Soft commodities

-

Range of markets

Gain exposure to geopolitical events through 20+ different commodity markets

-

Competitive pricing

We’re lowering the cost of trading, with spreads from just 0.06pts

-

Non-expiry spot contracts

Simplify your trading experience with our exclusive spot contracts

Soft commodities are generally agricultural products that are grown or bred for human consumption, as opposed to those that are mined. Soft commodities are traded on futures markets where people speculate on price fluctuations as supply and demand changes. Examples of soft commodities include coffee, corn, cotton, orange juice, soy bean oil, and wheat.

-

Diversify your portfolio

Soft commodities are often used by traders as part of their portfolio diversification to mitigate risk. -

Competitive pricing with ultrafast execution

Get the edge on the market by utilising of our market leading pricing and instant execution to capitalise on all market movements. -

Take advantage of leverage

You only put up a fraction of the value of the trade to open a position. Leverage can magnify your profits and your losses. -

Trade anytime, anywhere

Our multi-award-winning platform gives you instant access to soft commodities and thousands of other tradable instruments.

Live pricing

Major commodity market news

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

Ways to trade soft commodities

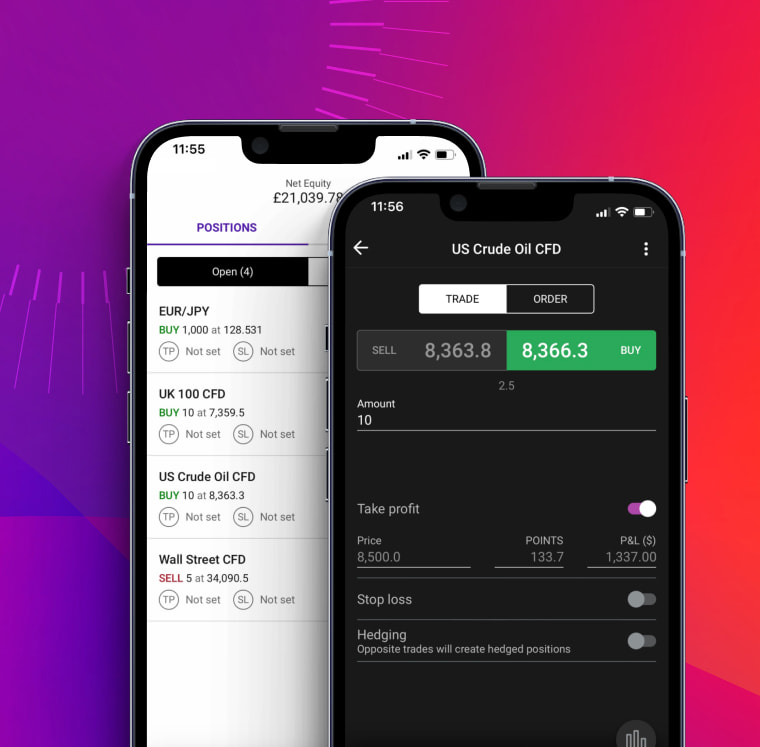

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

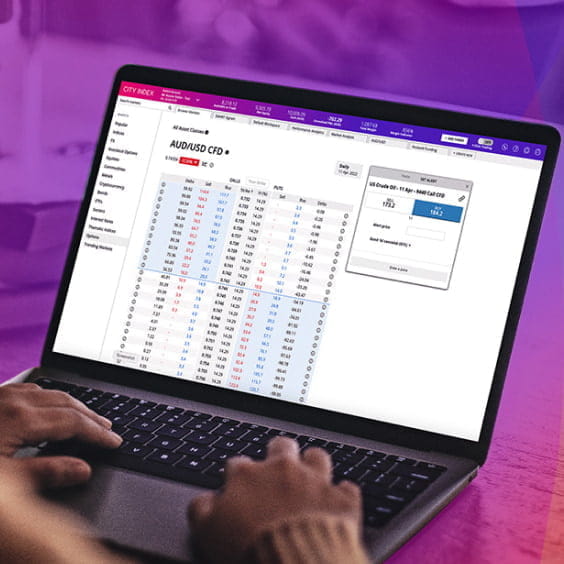

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade soft commodities with City Index

Whether you’re a new or experienced trader, it’s easy to open an account with City Index. All you have to do is complete our short, secure online form and you could be up and running on the live markets in minutes.

If you think a soft commodity like wheat or coffee is going to go up in value, you go long or ‘buy’. If you think a soft commodity is going to go down in value, you short or ‘sell’ it. Ready to start trading now? Get started with your application.

How to trade commodities

Discover everything you need to know about commodity markets, such as gold, oil and natural gas, including both hard and soft commodities.

Commodities market hours

Most commodity trading takes place on futures exchanges. Unlike stock exchanges, though, futures can be bought and sold almost 24-hours a day.

Commodity spot prices vs futures

Learn how to trade a range of commodity markets by spread betting or CFD trading, and choose from spot markets or futures contracts.