The EUR/USD was bouncing off its earlier lows but wasn’t going anywhere fast amid elections uncertainty in France, ahead of the release of US job openings data, which will come in just a few days ahead of the non-farm payrolls report on Friday. This morning saw the release of a slightly stronger-than-expected Eurozone core CPI inflation data, but this hardly had any impact as investors remain focused on politics. We have already observed a short-lived relief rally in mainland European shares and the single currency on Monday after the National Rally's narrower-than-expected victory in the French elections. Mainstream parties are now devising strategies to prevent the far-right party from achieving an absolute majority, while Marine Le Pen will also be seeking support from beyond her RN party should it fall short of an absolute majority in Sunday’s legislative elections. Consequently, French politics will remain in the spotlight for the rest of the week, keeping the EUR/USD forecast muddled for the time being.

Video: EUR/USD forecast and insights on FX majors and commodities

French elections uncertainty keeping euro restrained

Ahead of the second round of voting in the French elections on Sunday 7 July, investors are hopeful that the mainstream parties will strategically prevent the far-right National Rally from obtaining an absolute majority. Those hopes were lifted by the fact the participation rates in the first round were at their highest since 1986, and the abundance of three-way choices allows for the left-wing alliance and Macron to unite around tactical voting. As the deadline for negotiations approaches this evening, the most likely scenario is a hung parliament, which may mean the new assembly will struggle to reach a consensus on spending cuts, which is what worried investors in the first place. Still, the potential for Le Pen’s National Rally party to govern France is a key risk one cannot ignore. “If we’re just a few members of parliament away from a majority, we’ll try to go find them,” Le Pen said Tuesday.

Eurozone Core CPI comes in slightly stronger; unlikely to impact EUR/USD forecast

Eurozone core CPI remained at 2.9% against expectations of a slight fall, even if the headline rate fell to 2.5% from 2.6% as expected. The unemployment rate in the Eurozone remained unchanged at 6.4% as expected. I don’t think there's anything in these figures that would prompt the ECB to cut rates again in July after having just cut last month. The ECB will probably await additional data over the summer before seriously considering another cut in September, depending on the direction of oil prices, which have been rallying in recent weeks to reach their highest levels since April, and the political situation in Europe.

ECB President Christine Lagarde and Federal Reserve Chairman Jerome Powell are both set to speak later. Unless they say something completely unexpected, then we are unlikely to see any meaningful moves in FX.

Will the US dollar trend lower again?

Apparently, the dollar’s renewed strength is on the back of higher perceived chances of Donald Trump winning the US presidency race. This was underscored on Monday by the US Supreme Court granting Trump some immunity for trying to reverse the 2020 election results. As a result, he is now unlikely to face trial before the November vote, paving the way for him to return to the White House.

But will the dollar start trending lower again now that the market has reacted to the above development? Well, that depends partly on the outcome of this week's economic data from the US. These include the ISM Services PMI, the non-farm jobs report, and a few other economic indicators. On top of all that, you have the political situations in the UK and France, which could keep the euro and pound in a holding pattern, potentially supporting the dollar, this week.

But if the ISM manufacturing PMI is anything to go by, then we could see further weakness in US data this week. The PMI unexpectedly weakened to 48.5 form 48.7, indicating faster contraction, while key components of the report such as production, new orders, and employment all came in below 50, while inflation pressures eased as indicated by prices paid component fell. Meanwhile, we also saw a surprise 0.1% drop in construction spending on Monday.

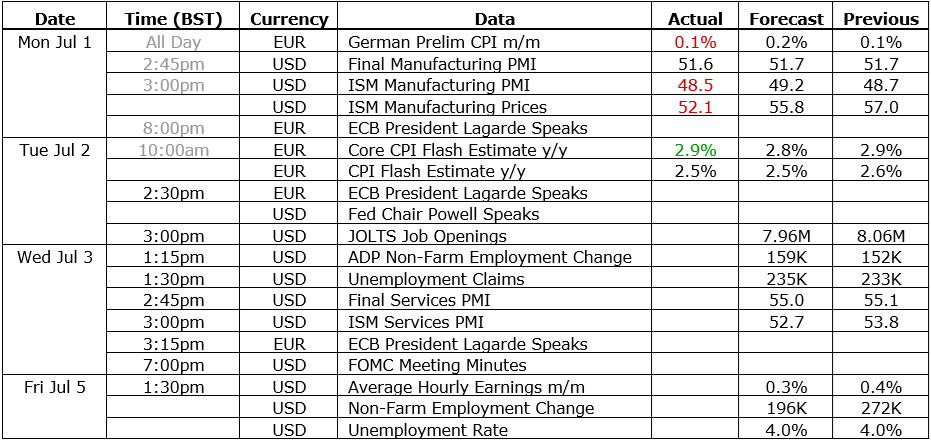

Here’s a full list of the key data releases to watch this week, relevant for the euro and US dollar, and thereby the EUR/USD forecast:

EUR/USD forecast: technical analysis and trade ideas

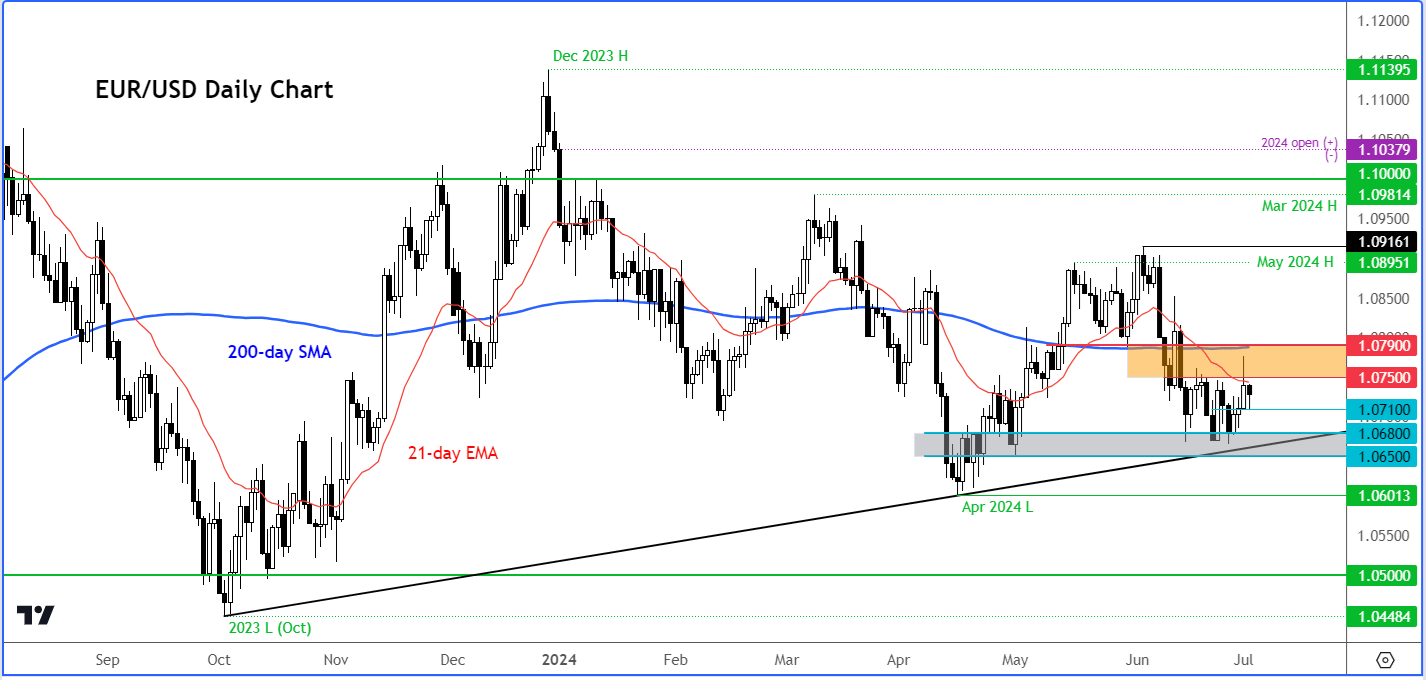

There's no clear directional bias on the euro, making the technical EUR/USD forecast difficult to read at this moment in time like most other currency pairs right now. But that could change once we have the elections uncertainty out of the way, and we see the release of the upcoming US data, which could set the tone for the remainder of this month.

Source: TradingView.com

There was a bit of a relief rally in the EUR/USD, but that momentum quickly faded, and now the currency pair is back at around the 1.0700-1.0710 area, which has been a short-term support level in recent trade. It hasn't really broken decisively below that area, with the pair finding decent support between the 1.0650 to 1.0690 area, where we also have a bullish trend line going back all the way to October coming into play. So, that area remains key. As long as we don't break that area, I think there's potential for a bit of a recovery in the euro against the dollar.

However, if that 1.0650-1.0690 area breaks down, then the April low at 1.0600ish will come into focus next, ahead of potentially 1.05 handle next. But we'll cross that bridge if we get there.

In terms of resistance, 1.0750 to 1.0790 area has been a pivotal area. Near the top of this range is also where we have the 200-day moving average converging with prior resistance and support.

So, those are some of the key support and resistance levels to watch this week. Depending on the potential direction of the breakout from this range, we could see some follow-up technical buying or selling in that direction.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade