Weekly analysis

- COT report: JPY, EUR, CAD, AUD, Crude Oil Analysis

- AUD/USD weekly outlook: July 1, 2024

- The Week Ahead: UK, French Elections, US Employment and PMIs

Donald Trump’s route back into the Whitehouse has become easier after the Supreme court ruled that he has immunity from official, not private acts. And that likely derails all of not most cases against him surrounding the January 6 insurrection. And with the Biden’s post-Presidential-debate emergency meeting assuring Biden will hold his ground to run against Trump, a second Trump presidency is beginning to look like a slam dunk.

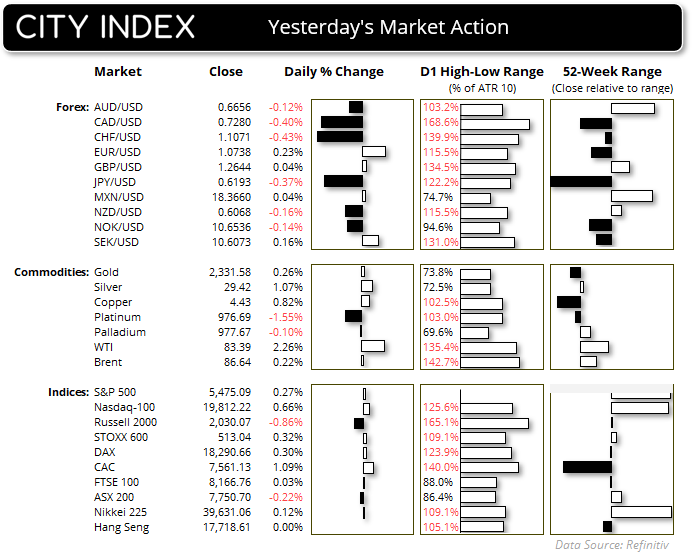

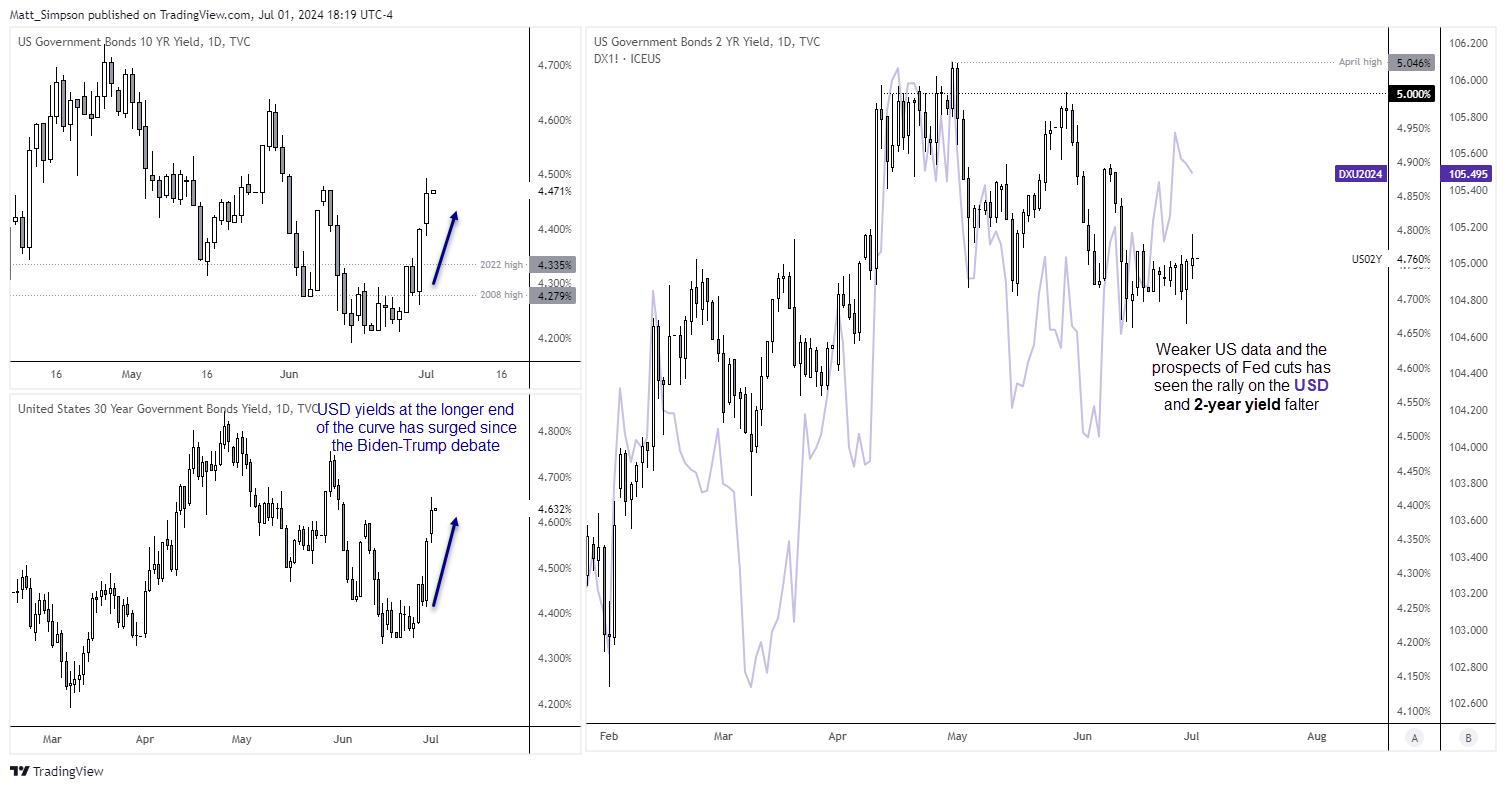

Bond treasuries continued to fall on Monday and sent yields higher following Joe Biden’s disastrous debate against Donald Trump. The fact that yields are rising without the US dollar suggests traders are more concerned that a Trump presidency would be more inflationary than a Biden one, prompting traders to offload treasuries at the longer end of the curve.

ISM manufacturing continued to soften at a fast enough pace to warrant Fed cuts without causing widespread panic. The headline PMI contracted at 48.5, new orders were also lower at 49.3 and prices paid (and inflationary gauge) rose at its slowest pace in six months at 52.1.

European markets gapped higher at Monday’s open after Marine Le Pen’s far-right party failed to secure an outright majority government. She was widely expected to win, but appetite for risk took solace in what they could from the situation. DAX futures rose as much as 1.25%, EUR/JPY reached a 32-year high and EUR/USD a 5-day high.

China’s economy continued to rise at a modest pace according to the latest government PMI surveys, with the composite index rising to 50.5, indicating a broad but mild expansion. A reading above 50 signifies expansion. However, manufacturing declined to 49.5, leaving services to prop up the broader economy with a print of 50.5. A separate reading by Caixin reported China’s final manufacturing figure at 51.8.

Korea’s exports slowed to 5.1% y/y, down from 11.7% and missing the 6.3% estimates to show global demand for their goods are waning.

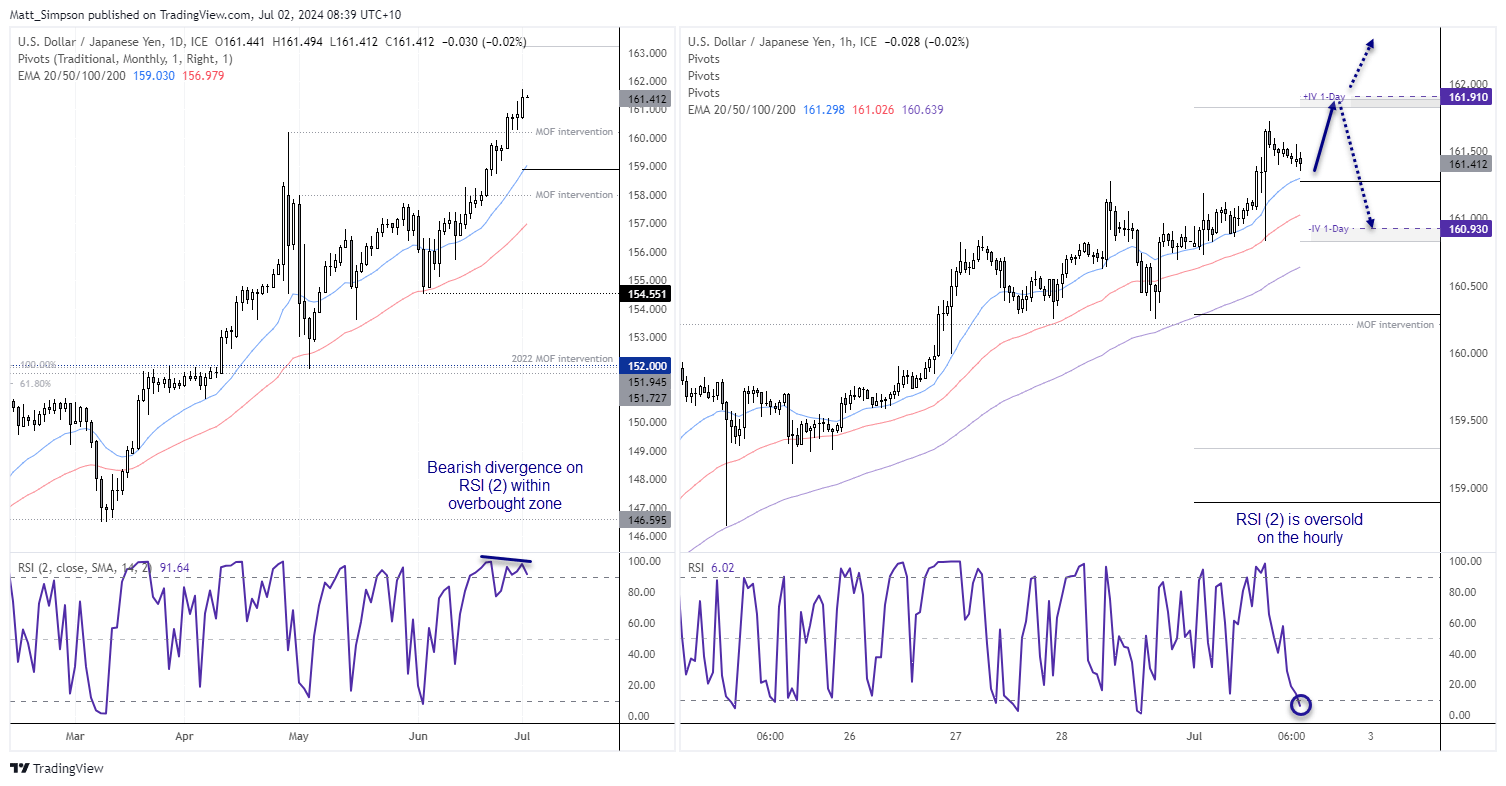

The yen continued to slide despite the latest round of warnings from Japan’s government officials last week. USD/JPY closed above 161 for the first time in 37 years and it has risen 10 of the past 13 sessions.

Economic events (times in AEST)

- 09:00 – South Korean CPI

- 11:30 – RBA minutes, retail sales

- 18:30 – Hong Kong retail sales

- 23:30 – Fed Chair Powell speaks

- 00:00 – US job openings (JOLTS)

USD/JPY technical analysis:

The uptrend on USD/JPY is undeniably strong. But unless the MOF intervene once more, the path of least resistance is likely higher. However, the two period RSI has formed a bearish divergence within the overbought zone on the daily chart. So it at least shows that the rally is beginning to lose steam, which brings the potential for a pullback - however minor.

The one hour chart shows prices have retraced from Mondays high and a holding above the 20. Moving average and daily pivot points. RSI is also oversold, so perhaps we're nearing a swing low. Today's bias is for another crack at 162, which sits just near the weekly R1 pivot an upper one-day implied volatility band. Given its round Number status, I wouldn't be too surprised as he pulled back from 162 if it makes it that far.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade