Popular instruments

Shares explained

Can I buy and sell shares on the same day?

Yes, there are no minimum holding periods for shares, meaning you can buy and sell them on the same day. So if you’re interested in day trading shares, all you’ll need is a trading account with a regulated provider such as City Index.

You don’t have to stick to day trading shares, either. The high volatility and liquidity offered by both indices and forex makes both asset classes hugely popular among day traders. To try out both without risking any capital, open your free City Index demo.

Is share trading different to share dealing?

The terms share trading and share dealing are often used interchangeably, but they describe two different approaches to the stock markets. Share trading is short-term speculation using leveraged products, share dealing is longer-term investing.

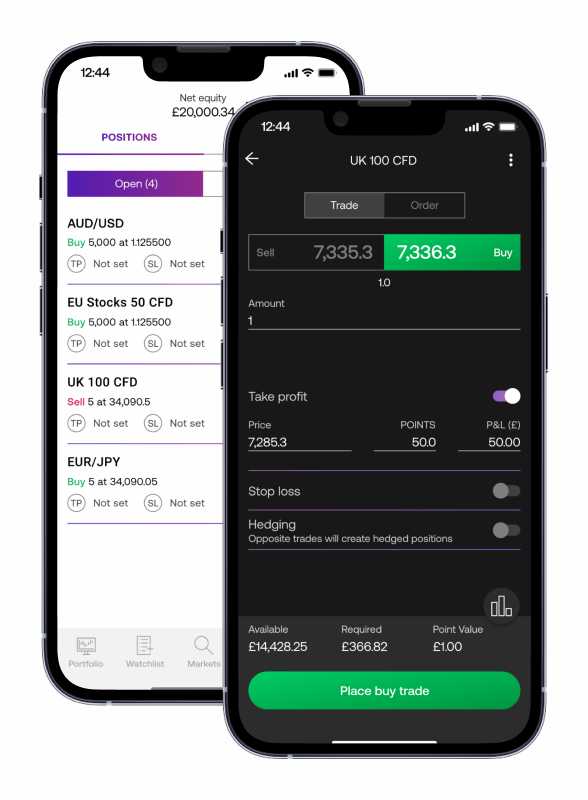

When you trade shares, you typically use leveraged products such as CFDs and spread betting to take a view on share prices without taking ownership of the underlying stocks themselves. So you don’t build a portfolio, but instead aim to profit from short-term price movements – which could be up or down.

Share dealing, on the other hand, is the traditional method of buying stocks outright and adding them to your portfolio. This gives you a much longer-term view, and is usually only used to take advantage of upward price movement.

Find out more about the difference between spread betting and investing.

Can you make money from shares?

Yes, you can make money from share trading. Just like any other financial market, you’ll make a profit by closing trades at a more favourable level than when you opened them. If a trade moves against you, on the other hand, you’ll make a loss.

To make consistent profits from share trading you’ll need a solid strategy and plan. We’d always recommend that beginner traders head over to the City Index Academy to learn how the markets work, then try a risk-free City Index demo to test your performance with virtual capital.