DAX starts the week on an upbeat tone

- German IFO business sentiment deteriorates to 88.6 vs 87.9 expected

- French elections are in focus

- DAX is guided higher by 100 SMA from the June low

The DAX is rising on Monday, extending gains from last week shrugging off political uncertainty in Europe with France's elections at the weekend and after weaker-than-expected PMI data on Friday.

Auto stocks are leading the gains after China and the EU agreed to hold talks on the planned EV tariffs on Chinese-made EVs.

Stocks are moving higher despite German business sentiment deteriorating in June. The latest IFO business climate index fell to 88.6 from 89.3, defying expectations of a rise to 89.7. Friday's data showed that German business activity slowed in June after improving over the past two months.

Optimism and signs of recovery at the start of the year are fading, showing that the German economy is still struggling to gain momentum.

This week, the economic calendar is relatively quiet, which means the focus will be on the French elections, with the first round on June 30th. The far right's Marine Le Pen is ahead in the polls.

Meanwhile, Friday's US core PCE inflation is also likely to impact sentiment at the end of the week.

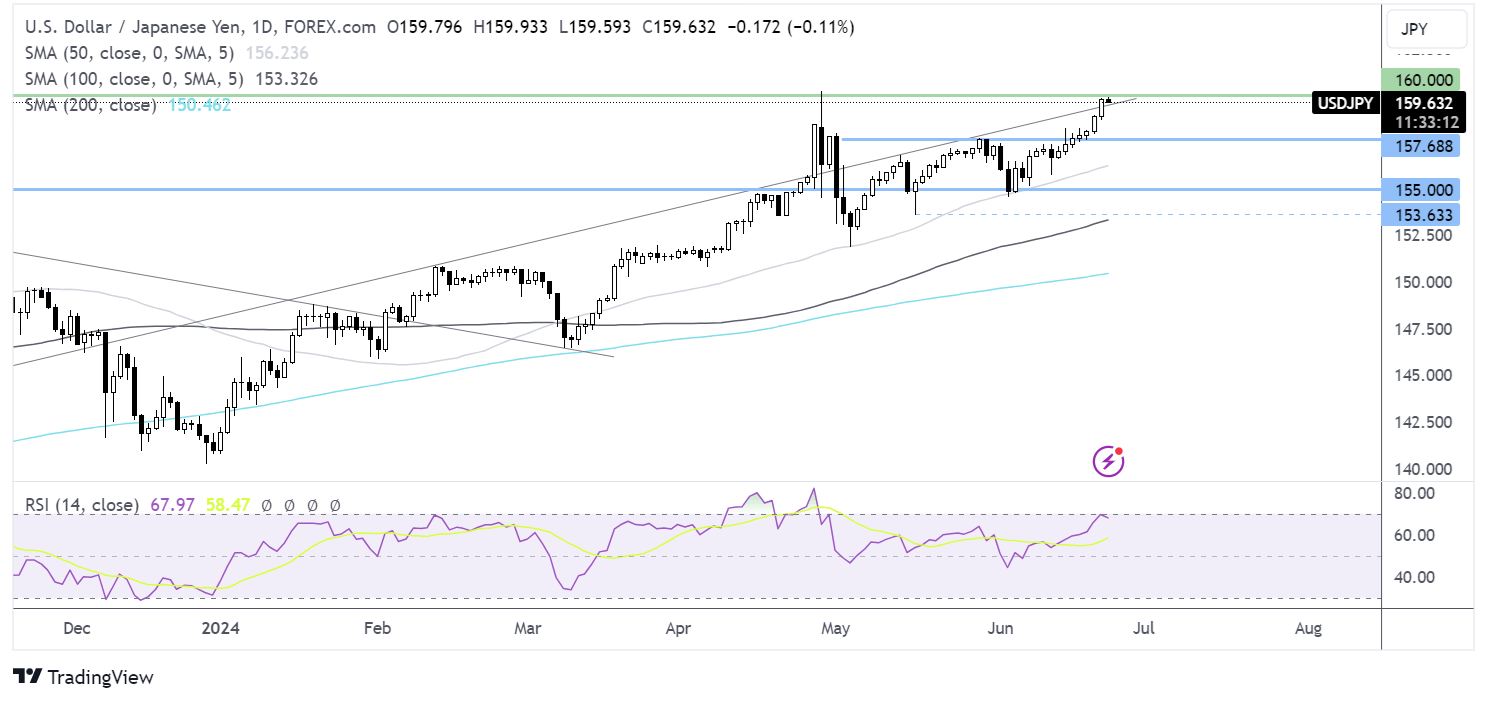

DAX forecast – technical analysis

After testing support at 17950, the DAX is being guided higher by the 100 SMA. Buyers will look to extend gains to the 50 SMA at 18335and on towards 18650, the April high.

Meanwhile, sellers will need a break below the 100 SMA at 18040 to retest 18000, the round number, and 17950, the June low. A break below here brings 17800, the May low, into focus.

USD/JPY back in intervention territory

- Pair hovers around an 8-week high

- US core PCE data on Friday is the key focus

- USD/JPY looks to 160.00

USD/JPY is once again in intervention territory as the pair hovers around an 8-week high.

The yen weakened to 159.94 its lowest level since April 29, when the yen weakness prompted the BoJ to intervene.

The yen has firmed slightly after Japanese authorities issued verbal warnings. They said the excessive foreign exchange movement could prompt a response, although no specific levels were given.

The yen has come under renewed pressure after the June BoJ meeting, where the central bank held off from reducing bond-buying stimulus until the next meeting in July.

The U.S. dollar rose again last week despite data painting a mixed picture of the US economy's state. US retail sales were weaker than expected, and jobless claims remained near a nine-month high. However, services PMI data on Friday were stronger than expected.

The data came as Federal Reserve officials continue to reiterate the need to see further evidence that inflation is cooling towards the 2% target before starting to cut interest rates.

The pair will focus on the US core PCE data on Friday. A soft reading could lift Fed rate cut expectations. Currently the market is pricing in a 70% probability of a September rate cut.

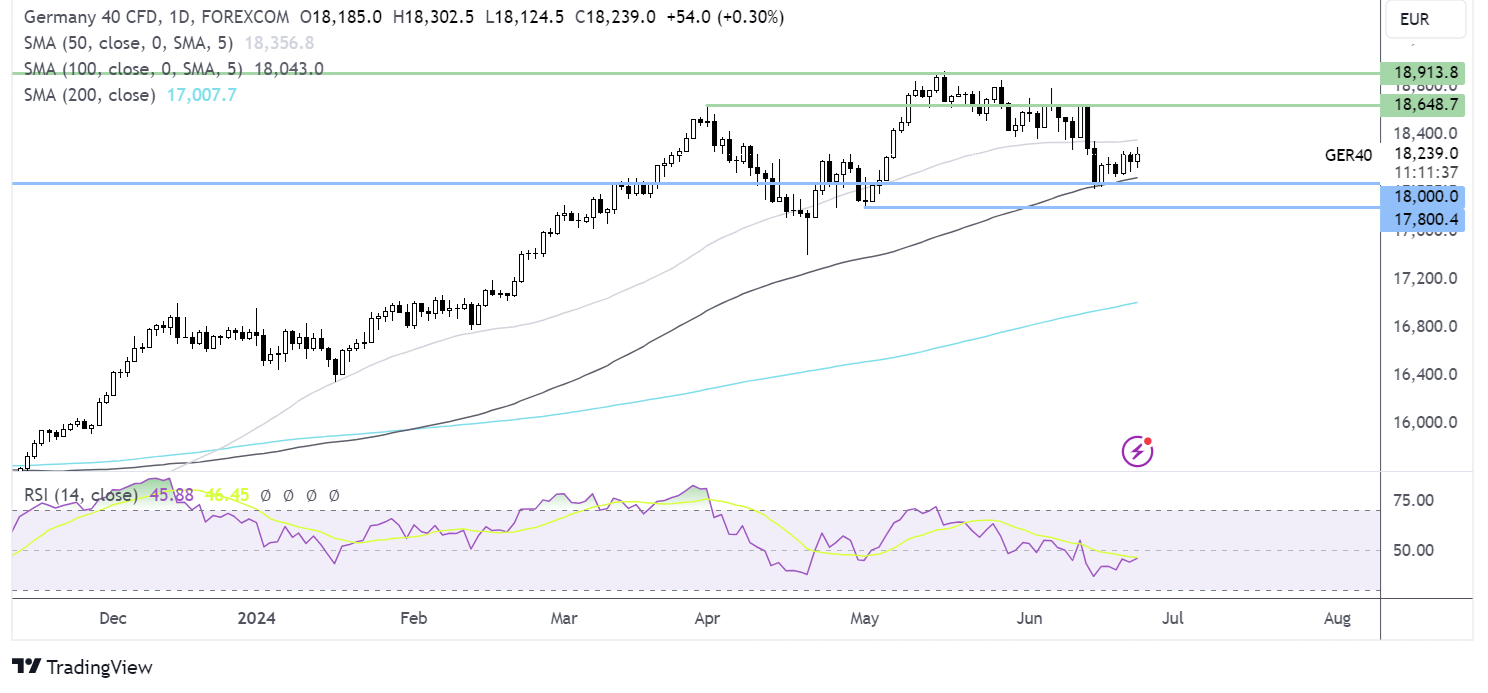

USD/JPY forecast – technical analysis

USD/JPY has continued to grind higher, rising above the rising trendline resistance, bringing 160.00 into the target.

Buyers will look to rise above the key resistance of 160.00 and 160.32, the YTD high.

However, given concerns over an intervention threat, a more likely scenario could be a test of support at 159.00 ahead of 158- 157.70, zone the early May and late May high.