EUR/USD Key Points

- After last week’s interest rate cut, the ECB is likely to remain on hold until at least September.

- The economic calendar is relatively quiet in Europe this week, shifting the focus to the US.

- EUR/USD is holding below its rising trend line and the 50-day EMA in the 1.0820 region, hinting at the potential for more downside in the coming week.

EU Parliamentary Elections Unlikely to Drive Markets

The ongoing European Parliament elections are one of the largest democratic events globally, involving nearly 400 million EU citizens, but they’re unlikely to have a major impact on markets.

These elections, held every five years across the 27-member bloc, will elect members of the European Parliament (MEPs) who represent the interests of European citizens. This election is the first after Brexit and will see 720 MEPs, with some countries gaining additional seats. The initial results will be revealed on the evening of June 9, once all polling stations have closed.

Key issues driving this election include defense and security, particularly in light of the ongoing conflicts in Ukraine and Gaza, as well as economic concerns, job security, poverty, public health, and climate change. The European Parliament, though it cannot propose legislation, plays a critical role in voting on laws and the EU budget, making it a significant counterpower to the European Commission.

The far-right parties are looking to increase their influence, which could impact the EU's stance on various policies, including support for Ukraine. The outcome of these elections will also determine the future leadership of the European Commission, with current President Ursula von der Leyen seeking reappointment.

While political aficionados will tune in closely, traders may want to focus more on economic data, including the fallout from last week’s ECB interest rate cut (more on both topics below)

Did the ECB Jump the Gun on Rate Cuts?

Last week, the European Central Bank (ECB) reduced its key interest rate by a quarter-point to 3.75%, marking its first rate cut since 2019 (and the first time its ever started cutting interest rates before the Fed). ECB President Christine Lagarde emphasized that although inflation has eased, it remains above the target at 2.6%, necessitating a cautious approach to future rate adjustments. Lagarde refrained from committing to a specific path for further rate cuts, indicating that policy rates will stay restrictive as long as needed to manage inflation effectively.

While the ECB joins other central banks like those in Canada and Sweden in lowering rates, it remains vigilant about inflation trends, similar to the US Federal Reserve. Analysts predict that the ECB might hold rates steady in the near term, awaiting more concrete signs of inflation control. ECB President Lagarde speaks again on Friday, giving her an opportunity to refine her message from last week.

UK Economic Data for EUR/USD Traders to Watch This Week

After the excitement of the ECB last week, it’s poised to be a quieter week for Eurozone economic data, but EUR/USD traders will still want to tune in for the following reports from the currency union:

Monday

Italian Industrial Production

Eurozone Consumer Inflation Expectations

Tuesday

No meaningful data

Wednesday

German Inflation Rate

German Current Account

Thursday

German Wholesale prices

Spanish Inflation Rate

Eurozone Industrial Production

Friday

French Inflation Rate

Italian Trade Balance

Eurozone Trade Balance

ECB President Lagarde speech

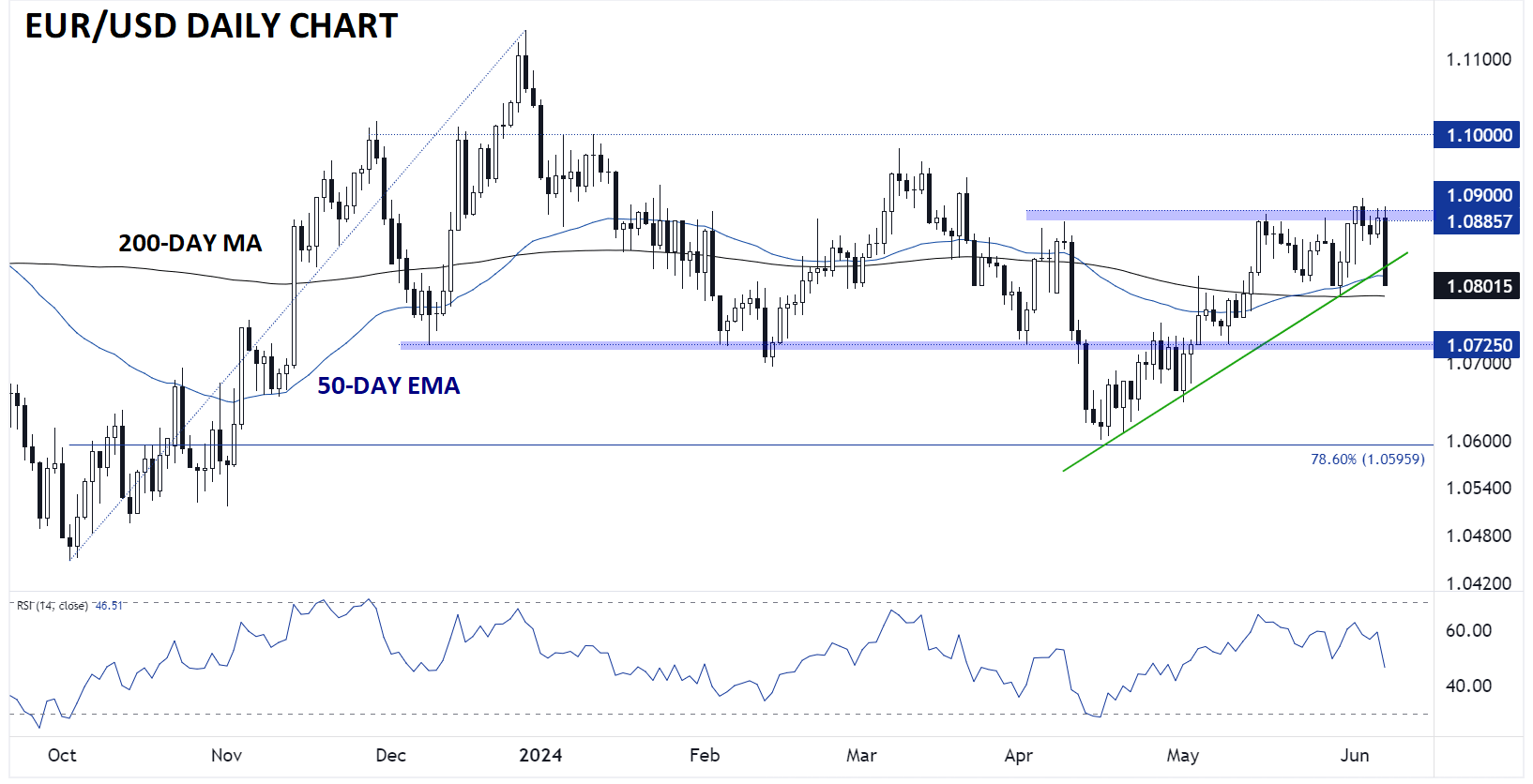

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Turning our attention to the daily chart, EUR/USD saw a huge selloff Friday in the wake of the stronger-than-expected US NFP report. As of writing on Friday afternoon, the pair is holding below its rising trend line and the 50-day EMA in the 1.0820 region, hinting at the potential for more downside in the coming week.

Initially, traders will be watching to see if the 200-day MA at 1.0785 holds, in which case the pair could bounce back to the mid-1.0800s, but a break of that key near-term level (not to mention the late May low at 1.0790) would open the door for a deeper drop toward the 1.0725 level.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX