Thematic indices

-

Take a broad position

Trade a basket of shares in a specific sector or industry

-

Go long or short

Think FAANG stocks are set to fail? Take a short position

-

Margin from 10%

Maximise your exposure with minimal outlay

What are Thematic Indices?

-

Bespoke groups of equities

Each thematic index represents a basket of US-listed shares, enabling you to trade emerging themes in a single position. -

Choose your theme

Pick from five themes to trade: FAANG+, cannabis, the remote economy, ESG. -

Trade your way

Go long or short with spread betting or CFDs. Use thematic indices to hedge existing positions, gain exposure to large-cap equities, or as part of your analysis.

Our thematic indices

What moves thematic indices?

Like benchmark indices, thematics move according to the price action of their constituent stocks, which might be affected by:

- Earnings releases

- Macroeconomic events

- News on the theme

Start trading with City Index:

- Choose from 5 unique thematic indices

- Trade with a margin from just 10%

- Find out more about thematic indices pricing

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

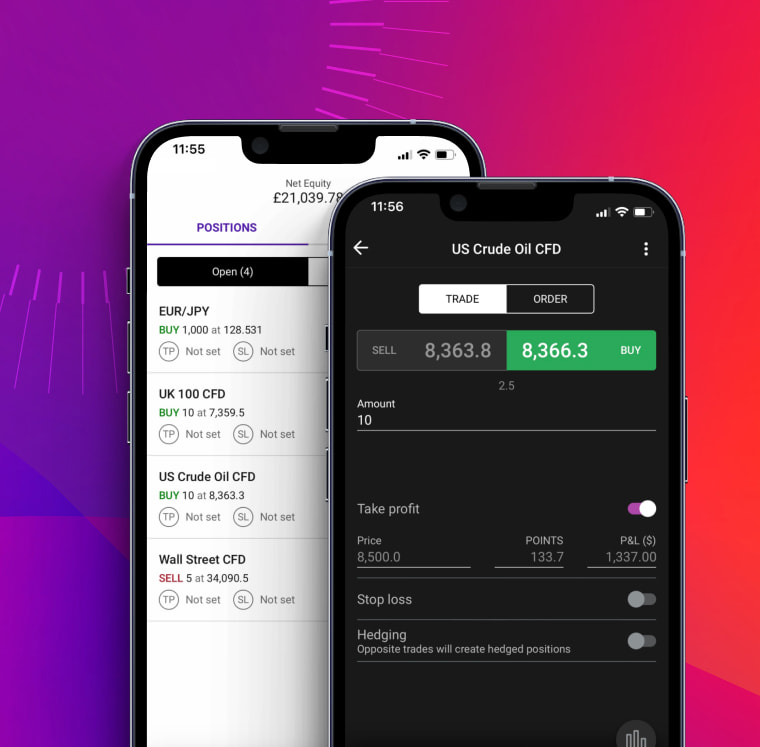

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Thematic Indices FAQ

How do Thematic Indices work?

Thematic Indices work in much the same way as most stock indices, creating an index value by combining either the market capitalisations or the share price values of all the constituents, and dividing it by that day’s divisor.

Each index will have its own methodology to identify companies that belong on the list. The most common is a ‘relevance score’ which assesses how much of the company’s revenue is generated from the business segment. For example, a green energy stock will need to make the majority of its income from renewable energy sources.

Learn more about how indices work here.

What are thematic indices?

A thematic index is an instrument that tracks the performance of a group of companies that all belong to a particular investment theme. These could be based on sectors or certain performance metrics – such as growth.

A thematic index creates the opportunity for traders to get exposure to a number of companies from a single position, taking advantage of ‘trends’ within the economy at large.

With City Index, you can trade thematic indices on:

- FAANG+

- Cannabis

- Remote working economy

- ESG

- Green

Learn more about indices trading here.

If you have more questions visit the FAQ section or start a chat with our support.