EUR/USD looks to inflation data & Fed Powell speech

- Eurozone CPI is expected to cool to 2.5% YoY FROM 2.6%

- French election still creates some uncertainty

- EUR/USD struggles above 1.07

The euro has given back some of yesterday's gains as investors continue to digest the first round of French elections and look ahead to inflation data from the eurozone.

The far-right National Party won the first round of the snap elections but with a smaller majority than some polls had projected and far from securing an outright majority.

The final outcome is still certain. Should the National Rally Party gain a strong alliance to control parliament, there are still some concerns over what that could mean for fiscal spending plans. Marine Le Pen has pledged to increase spending, which would create fiscal concerns for France and could keep the market cautious.

Attention now turns to eurozone inflation, which is expected to cool to 2.5% YoY, down from 2.6%. The data comes after German inflation yesterday eased by more than expected to 2.2% after two months of rising. A resumption of the downward trend in inflation would support another rate cut by the ECB.

ECB president Christine Lagarde is due to speak again today. Yesterday, she reassured that the ECB won’t be cutting rates consecutively, saying that the central bank lacked the necessary data to prove that inflation was still falling. The ECB is expected to cut again this year, although the next move will likely be in September and not this month.

Meanwhile, the USD is tracking yields higher on worries that Trump will win the November election. Today, Federal Reserve Chair Jerome Powell is due to speak. His comments come after core PCE eased to a 3-year low, and recent data from the US shows some signs of the slowing economy.

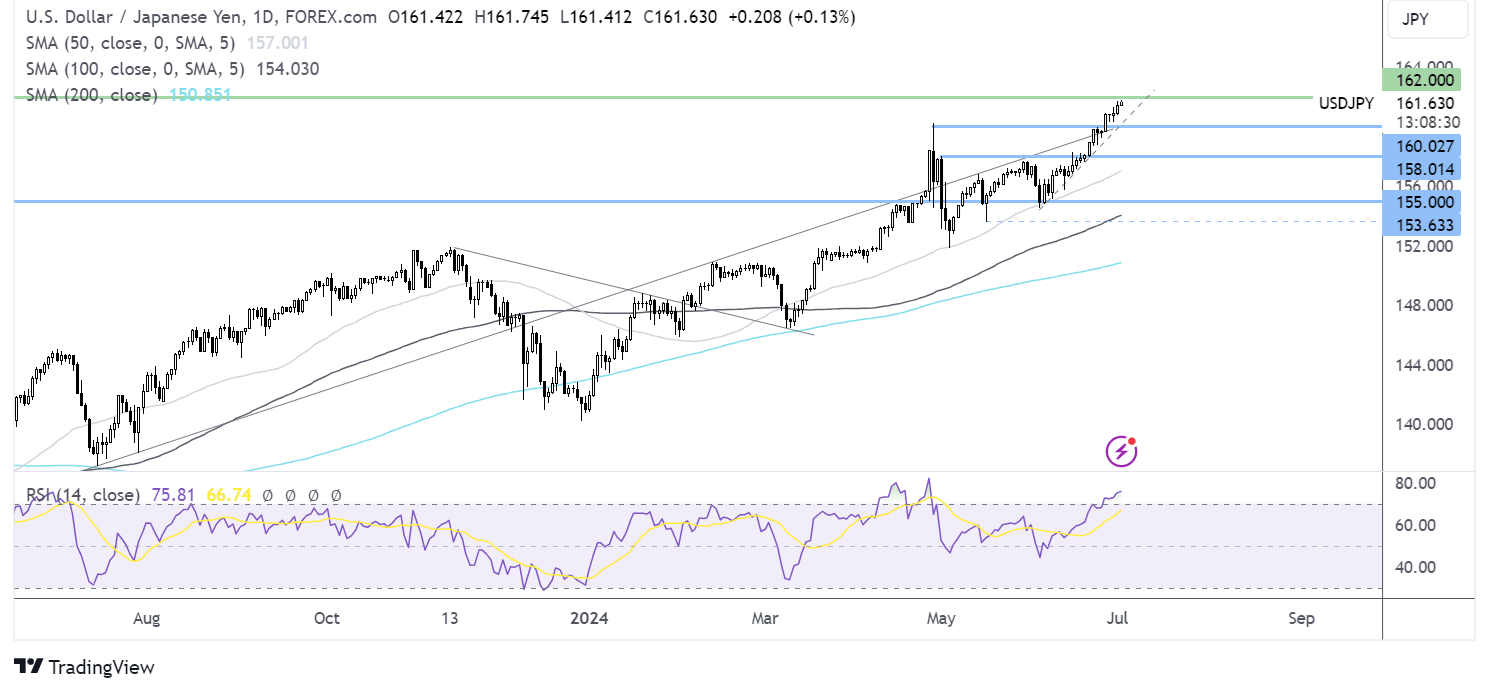

EUR/USD forecast – technical analysis

EUR/USD has recovered from 1.0660 low, briefly spiking to a high of 1.0775, the 50 SMA, before easing lower.

The price is struggling above 1.07 as it tests the falling trendline support. A break below here brings 1.0660 back into focus.

Should buyers successfully defend 1.07, a rise above the 50 & 200 SMA and weekly high at 1.0780/90. A rise above here brings 1.0915.

USD/JPY rises towards 162.00 ahead of Fed Chair Powell’s speech.

- USD tracks yields higher on rising bets of Trump winning the election

- Fed Chair Powell to speak & JOLTS job openings due

- USD/JPY looks to 162.00 near-term

USD/JPY is pushing higher, reaching fresh 38-year highs within a breadth of 162.00. The U.S. dollar is tracking treasury yields higher as investors weigh up the likelihood of Donald Trump's second presidency and ahead of a speech by Federal Reserve Chair Jerome Powell.

The currency pair, which is highly sensitive to U.S. Treasury yields and yields, climbed almost 14 basis points to 4.479% at the start of the week. This move could be attributed to rising expectations that Trump could win the presidency, which may result in higher tariffs and government borrowing.

Meanwhile, attention is also turning to Federal Reserve chair Jerome Powell, who will speak at the ECB central bank conference later today. The market will be watching for clues about when the central bank may start cutting interest rates. Speakers have reiterated the need for greater confidence that inflation is cooling to the 2% target.

In addition to Powell's speech, attention will also be on JOLTS job openings, expected to fall to 7.85 million, down from over 8 million in April. Signs of a weakening jobs market could pull the US dollar ahead of Friday's nonfarm payroll report.

Meanwhile, the Japanese yen is weakening further after overnight inflation data showed that CPI unexpectedly cooled to 2.4% year on year, down from 2.7% previously. On a monthly basis, inflation expectations fell -0.2%.

The data comes after the Japanese GDP was downwardly revised for Q1, pointing to sluggish demand and raising questions over the Bank of Japan's ability to hike interest rates any time soon.

The yen remains firmly in intervention territory, and Japanese authorities could wait until July 4th, the US public holiday, when liquidity is low before making a move.

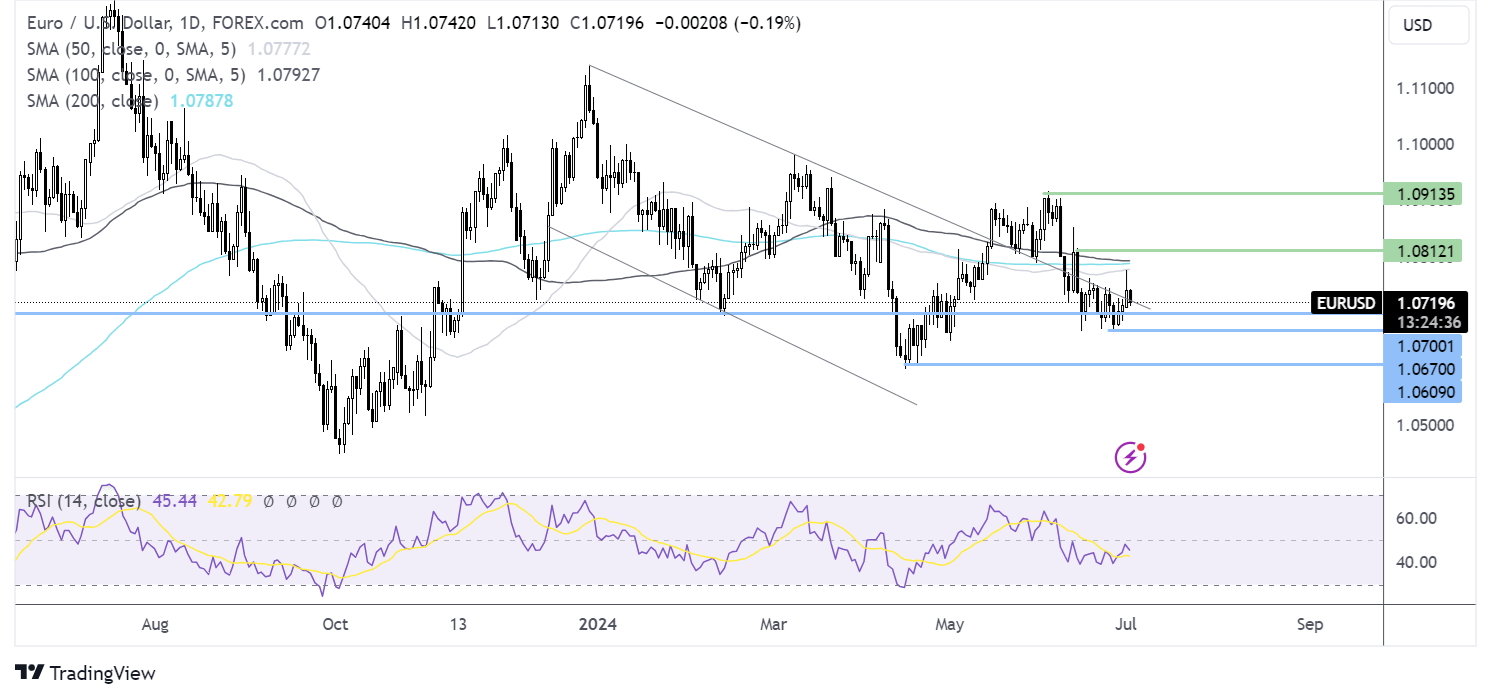

USD/JPY forecast – technical analysis

USD/JPY continues to grind higher towards 162.00. The RSI is in overbought territory, but this is more of a psychological game rather than a technical trade. If left untouched, 165.00 would be the next logical upside target.

Support can be seen at 160.00. Below here 158.00, the May high comes into play. However, a move lower due to intervention could spark a deeper selloff towards 155.00.