- EURUSD is trading on the border of its key consolidation

- ECB’s Christine Lagarde to clarify further monetary policy stands

- FOMC minutes are in sight today for further monetary policy insights

Previous ECB Lagarde speech highlights:

- A bumpy road can be expected towards the 2% inflation target

- Manufacturing goods below 2% are offsetting a balance between goods and services, yet factors supporting elevated services are watched closely for a more confident step in the rate cut direction

- Future decisions will continue to be data dependent with a cautious approach towards rate cuts

- It is important to consider spillover effects from the monetary policies of other regions, such as the US

Speaking of the Fed, the highlights from Powell’s latest speech include:

- Inflation data from April and May suggest rates are getting back on the disinflationary path

- Fed officials still want to see further inflation data aligned with the target rate to cut rates more confidently

- Early rate cuts can push inflationary pressures back into the play, while late rate cuts can possibly push the economy towards a recession

The FOMC minutes are coming up later today after the release of the ISM services PMI, for a possible clarified insight towards the Fed’s next steps

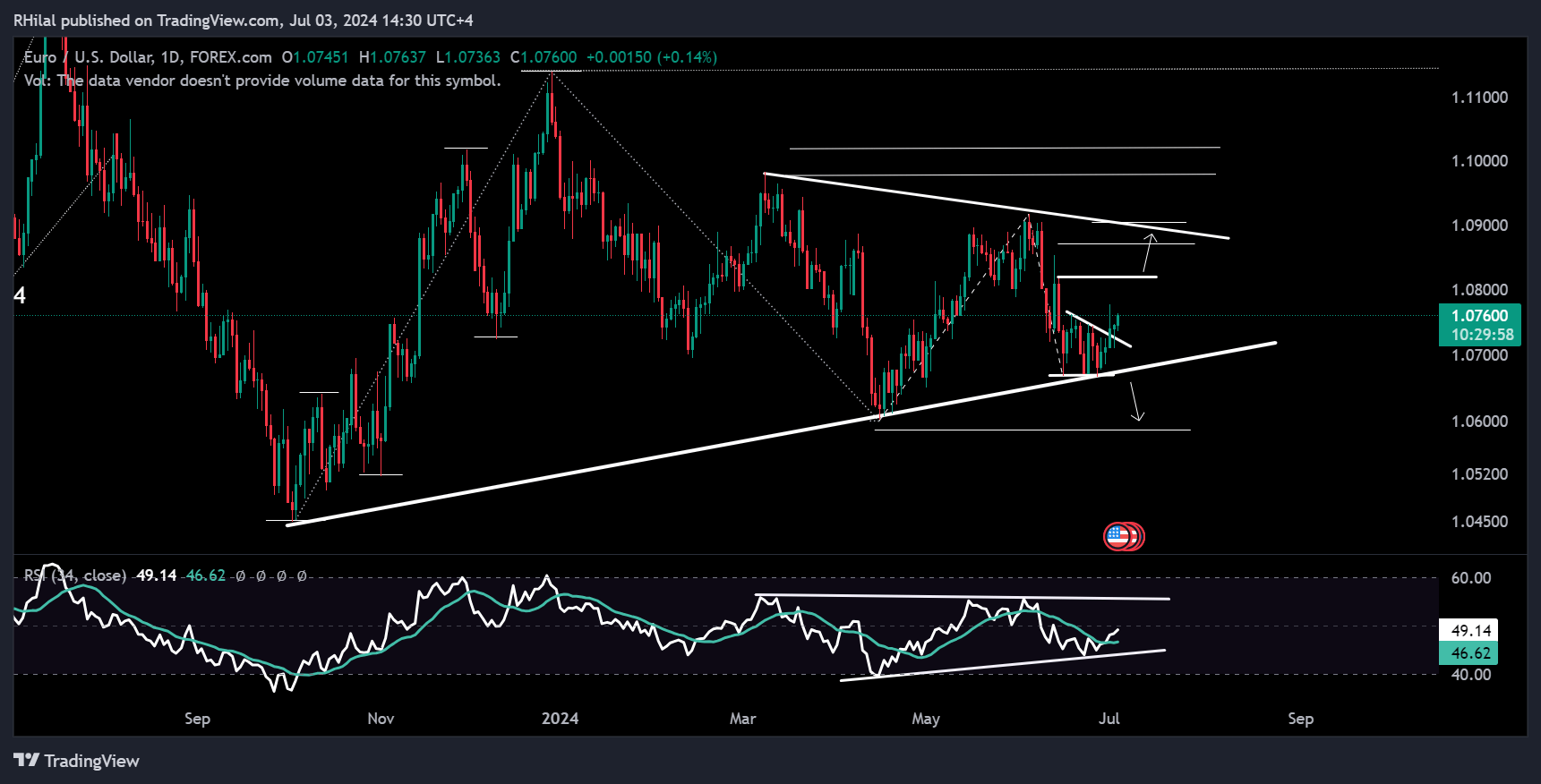

EURUSD Forecast: EURUSD – Daily Time Frame

From the perspective of consolidations, the EURUSD's latest trend has consolidated within a minor descending triangle at the bottom of its larger consolidation around the 1.067 level. This consolidation connects the highs of March and June 2024 and the lows of April and June 2024.

Upside

Given the latest election results along with the cautious moves of the ECB towards a second rate cut, the EURUSD broke out of its minor consolidation on the upside. The potential resistance levels facing the EURUSD’s trend are 1.0820, 1.0870, and 1.09 respectively.

Fed rate cut anticipations can add bearish pressures on the DXY and support the bullish trend of the EURUSD

Downside The 1.067 level remains key support. If broken, it can pave the way towards a drop near the 1.0590 support.

Following today’s FOMC minutes, attention is expected to shift towards the non-farm payrolls for the week’s final share of volatility.

--- Written by Razan Hilal, CMT