Reviewed by Patrick Foot, Senior Financial Writer.

What are the costs of spread betting?

Essential trading costs

Other potential charges

What is the spread?

The spread is the difference between the buy price and the sell price of a market. Any financial market will be quoted with a spread – it simply reflects the difference between the maximum price buyers are willing to offer for a market, or a seller is willing to accept.

In spread betting, however, the spread also covers your cost to open and close a trade.

At City Index, we don’t charge commission on any spread betting markets. Instead, our charges to open and close a trade are incorporated into the spread.

Open your City Index account to see our spreads on 1,000s of markets. Or if you’re not quite ready for live trading, try a demo instead.

How to read the spread

To read the spread, you simply minus a market’s buy price from its sell price.

- The buy price (sometimes called the offer) is always slightly higher than the market’s current level

- The sell price (or bid) is always slightly lower than the market’s current level

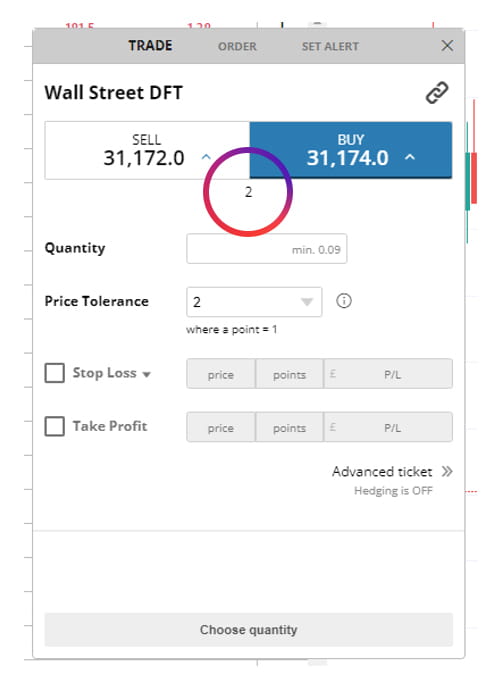

For example, say that Wall Street has a sell price of 31,172 and a buy price of 31,174. 31,174 - 31,172= 2 so the spread is 2 points.

How the spread affects profits

The tighter the spread, the quicker your trade can move into profit-earning territory.

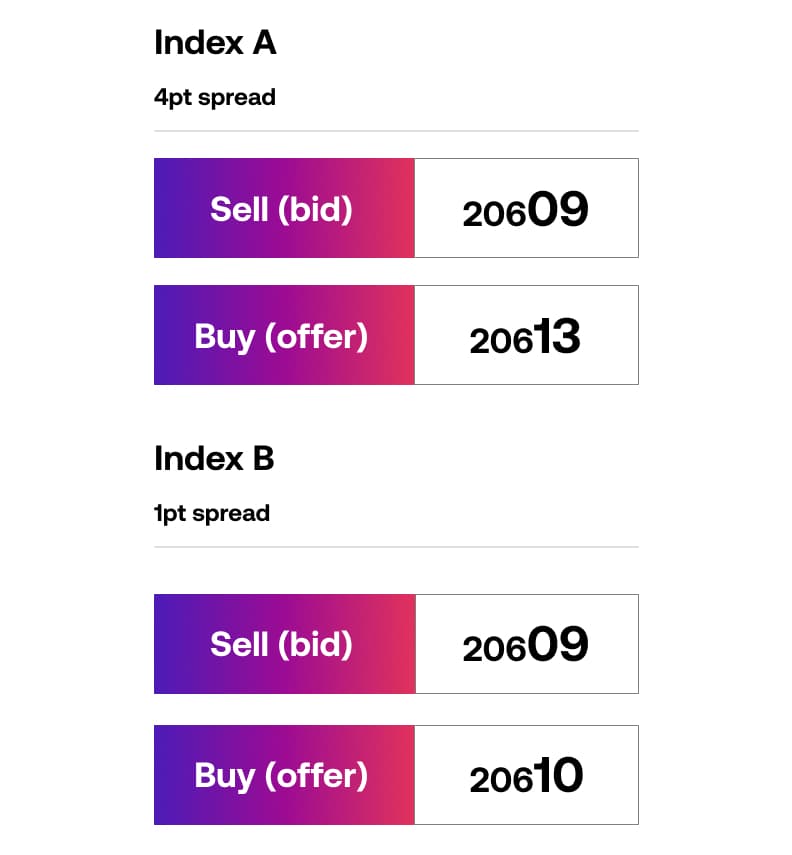

If you want to open a long position on index A, you’ll open your position at the buy price: 20613. Then, when it’s time to exit the position, you’ll trade at the sell price. Because of this, you’ll need the sell price to be higher than 20613 before you can make a profit.

Essentially, the four-point spread means you need the index to rise five points before you can make a return. If the index had a one-point spread, your position would potentially turn a profit much quicker.

The same is true when going short. Here, you’d open your position at the sell price (20609) and close it at the buy price. So you’d the buy to drop below 20609 before you make any profit.

Fixed vs variable spreads

There are two main types of spread that you may encounter when spread betting: fixed spreads and variable spreads.

- Fixed spreads stay the same throughout the day. If an index has a fixed 2-point spread, for example, you know that you’ll pay 2 points to trade regardless of how volatile or liquid the market is

- Variable spreads can change over the course of the day. Typically, they might get wider when a market is experiencing high volatility or low liquidity

What are overnight financing charges?

Overnight financing charges are how you pay to keep a leveraged position open for more than one day. Essentially, they’re an interest payment to cover the cost of the leverage that you use overnight.

Spread betting is leveraged, which means you don’t pay for the full value of your position. Instead, your provider in effect lends you the asset to open a long position – or borrows the asset from you when shorting. Financing is how you pay for this loan, and to calculate the true cost of a spread bet, you should take it into account.

You’ll only pay overnight financing on daily funded trades (DFTs), not on futures. Why? Because futures have the cost of leverage incorporated into the spread. So while their spreads are wider, futures might be more cost effective if your trading over the longer term.

How does overnight financing work?

Overnight financing works using the equivalent base rate of the instrument you are trading. For UK markets, the base rate is SONIA. The table below shows the rates for other regions:

Currency |

Benchmark |

|---|---|

| EUR | STR |

| GBP | SONIA |

| JPY | TONAR |

| SGD | SORA |

| USD | SOFR |

On long positions, you’ll pay the equivalent base rate +2.5%. On short positions, on the other hand, you’ll ‘receive’ the rate -2.5%. If the rate is low, then you may be charged a daily finance fee on a short position.

Overnight financing is calculated based on the size of your trade at the end of the day, then divided by 365 to get a daily rate.

Overnight financing example

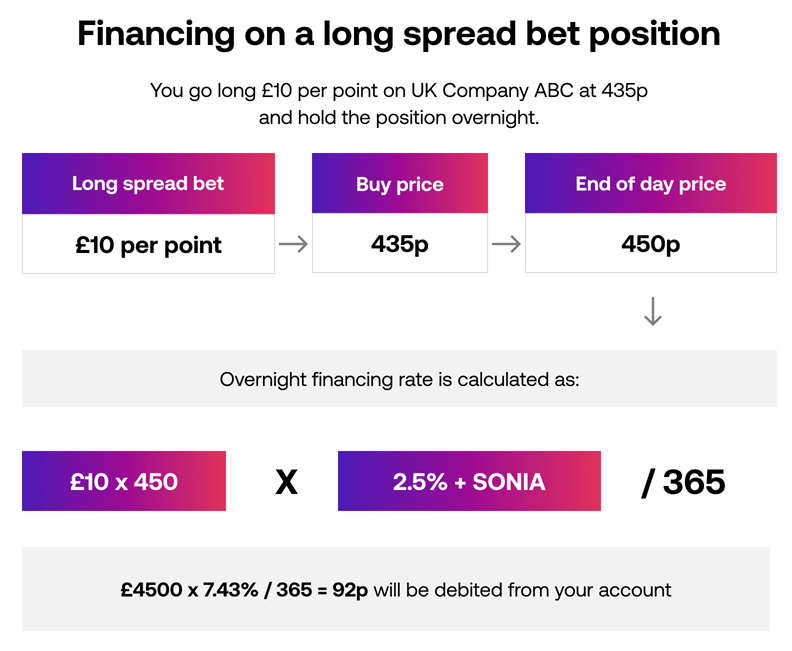

Say, for example, you decide to go long £10 per point on UK Company ABC at 435p. The trade is doing well and the price has increased to 450p at the end of the day. However, it is still some way from your target price of 480. You decide to keep the trade open overnight.

- The total size of your position is (450p x £10 per point) £4500 at the end of the day

- Assuming an illustrative SONIA rate of 0.73%, your overnight rate is 3.23%

- 3.23% of 4500 is £145.35, divided by 365 gives you a charge of 40p

Please note that you must have sufficient funds in your account to cover the financing charge.

The daily financing fee will be applied to your account each day that you hold an open position (including weekend days).

Other charges

Those essentially cover the total cost of spread betting – but there are a couple of other optional charges that you should be aware of. Let’s take a look at both: rolling over futures and guaranteed stop losses.

Futures rollover costs

When futures positions are nearing their expiry date you can, if you wish, roll your trade into the following period by selecting the auto rollover tick box in the order ticket. To carry out this transaction, you’ll pay half of the market’s spread.

If you are long, your position will be closed at the mid-price and re-opened at the new buy price. If you are short, your position will be closed at the mid-price and opened at the sell price in the back month.

It is cheaper to roll over to the next contract than closing the trade yourself and then reopening it. This is because when closing and opening manually you pay the full spread, whereas you only pay half by rolling over.

Rollover example

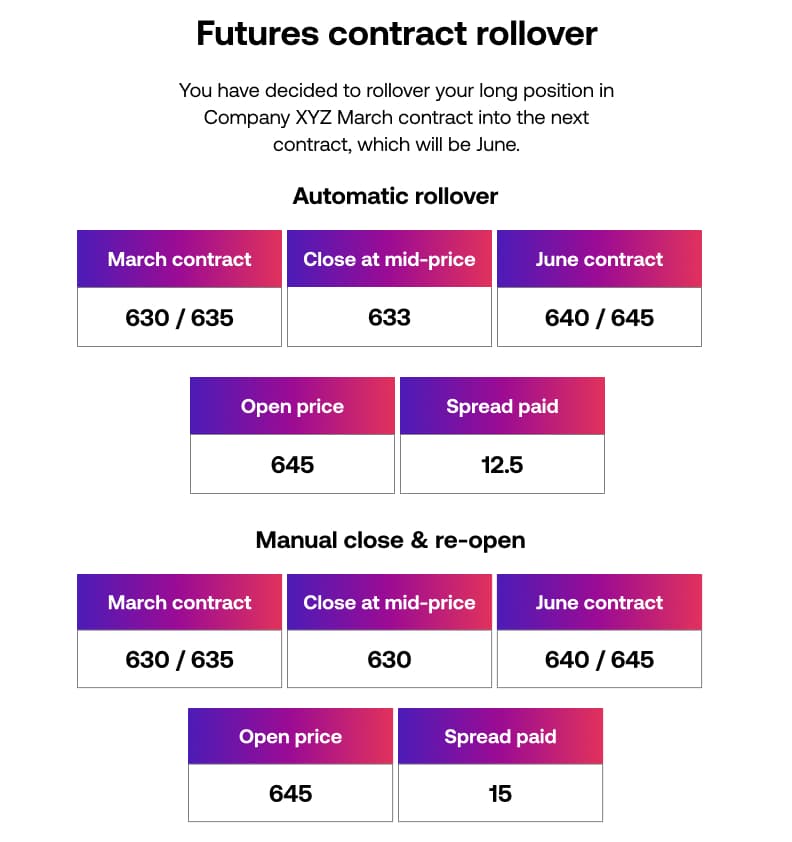

You decide to roll over your long position in Company XYZ March contract into the next period, which will be June.

At the time of the roll over, the March spread is 630/635 while the June spread is 640/645. Your position is closed at the March mid-price of 632.5 and then automatically reopened at the June buy price of 645.

Had you closed the trade yourself, you would have closed at 630, before re-opening at 645.

Guaranteed orders

There is no charge for placing standard stop and limit orders. There is, however, a one-off fee for guaranteed stop losses which is charged upon trigger.

Please note, guaranteed orders are only available on certain markets during the relevant market hours and the charges associated with them vary. Please see the relevant Market Information sheet on the trading platform for full details.

Inactivity fees

You may be charged an inactivity fee on your account if you don’t open any positions for a significant length of time.

With City Index, for example, we’ll debit £12 per month from your retail account if you don’t use it to open a position – or maintain an existing position – for more than 36 months. If you wish to reactivate your account after this time, we may have to reassess your trading experience.

* Spread Betting and CFD Trading are exempt from UK stamp duty. Spread betting is also exempt from UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.