UK election update: Labour win likely

The countdown to 4th July, election day is on, and the polls have broadly continued to show the same pattern we've seen across the course of the election campaign: Labour retaining their lead of around 20 points above the Conservatives.

According to the BBC poll tracker, the Labor Party has 41%, and the Conservative Party has 21%.

Meanwhile, Reform UK has continued to edge higher, and they are now at 16%, their highest level since 2019 when they were called the Brexit party.

Source: BBC

Source: BBC

The polls tell us that the most likely outcome is a landslide win for Labour, and while a hung Parliament can't be discounted, it looks unlikely.

Both parties have released their manifestos. The IFS and BBC Verify have analysed the manifestos and calculated the tax burden as a percentage of GDP. There is little difference, with Labour at 37.4% and the Conservatives at 36.7%.

So what does this mean for the pound and UK market?

Labour victory

How could a labour victory impact GBP?

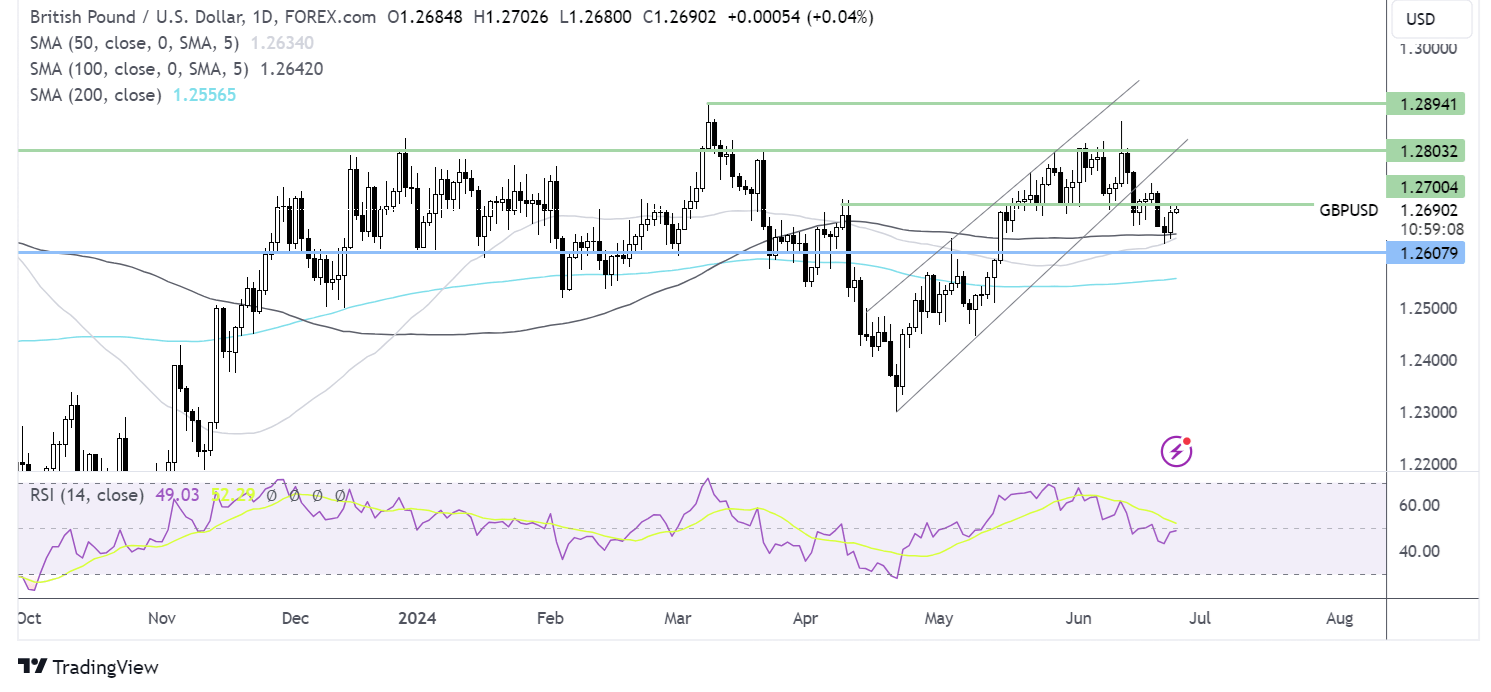

The polls show Kier Stammer’s party is set for a landslide victory, which could be good news for the pound. A period of political stability amid a less divided party and Labour's pledge to help improve ties with the European Union could support sterling. Removing trading frictions with the EU could help ease some of the weight of Brexit on the pound. That said, the pound is unlikely to return to the pre-Brexit levels of 1.50 anytime soon. Significant changes in the EU and UK trading relationship will not be an immediate priority. Any upward move in the pound post results will likely be limited.

The market has broadly priced in a Labour win since it is widely expected. The pound had been trading relatively stable heading into the election, with the Bank of England and macro data having more impact. A possible rate cut in August will likely impact the pound more than a Labour victory.

How could a labour victory impact the FTSE 100?

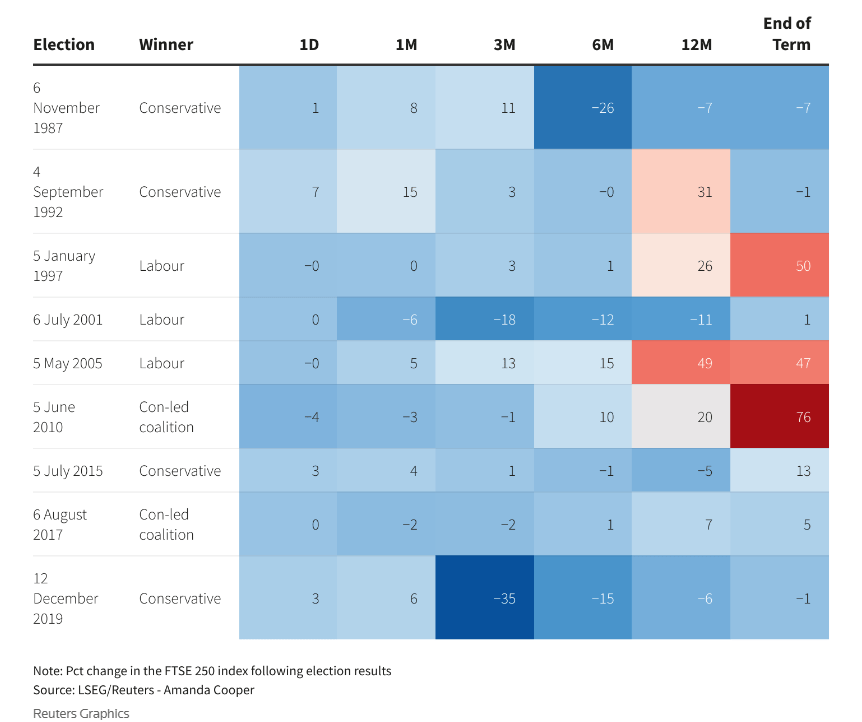

A Labor victory could be modestly beneficial for gilts and stocks, particularly if it is by a big margin, with just weeks to go until the Election. The FTSE has gained 6% this year as traders back Labour’s agenda of keeping spending tight, controlling sky-high debt, and boosting homebuilding and infrastructure. According to Reuters, UK domestic stocks perform better under Labour.

Political stability and less policy uncertainty could benefit UK businesses and growth. However, it is difficult to separate this from any move by the BoE to cut interest rates. Should the BoE cut rates in Q3, this could be more beneficial for boosting the economy and lifting the stock market than Labour policies.

Sectors & stocks

Of course, there could be individual movers amid questions such as whether NatWest’s share sale will go ahead or what could happen to water regulation or companies using zero-hour contracts. While these questions could impact specific sectors or stocks such as utilities and banks, these uncertainties are unlikely to impact at an index level.

Hung parliament

Given Labour's lead in the polls, even a hung parliament looks unlikely. However, polls can be wrong. A hung parliament could be considered the worst outcome for UK assets, with a potential selloff after the results. The market dislikes uncertainty, and it often performs better in the run-up to a general election when it is confident about who will win. The bottom line is that elections can cause some volatility, especially after a surprise. However, the impact is often short-lived.

Conservative win

A conservative win is looking extremely unlikely. Even Chancellor of the Exchequer Jeremy Hunt considers it an almost impossible task. If the impossible were to happen, it could result in an initial bearish knee-jerk reaction in the pound and UK assets, as the market will dislike the surprise. However, again, it's worth noting that the BoE’s actions could have more of an impact than any Conservative policies.