Spread betting on shares

-

Tight spreads

Spreads from 0.1% on UK shares

-

Extensive market offering

Spread bet on 4,700+ global shares

-

Award winning

Best Spread Betting Provider, Shares Awards 2021

Spread betting is a popular way to trade shares. City Index offers a choice of 4,700+ global shares from companies listed on all the major global exchanges.

-

Commission free

No commission and tight spreads. -

Extended hours trading

Access pre and post market news. -

Low margins from 20% on UK and US stocks

Gain the same level of market exposure for a relatively small initial deposit. -

Enjoy tax-free trading on spread betting products

No UK Capital Gains Tax (CGT) to pay on any profits*.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Live spread betting prices

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

City Index offers two popular ways to spread bet shares: Daily Funded Trades (DFTs) and futures.

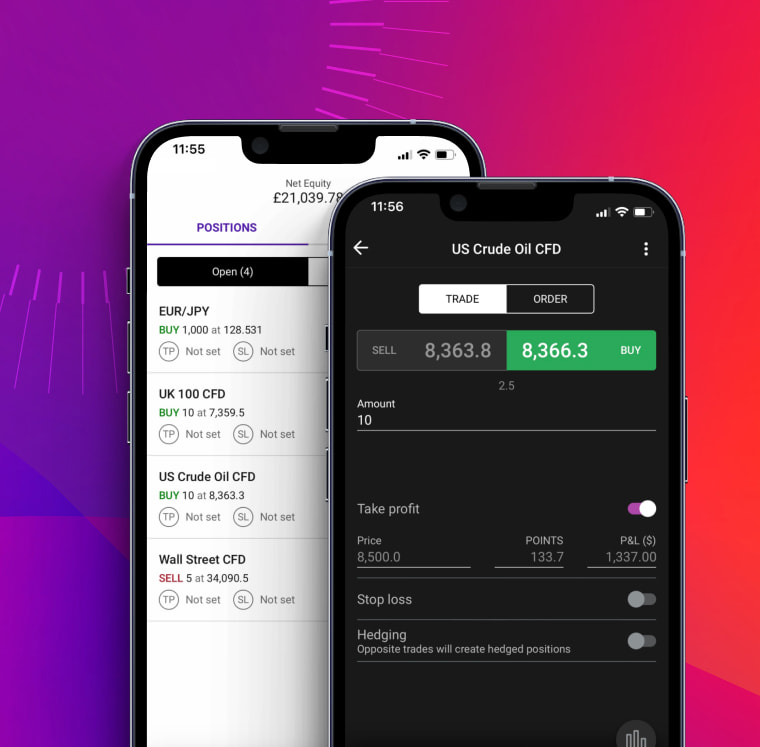

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Shares spread betting FAQ

Do you own shares when spread betting?

When you spread bet on a stock, you’re making a bet on whether its price is going to head up or down. So no, you never actually take ownership of the underlying shares themselves.

This can bring multiple advantages over traditional share dealing. For example, if you believe that a stock is going to fall in price, then you can open a short bet that will profit from any downward movement. Plus, you can access leverage to make your capital go further.

However, both shorting and leverage will increase your overall risk, which means that risk management is imperative when spread betting on shares.

What shares can I spread bet on?

With a City Index account, you can spread bet on 1000s of shares in the UK, Europe, the US, Asia and beyond. That includes Apple, Amazon, Barclays, AstraZeneca, Volkswagen, Sony, Softbank and Tesla – among 8500+ other markets.

To browse our full range of shares spread betting markets, log in to your City Index account and head over to the ‘Browse Markets’ tab, then select ‘Equities’ from the left-hand side. If you have an account with both CFD trading and spread betting enabled, then you can filter to only see spread betting markets using the ‘Product Types’ dropdown.

Is spread betting cheaper than share dealing?

Spread betting can work out to be less expensive than traditional share dealing, mostly because you can access leverage and don’t have to pay commission. This means that you can open a spread betting position for a fraction of the cost of buying shares outright.

Many shares spread betting markets require only 20% margin. So, for example, you can trade £1000 worth of Tesco stock with just £200 in your account. To buy that stock outright with share dealing, you’d need £1000 plus commission.

With either option, your profit or loss will be based on the full £1000. While leverage can help you do more with your capital, it will also increase your risk.

Instead of paying commission, the cost to spread bet on shares is covered by the spread – the difference between a market’s buy and sell prices.

If you have more questions visit the FAQ section or start a chat with our support.