Gold barely responded to recent interest rate and inflation news out of the US in the past few weeks. The Fed dropped its reference to further rate rises this year, but Jay Powell kept the options open. European Central Bank guidance was fuzzy. The Bank of Japan began its first cautious steps away from a decades-long policy of quantitative easing. Gold appears to be trapped on a short-term technical basis in a trading range between $1,950 and $1,965.

Our precious metals team have recently relaunched a new platform, ”StoneX Bullion”, tied to the successful US franchise, and providing a seamless global product within the precious metals markets. The website is https://stonexbullion.com/

Gold technical and dollar relationship, two-year view

Source: Bloomberg, StoneX

Economic backdrop

Data on US inflation and spending numbers raised some fears of further interest rate hikes. Core Personal Consumption Expenditure, one of the Fed’s key parameters when framing policy, was actually slightly lower than the market consensus expectation, but at 4.1% annual rate it still points to a prolonged period of restrictive policy.

This tipped gold lower with the selling accelerated by the severance of key moving averages. Spot gold, which had previously been edging higher and testing $1,980, dropped smartly towards $1,950 before some fresh bargain hunting appeared.

As far as gold is concerned, economic data are still likely to put a cap on fresh strength, barring exogenous shocks. Were the US economy to tip into a recession in partial response to continued restrictive policy then this would be supportive as it would generate concerns and uncertainty.

Judging from the healthy personal spending numbers that were released at the same time as the PCE figures, that possibility currently looks relatively remote. The University of Michigan Sentiment Index, a closely watched gauge of consumer sentiment rose for the second month in succession, for the best reading since October 2021, with all components improving “considerably”, led by an 18% surge in long term business conditions, and a 14% gain in short-run business conditions.

While there was a glimmer of positive sentiment in the gold market two weeks ago, we are back to where we started. Gold continues to consolidate between $1,950 and $1,980. Silver is struggling to regain the $25 level.

Silver is posting a surplus this year that we currently estimate as equivalent to eight weeks’ global industrial demand and with investment demand still very anemic there is little prospect of a fundamentally-driven rally without either gold changing gear or an improvement in base metal sentiment. Neither of which look particularly encouraging at the moment.

Physical investment

The latest Commodity Futures Trading Commission (CFTC) figures, report on the period up to Tuesday 25th July, when gold had slipped from testing $1,985 and was hovering around $1,960, and silver was slipping from testing $25.25. Money Managers on COMEX added long gold positions for the third successive week, by 72 tonnes, or 19%, and reduced shorts by 30 tonnes, or 23%. This took the net long position to 359 tonnes from 256 tonnes.

Silver longs were trimmed, after a massive increase in longs the previous week, by 908 tonnes, or 11%, while shorts increased by 713 tonnes, or 18%. This took the net long position to 3,151 tonnes, down from 1,622 tonnes. Professional sentiment has been negative towards silver, and this have removed some of the speculative overhang, opening the path for further strength when the circumstances are right.

Gold suffered continued attrition in Exchange Traded Products (ETPs). Since the start of June there have been only four days out of 42 in which there were any ETP creations and tonnage has dropped by 80 tonnes, or 3%, to 3,393 tonnes. For comparison, global gold mine production is circa 3,700 tonnes. Silver has seen just 15 days of creation over the same period, for a loss of 526 tonnes, or 2%, to 22,770 tonnes. For comparison, global silver mine production is circa 25,600 tonnes.

For the time being gold is likely to continue to tread water and silver is expected to underperform because of an uncertain economic environment. Gold will do very little until we have the NonFarm payroll numbers from the States at the end of this week. A strong number will be bearish for gold; a weaker number will be supportive.

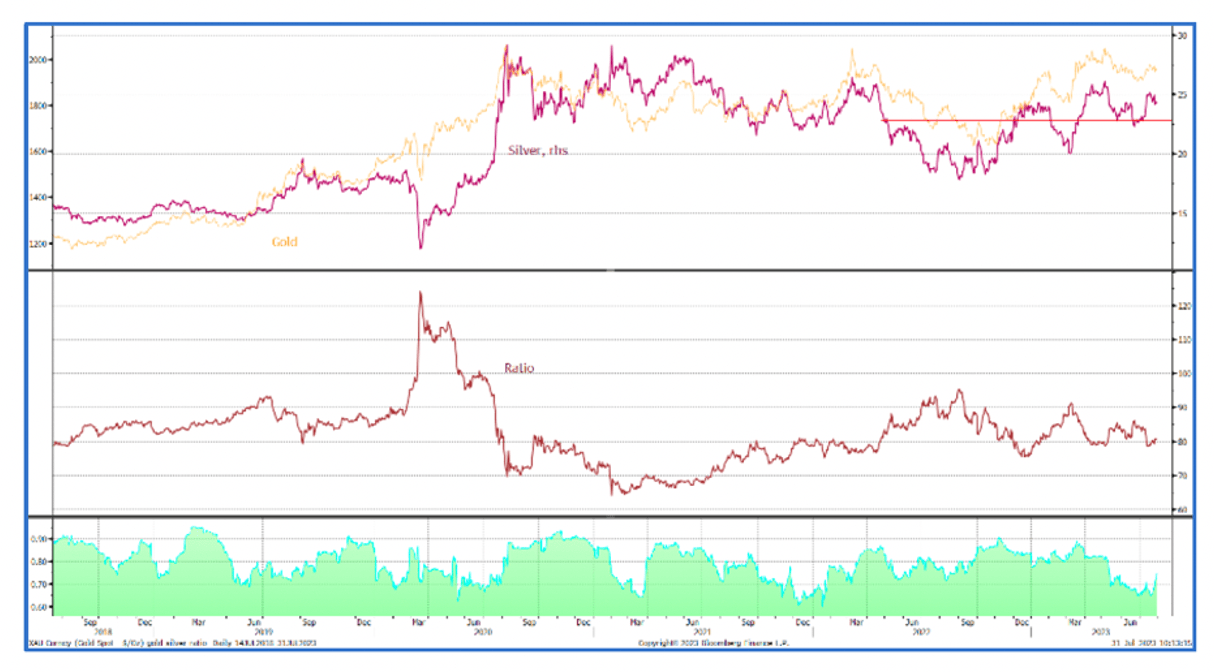

Gold and silver, five-year view

Source: Bloomberg, StoneX

Taken from analysis by Rhona O’Connell, Head of Commodity Market Analysis for EMEA & Asia, StoneX Financial Ltd.

Contact: Rhona.Oconnell@stonex.com.