DAX Technical Analysis: The German DAX index is showing a bullish signal, setting the stage for potential gains on Friday and possibly in early next week once the French elections are out of the way. European markets have been supported so far today, with the US out celebrating Independence Day. Dip-buying continues to dominate, and the recent consolidation suggests a fresh rally is imminent.

Video: DAX technical analysis and insights on FTSE, CAC and metals

Key Market Drivers

- French Elections: Concerns have eased, and investors are more confident. Prominent political figures are urging voters to prevent Marine Le Pen's far-right National Rally from gaining power, which is positively impacting the euro and stock markets.

- US Federal Reserve: Expectations are growing that the Fed will cut rates in September, especially after disappointing US macroeconomic data released throughout this week.

- UK General Elections: Labour is expected to win decisively tonight, but a hung parliament could undermine investor confidence. Here’s my FTSE 100 analysis from earlier.

DAX Technical Analysis

Source: TradingView.com

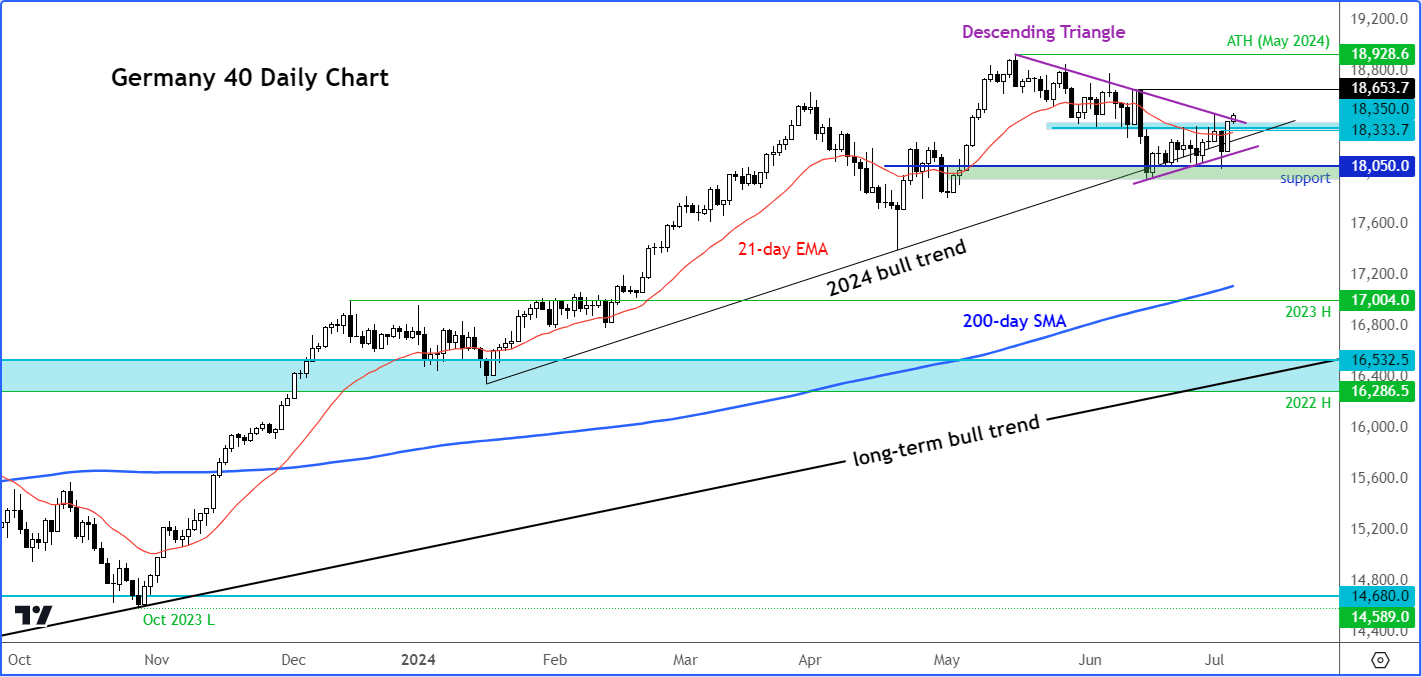

Breakout from Descending Triangle

- Breakout: The DAX broke out of a descending triangle pattern, surpassing key levels such as Tuesday’s high of 18333 and resistance around 18350 area.

- Key Support Zone: The now broken 18333-18350 range is critical, where several technical indicators converge, including the 21-day exponential moving average.

Upside Targets

- Target 1: 18653 – The most recent high before the latest drop.

- Target 2: 18900 – Liquidity resting above the all-time high.

Trading Strategy

- Dip-Buying: Despite macro concerns, buying on dips has been effective in 2024 for both the DAX and major US indices like the Nasdaq 100. That said, past performance in is not always a reliable indicator of future, so never forget your risk management.

- Long-Term Outlook: The DAX is holding comfortably above its 200-day average and around its short-term 21-day exponential. The minimal pullback from the May all-time high and subsequent consolidation indicates readiness for another upward move.

Alternative Scenario

- Support Failure: If support around 18333-18350 fails, the DAX may dip to the 18000-18050 area. However, given the bullish breakout this week, this is not the primary expectation.

Conclusion

The DAX index is poised for a potential rally, supported by easing concerns over the French elections and expectations of a US Federal Reserve rate cut. Key technical levels and trading strategies suggest that buying on dips remains a favourable approach.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade