.

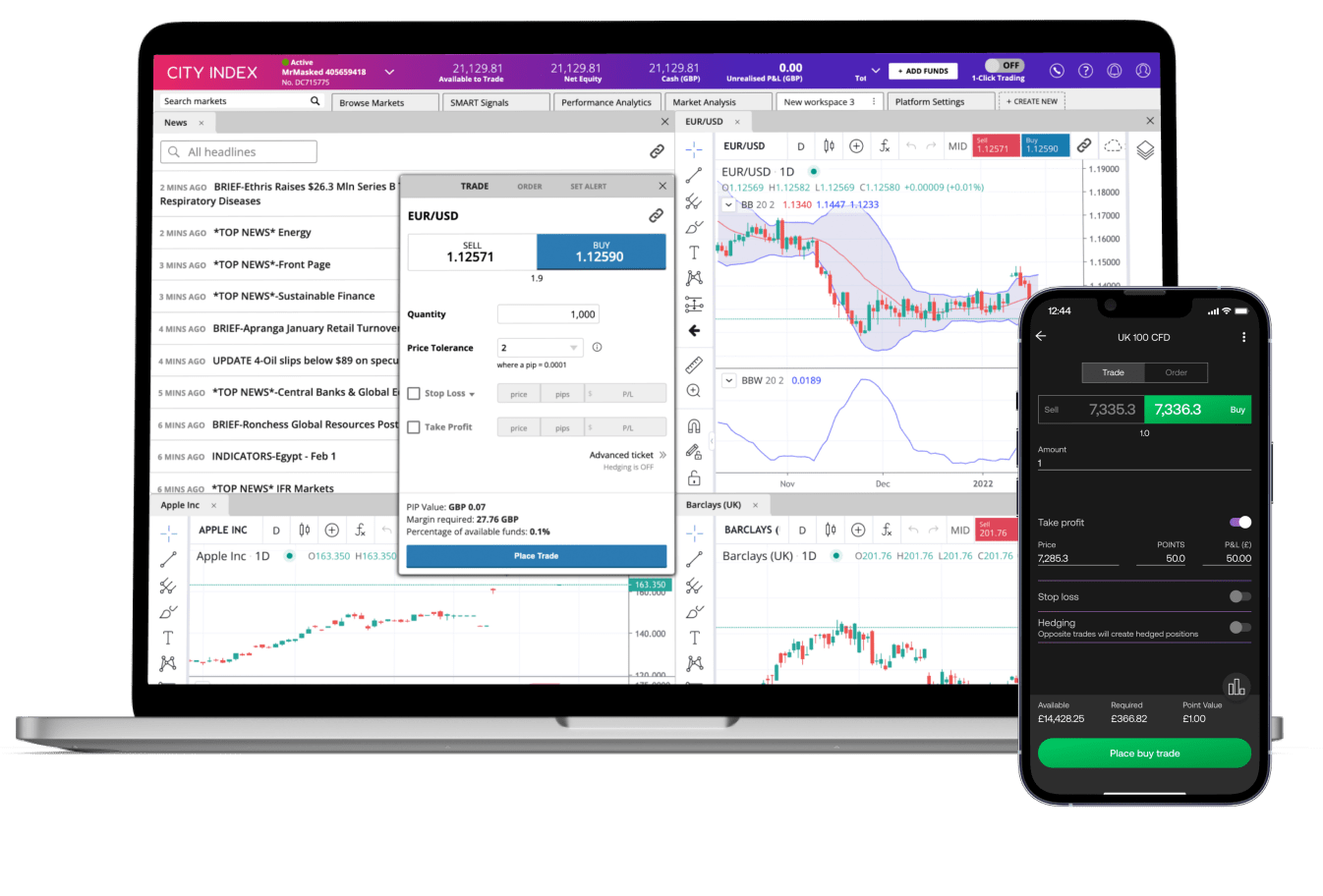

Seamless multi-device dealing

Access your corporate account at home or on the go.

Desktop

Log in to Web Trader – our best trading experience yet built on powerful HTML 5 technology. Accessible from all operating systems and major browsers.

Mobile

Seize trading opportunities wherever, whenever with the City Index mobile app, complete with advanced tools and charts.

Introducing Our New Interest Payment Scheme

City Index is now offering an Interest Payment Scheme, an opportunity to earn interest on your tradable account funds.

Here's how it works:

Eligibility:

Clients with an average of £20,000 or more in tradable funds throughout the month and maintain an active trading status* are eligible for this scheme.

Interest Rate:

We will apply an initial interest rate of 2.5% to the average tradable funds in your account(s) each calendar month.

Payment:

The accrued interest will be credited to your account based on the previous month's funds the following month.

*An active client is defined as someone who regularly trades and holds open positions on their accounts.

Please contact us to find out more information or to register your interest.

Transparent pricing, competitive spreads

City Index is proud to be a market-leading partner with a proven track record of award-winning platforms, pricing and service.

Corporate account FAQ

Can I receive interest on my tradeable funds?

Upon request, we may pay interest on Tradeable funds which average £20,000 or more over a calendar month.

How can I find out if I am eligible to receive interest?

Interest will only be paid to clients with £20,000 or more in their tradeable funds throughout the calendar month, Clients must also have an active status which means they trade and manage their accounts regularly. Contact your relationship manager or Client Management for more details.

What do I need to open a corporate account?

To open a corporate account, you’ll need a company account that holds at least £50,000. To verify your application, we’ll need information about your company, including its address, bank details, compliance issues and the origins of your funds.

There are a variety of other documents you’ll have to provide when you apply.

- Evidence of incorporation

- Proof of registered address

- Memorandum and Articles of Association

- Last two years of reports and accounts

- Details of directors and shareholders

You can see the full application form here. Please note that for more complex structures, there may be more information needed. If you have more questions, please contact New Accounts.

What are the benefits of a corporate account?

The key benefits of a corporate account are that you can:

- Have multiple authorised accounts, which means that you can manage your trading as a team

- Use corporate cash deposit, using company money to fund and trade, provided you meet our minimum deposit of £50,000

- Trade under your business name, instead of your personal account

- Get competitive, transparent and reliable pricing from a global market leader

If you want to open a corporate account, you can see the full application form here.

What is a corporate trading account?

A corporate account allows you to trade financial markets – including shares, indices, commodities and currencies – in the name of a UK limited company. Corporate trading accounts offer the same functionality as a standard account, but you can nominate individuals to place trades and manage the account on behalf of the company.

Usually, corporate accounts are set up by institutional investors who want to conduct their trades under a formal business umbrella, rather than using individual trading accounts.

Want to open a corporate account? Start the application here

If you have more questions visit the FAQ section or start a chat with our support.