GBP/USD Key Points

- With a series of strong economic reports reinvigorating the “US Economic Exceptionalism” theme from Q3, it’s not surprising that the US dollar is the strongest major currency on the day.

- GBP/USD is finally breaking out of its 7-week, 200-pip range between 1.2600 and 1.2800.

- A break through 1.2525 support could open the door for a continuation down toward the “measured move” target of the consolidation range closer to 1.2400

GBP/USD Fundamental Analysis

Confounding expectations for an imminent slowdown, the US economy appears to have accelerated in the first month of the year, if the early economic data is correct.

After a jaw-droppingly strong reading in Non-Farm Payrolls on Friday, this morning’s ISM Services PMI report also beat expectations, with the headline reading coming in at 53.4 vs. 52.0 expected. For the uninitiated, the ISM survey provides one of the broadest, most timely measures of “on the ground” economic activity in a country:

Source: ISM

With a series of strong economic reports reinvigorating the “US Economic Exceptionalism” theme from Q3, it’s not surprising that the US dollar is the strongest major currency on the day.

Looking across the rest of the week, there’s little in the way of major US data releases on tap, though multiple Fed speakers will take the stage across Tuesday, Wednesday, and Thursday, likely to reiterate that a March interest rate cut is a long shot, especially in light of the recent NFP and ISM readings.

Like the US, the UK economic calendar is relatively quiet, with tomorrow’s Construction PMI report providing potentially the biggest data-driven impetus for volatility this week.

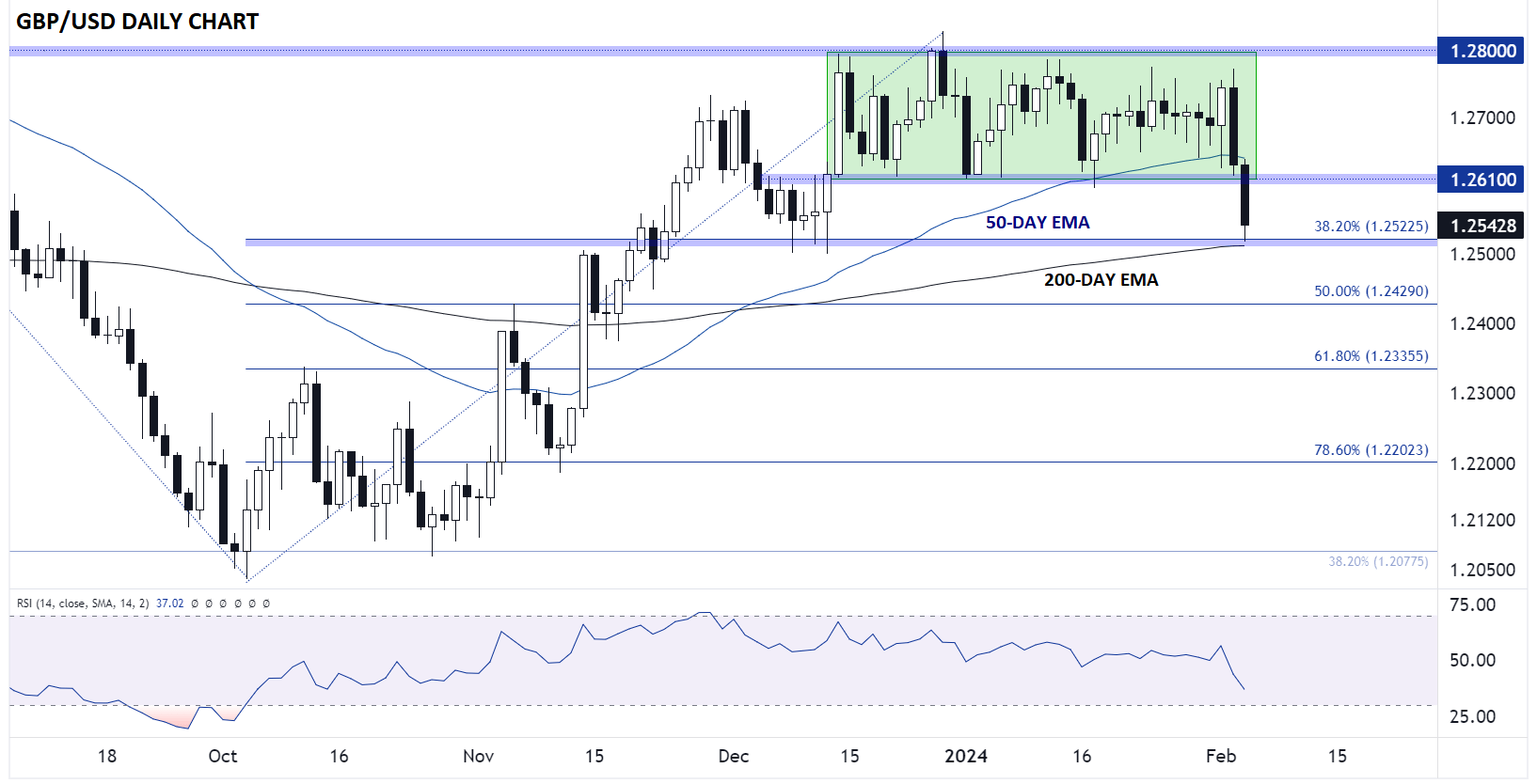

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Keying in on GBP/USD, cable is finally breaking out of its 7-week, 200-pip range between 1.2600 and 1.2800. The selloff kicked off after Friday’s strong NFP data, and it has carried over into this week’s trade on the back of the strong US data and hawkish “Fedspeak” over the weekend.

As of writing, the pair is testing support at the confluence of its 200-day EMA and the 38.2% Fibonacci retracement of its Q4 rally near 1.2525. If that level gives way, it would open the door for a continuation down toward the “measured move” target of the consolidation range closer to 1.2400; note that the 50% Fibonacci retracement of the Q4 rally comes in near 1.2430 as well.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX