CFD trading on shares

-

Low commission

Commission from 0.08% on UK shares

-

Extensive range of shares

Trade CFDs on 4,700+ global shares

-

Trade pre and post market

Access US stocks on extended hours

CFD trading is a popular way to trade shares. City Index offers a choice of 4,700+ global shares from companies listed on all the major global exchanges.

-

Benefit from leverage

Retail margins from 20%. -

No UK stamp duty to pay

Pay no UK stamp duty on share trades*. -

Low costs of trading

UK commissions from 0.08%, and US shares from 1.8cps. -

Extended hours trading

Access pre and post market news.

*CFD Trading is exempt from UK stamp duty. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

*CFD Trading is exempt from UK stamp duty. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Real-time pricing

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

CFDs are ideal for shorter-term trading on technical levels and market news.

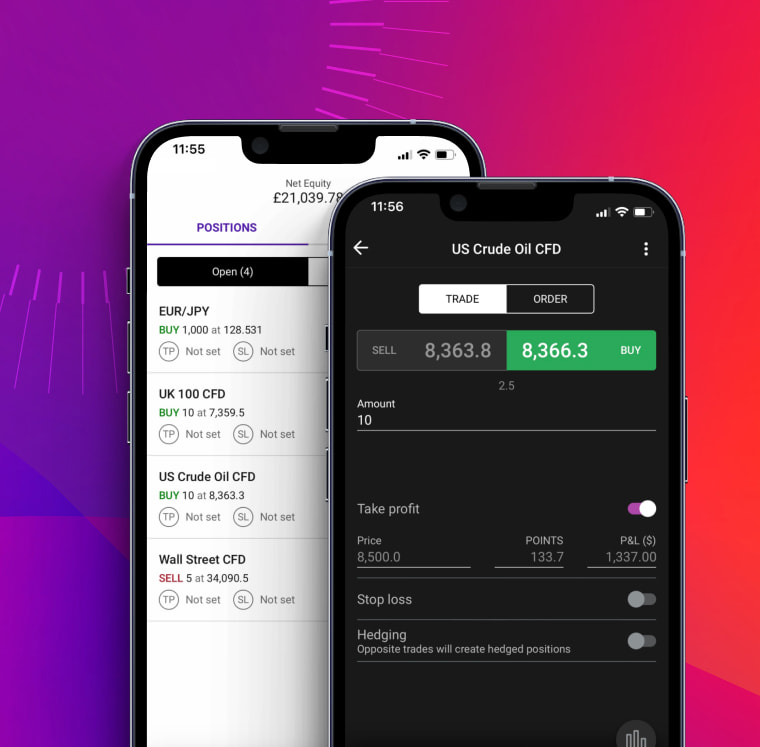

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Shares CFD trading FAQ

Do I pay commission with share CFDs?

Yes, you’ll pay commission to trade any share CFD markets with City Index – unlike all other asset classes, where you’ll pay via the spread instead. This makes the process of buying share CFDs fairly similar to the underlying market.

Our commission rates are just 0.08% on European and UK markets, or 1.8 cents per share on US ones. There’s a minimum commission of £10 on UK stocks, €10 on EU stocks and $10 on US stocks.

Want to trade shares with no commissions? Open a spread betting account, which features zero commissions on any markets.

What is the difference between a CFD and a share?

A share is a single unit of ownership in a publicly traded company. A CFD is a contract that enables you to trade on the price movements of shares – alongside lots of other markets including indices, forex and commodities – without ever owning the underlying asset.

When you buy a single share CFD, it gives you the same exposure as buying one share. Buying one Apple CFD, for example, is the equivalent of buying an Apple share. However, the key difference is that with the CFD you never take ownership of the share itself. Instead, you’re trading a contract in which you agree to exchange the difference in the stock’s price from when you open your position to when you close it.

What happens when you trade a share CFD?

When you trade a share CFD, you’re entering into a contract in which you and your CFD provider agree to exchange the difference in an asset’s price from when your position is opened to when it is closed.

Say, for example, that you buy 100 Coca-Cola CFDs at $55, then close your position at $60. You’d exchange the difference between $60 and $55, earning you a profit of $5 for each CFD you bought – or $500 overall. If Coca-Cola had fallen to $52 instead, you’d lose $300.

If you have more questions visit the FAQ section or start a chat with our support.