Pre-market and after-hours trading

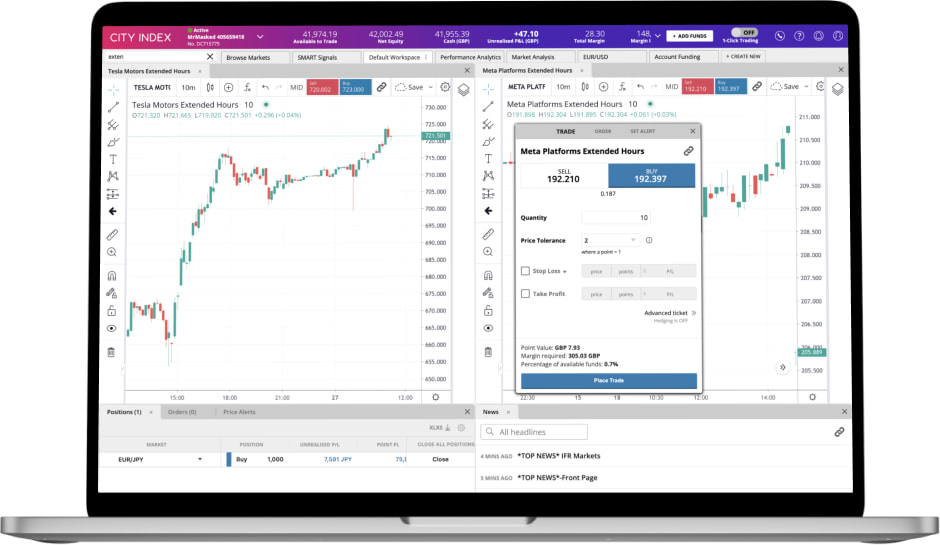

Take your position on Tesla, Apple, Amazon and more out of hours with City Index’s pre-market and after-hours trading – available on 70+ popular US stocks.

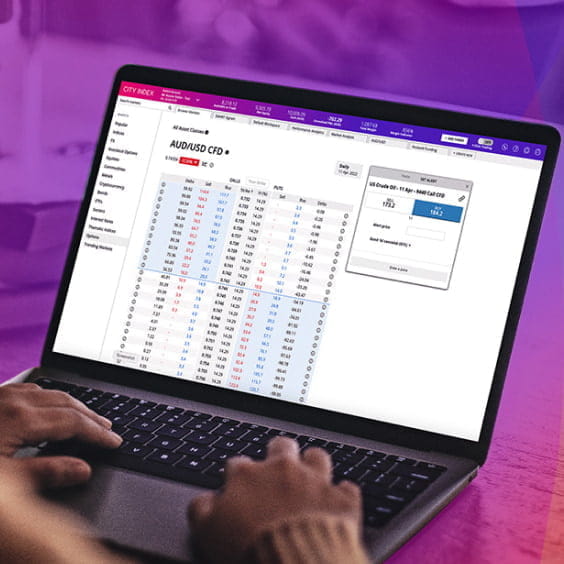

Award-winning trading platforms to suit your style

Enhanced trading access

Enjoy our exclusive extended hours on 70+ major US shares and speculate on company earnings the second they are released.

A platform powered by StoneX

Experience a leading trading platform operated by a renowned financial services provider and member of the Fortune 100, StoneX Group Inc.

-

React as soon as news breaks

Take your position on 70+ US stocks pre-and post-market

-

Trade on an award-winning platform

Open and close positions wherever you are with our web and mobile platforms

-

Stay ahead of the market

Set alerts for markets you’re interested in and receive SMS notifications

How to trade out of hours

Take a position on popular US stocks with spread bets or CFDs in just four steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade

- Choose your position and size, and your stop and limit levels

- Place the trade and monitor the market

Our extended hours markets are completely separate from our regular offering – running from 08:00 to 00:00 GMT.

You can find them in our Web Trader platform or mobile app by selecting ‘US Equities (Extended Hours)’ from the menu or searching for a company and choosing the market labelled ‘Extended Hours’.

Learn more about shares trading with City Index

City Index offers extended market hours on 73 popular US stocks and ETFs.

| Adobe Systems | Cisco Systems | Mastercard | Roku Inc |

| Advanced Micro Devices | Citigroup | Merck and Co | Salesforce.com |

| Alibaba | Coca-Cola Co | Meta | Snap Inc |

| Alphabet Inc A | Coinbase Global Inc | Micron Tech | SPDR DJIA Trust |

| Alphabet Inc C | Costco Wholesale | Microsoft | SPDR Gold Trust (US) |

| Amazon | Delta Airlines | Moderna | SPDR S&P 500 ETF |

| AMC Entertainment | Digital World Acquisition A | Netflix | Starbucks Corp |

| American Airlines Group | Energy Select SPDR | Nike CL B | Taiwan Semiconductor Mfg ADR |

| Apple | Exxon Mobil | NIO | Tesla |

| Applied Materials | GameStop Corp | Novavax Inc | |

| ARKK - ARK Innovation ETF | General Motors Co | Nvidia | Uber Inc |

| AT&T | Intel Corp | Occidental Petroleum | United States Oil Fund |

| Baidu | Invesco QQQ Trt Srs 1 | Palantir Tech Inc A | Visa |

| Bank of America | iPath S&P 500 VIX B SERIES | Paypal Holdings Inc | WalMart Stores |

| Berkshire Hathaway Class B | iShares Barc 20+ Yr Treasury ETF | Procter and Gamble | Walt Disney |

| Block Inc | iShares Russell 2000 ETF | Qualcomm | Wells Fargo and Co |

| Boeing Co | JP Morgan Chase | Rio Tinto (USD) | |

| BP Plc (ADR) | Kraneshares CSI China Internet | Rivian Automotive Inc | |

| Chevron | Lucid Group Inc | Robinhood Markets Inc |

What is pre-market trading?

Pre-market trading takes place before the regular market session. The US market opens at 09:30 EST each day, but our pre-market session starts at 04:00 EST, or 08:00 GMT.

Learn about the regular stock market hours

What is after-hours trading?

After-hours trading is the session that takes place once the regular market has closed. The US market closes at 16:00 EST, but our after-hours trading session runs until 20:00 EST, or 00:00 GMT.

What are the benefits of trading out of hours?

Most companies report their earnings outside of stock exchange hours. This means that by the time trading starts, the news has been digested and the larger price movements are over.

To react immediately, traders have to take their positions in pre- and post-market sessions.

What are the risks of out-of-hours trading?

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels.

Although news breaks out of hours, a lot of traders prefer to stick to the main market, which results in fewer counterparties to take the other side of your trades. The lower liquidity can make prices more unstable – resulting in massive price swings – and also result in larger spreads.

Volatility can be exciting for those with a high risk appetite, but for less experienced traders, it can be daunting. If you do decide to trade after hours, we’d recommend protecting your trades with our suite of risk management tools, including stops and limits.

Learn how to manage your risk.

Our extended hours offering is a continuous market, running from 8:00 to 00:00 GMT. By keeping it separate from our normal offering, we can ensure individuals with lower risk appetites aren’t exposed to the volatility that out-of-hours trading brings.

40 years' experience

as a provider

Award winning broker

Listed on the NASDAQ

Open an account today

-

Registerto open an account – applying is easy and takes minutes

-

Funddeposit easily and securely via debit card or bank transfer

-

Start tradinghundreds of markets on desktop, web and mobile

Open an account today

Open an account with City Index today and start trading instantly, once your account is approved.

Access thousands of global markets, including indices, shares, FX, commodities & more – all with competitive spreads, low cost trading and fast, reliable execution.

Frequently asked questions

How much does it cost to trade during extended hours?

Trading during extended hours does not cost anything more than taking a position during the normal session.

However, during extended market hours, volatility may rise, or liquidity may be low. High volatility or lower liquidity may result in a wider spread, increasing the cost of your trade.

See our costs and charges

Why do stocks move after hours?

Stocks move after hours because most company announcements are released after the main session has finished. The appetite for trading after hours means that many brokers have started offering extended hours which has increased the amount of price changes that take place out of hours.

See our market hours

Does after-hours trading affect opening prices?

After-hours trading has an impact on opening prices, as transactions have been happening and shifting the market price, even though the main market is closed. This is why the opening price often differs from the previous night’s close.

Learn how to trade shares

If you have more questions visit the FAQ section or start a chat with our support.