Account types

-

Open an accountRegister your details and open an account in minutes

-

DepositFund your account through our secure funding portal

-

Start tradingAccess over 13,500 markets on desktop or via the app

-

Open an accountRegister your details and open an account in minutes

-

DepositFund your account through our secure funding portal

-

Start tradingAccess over 13,500 markets on desktop or via the app

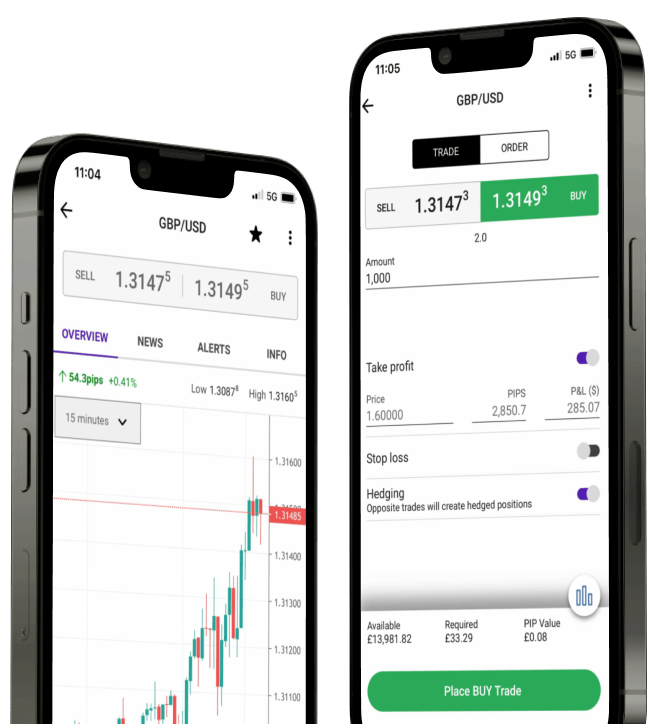

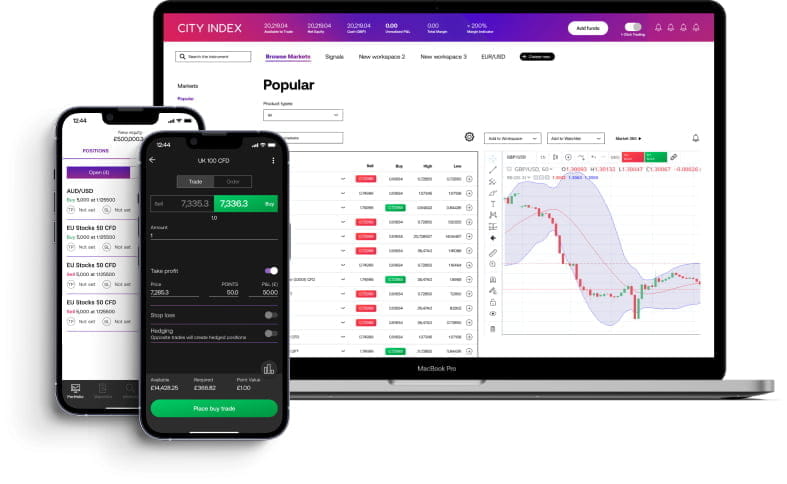

Standard account

Access a world of trading opportunity with a City Index standard account and start trading over 13,500 markets on our award-winning suite of platforms and apps, with advanced trading tools designed to help you get the most from every trade.

- Competitive pricing on thousands of popular markets

- Advanced TradingView charting package with 80+ technical indicators

- Round the clock customer service via live chat, email and phone

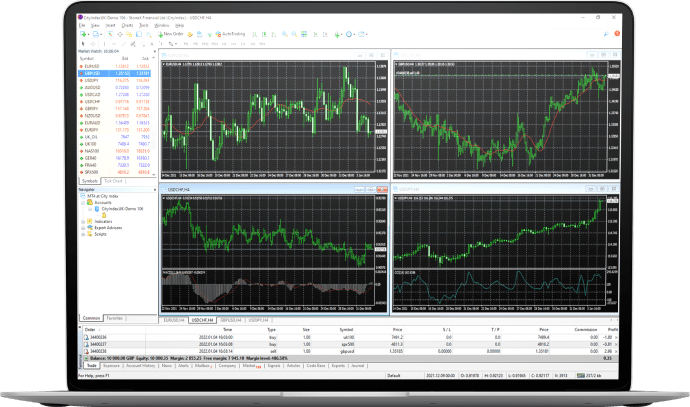

MT4 account

Trade thousands of global markets with ultra-tight spreads on the world’s most popular FX trading platform, now with access to more asset classes, including indices and commodities. Analyse every new opportunity with an extensive range of custom indicators, drawing tools and integrated news and analysis.

- Access more than 80 currency pairs

- Expert Advisors from FX Blue

- Wide range of charts and timeframes

Who are City Index?

City Index is a global Spread Betting FX and CFD provider who have helped traders navigate the markets since 1983.

We have over 40 years of experience and are trusted by traders for our fast, reliable execution.

Introducing Our New Interest Payment Scheme

City Index is now offering an Interest Payment Scheme, an opportunity to earn interest on your tradable account funds.

Here's how it works:

Eligibility:

Clients with an average of £20,000 or more in tradable funds throughout the month and maintain an active trading status* are eligible for this scheme.

Interest Rate:

We will apply an initial interest rate of 2.5% to the average tradable funds in your account(s) each calendar month.

Payment:

The accrued interest will be credited to your account based on the previous month's funds the following month.

*An active client is defined as someone who regularly trades and holds open positions on their accounts.

Please contact us to find out more information or to register your interest.

City Index offers over 13,500 markets with ultra-tight spreads and low commissions.

Learn how to master the markets with our how-to guides and video tutorials in the City Index Trading Academy.

Ultra-tight spreads, lightning-fast execution speeds

Our best execution policy means we will always deliver the fastest possible execution on all trades at City Index. If the price moves in your favour while your order is being processed, we will execute your order at the better price.

Account types FAQ

Can I receive interest on my tradeable funds?

Upon request, we may pay interest on Tradeable funds which average £20,000 or more over a calendar month.

How can I find out if I am eligible to receive interest?

Interest will only be paid to clients with £20,000 or more in their tradeable funds throughout the calendar month, Clients must also have an active status which means they trade and manage their accounts regularly. Contact your relationship manager or Client Management for more details.

Which account type is best for me?

The best account type for you will depend on your trading goals and experience – whether you’re looking for more support from us or have the experience to take on more sophisticated platforms.

Our standard spread betting and CFD trading account is designed for the everyday trader. It comes with competitive spreads on thousands of global markets, round-the-clock support, and integrated risk management – such as negative balance protection.

Learn more about our standard account

An MT4 account gives you access to one of the most popular FX trading platforms. Although it’s a dedicated FX platform, you can also trade indices, shares and commodities. It’s more suited to the experienced trader who wants to build automated trading systems and access advanced charting tools.

Learn more about our MT4 account

A professional account is for the expert trader who meets our eligibility requirements. You’ll get broker-assisted dealing but will lose the negative balance protection and leverage limits that come with a retail account. We’ll assume you have a higher level of knowledge, and understand the risks involved in trading.

Learn more about our professional trading account

A corporate account is suitable for institutional and retail business trading. It allows multiple authorised users and corporate cash deposits.

Learn more about our corporate account

What do I need to open an account?

To open an account, we’ll need you to provide a few personal details, such as your name, address and tax ID number (National Insurance Number) so that we can establish your identity.

In the majority of cases, this is all we require. But you may also be asked to provide supporting documents if we cannot verify the information provided – this could include a government-issued photo ID and proof of address.

There is no minimum deposit to open an account, but your application will be considered based on your income and savings.

The information you provide will be treated in the same, secure manner as all your other data held with us. It will not be shared publicly and will only be used for our reporting purposes with the FCA.

Ready to open an account? Start your application here.

If you have more questions visit the FAQ section or start a chat with our support.

Want to test your trading strategies in a risk-free environment?

- £10,000 virtual funds on our award-winning platform

- Get the same access as full account holders to research and analysis

- Available on desktop, web, mobile or tablet