NFP Report Key Points

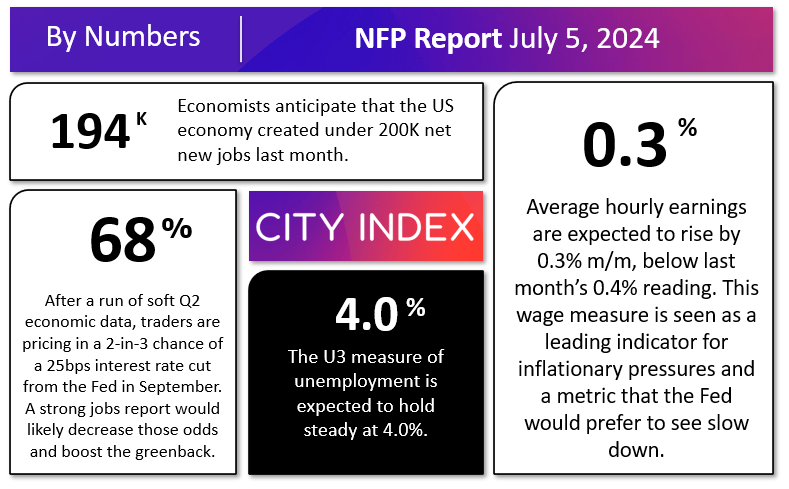

- NFP report expectations: +194K jobs, +0.3% m/m earnings, unemployment at 4.0%

- Leading indicators point to a roughly as-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 150-200K range.

- EUR/USD is rallying toward the key 1.0800 level that could set the tone for the rest of the month.

When is the June NFP Report?

The June NFP report will be released on Friday, July 5 at 8:30 ET.

NFP Report Expectations

Traders and economists expect the NFP report to show that the US created 194K net new jobs, with average hourly earnings rising 0.3% m/m (3.9% y/y) and the U3 unemployment rate holding steady at 4.0%.

NFP Overview

Despite the Q2 slowdown in economic data (including a notable uptick in initial jobless claims and a series of cooler-than-feared inflation readings), the Jerome Powell and the rest of the Federal Reserve appear to be in no hurry to cut interest rates.

The market has taken its cue from Fed comments, nearly pricing out a potential interest rate cut at the central bank’s meeting later this month (~6% odds per CME FedWatch as of writing). Any decent jobs report would likely be the proverbial “nail in the coffin” for July rate cut hopes, but outside of that, market volatility in reaction to NFP may be somewhat subdued unless we see a big slowdown in the labor market this month.

In terms of the NFP report, traders and economists are anticipating a slight moderation from last month’s strong jobs growth, with wages and the unemployment rate expected to come in roughly in line with recent trends:

Source: StoneX

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Services PMI Employment component fell to 46.1 from 47.1 last month.

- The ISM Manufacturing PMI Employment component slipped to 49.3 from 51.1 last month.

- The ADP Employment report showed 150K net new jobs, essentially unchanged from last month.

- Finally, the 4-week moving average of initial unemployment claims ticked up to 239K, up from 222K last month to near the highest level in 10 months.

Weighing the data and our internal models, the leading indicators point to a roughly as expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 150K-200K range, albeit with a big band of uncertainty given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.4% m/m in the most recent NFP report.

Potential NFP Market Reaction

|

|

Wages < 0.2% m/m |

Wages 0.2-0.4% m/m |

Wages > 0.4% m/m |

|

< 175K jobs |

Bearish USD |

Slightly Bearish USD |

Neutral USD |

|

175-225K jobs |

Slightly Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

> 225K jobs |

Neutral USD |

Slightly Bullish USD |

Bullish USD |

After drifting lower this week, the US dollar index is near the middle of its 3-month range, leaving a balanced outlook heading into NFP for the world’s reserve currency. With two more NFP reports (and 3 more CPI reports) on tap before the Fed is likely to make a substantive decision on interest rates, the probability of a large multi-hundred pip move in major currency pairs is low.

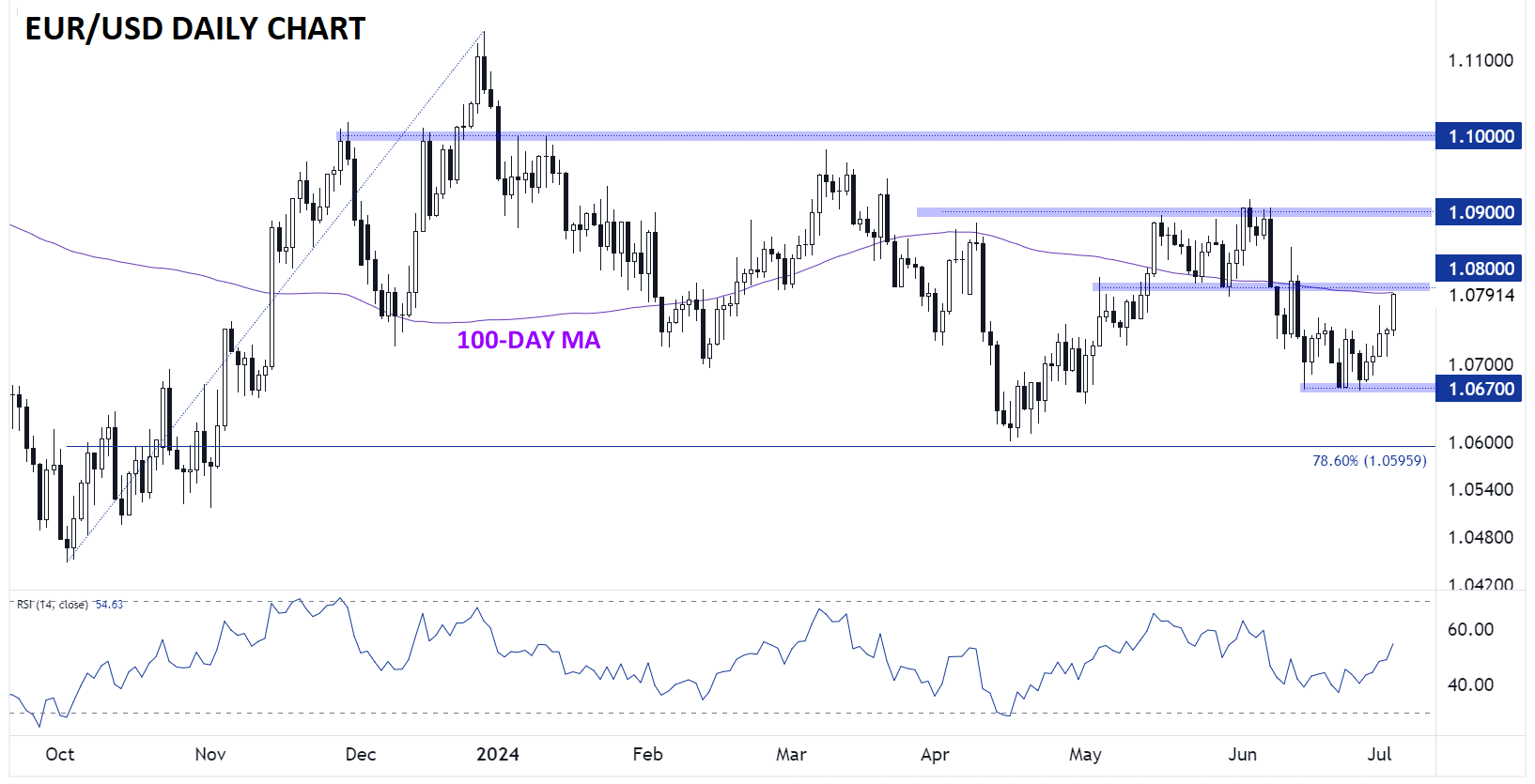

US Dollar Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

As the chart above shows, EUR/USD has seen a solid rally to start the week after testing support at the 1.0670 level in late June. As of writing, the pair is approaching a key level of previous-support-turned-resistance at 1.0800, which also coincides with the 100-day MA. That will be the key pivot level for the rest of the week: If EUR/USD can finish above 1.0800, potentially supported by a weaker-than-expected US jobs report, it would open the door for a continuation toward 1.0900 as we move through the month. Meanwhile, a weekly close below 1.0800 would keep the established 1.0670-1.0800 range in play for the short term.

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX