Bullish factors

- Uncertainty about the feasibility of budget targets in 2024 may increase risk premium requirements by investors for Brazilian assets and decrease foreign investments, weakening the BRL.

- Moderation of IPCA in October may reinforce the perception that the Central Bank will maintain its pace of cuts to the basic interest rate (Selic), which would be detrimental to the national interest rate differential, weakening the BRL.

Bearish factors

- Minutes of the Monetary Policy Committee (Copom) decision may acknowledge a more challenging foreign environment and higher Brazilian fiscal risks, which could cast doubt on its interest rate cuts trajectory and would benefit the national interest rate differential, strengthening the BRL.

- Disclosure of data on the Chinese economy can reinforce the perception of a faster recovery in the country, favoring the performance of currencies from commodity-exporting countries, such as Brazil.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

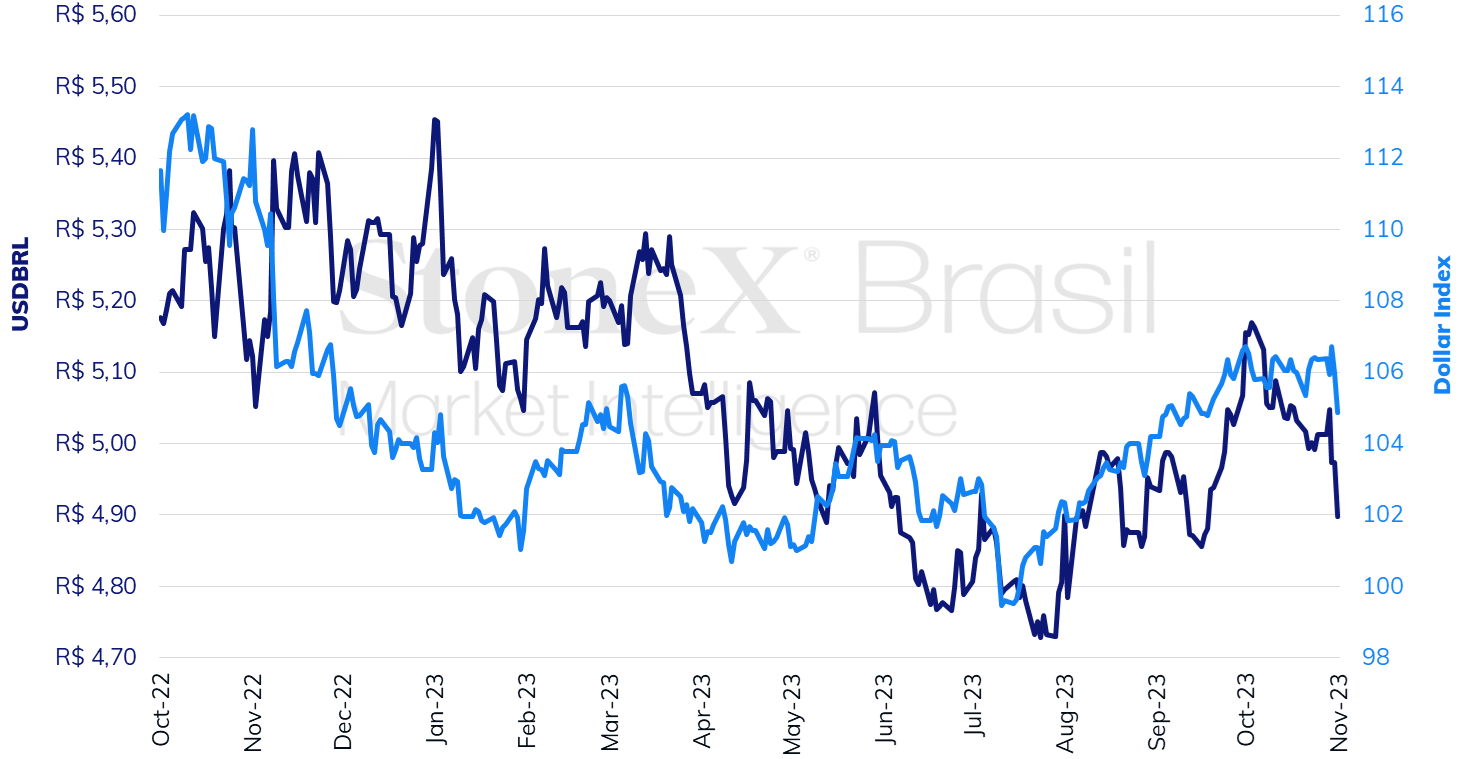

The USDBRL ended the week lower, closing Friday's session (03) at BRL 4.897, a weekly decline of 2.3%, a monthly decline of 3.0%, and an annual decline of 7.2%. The dollar index closed Friday's session at 104.9 points, a change of -1.4% for the week, -1.0% for the month, and +1.5% for the year. The foreign exchange market reacted to the monetary policy decisions of the Federal Reserve and the Central Bank of Brazil, the publication of moderate data for the American economy, concerns about Brazilian fiscal targets, and the formation of the end-of-month Ptax rate.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

THE MOST IMPORTANT EVENT: Copom's minutes

Expected impact on USDBRL: bearish

The Monetary Policy Committee (Copom) carried out its third consecutive reduction of 0.50 p.p. for the basic interest rate (Selic), unanimously indicating that it should maintain the pace of cuts "in the next meetings" if the expected scenario is confirmed. However, the statement brought some gaps regarding recent comments by authorities from the Central Bank of Brazil, and the meeting minutes may provide a more detailed analysis of these points. Firstly, recent concerns about the Brazilian government's fiscal policy conduct did not enter the monetary authority's assessment of inflationary risks, receiving only a note on its importance for anchoring inflation expectations. However, fiscal concerns have significantly impacted market participants' future expectations regarding interest rates, exchange rates, and inflation, warranting a more careful assessment. Additionally, the statement states that "the current situation, particularly due to the international scenario, is more uncertain than usual and requires caution in conducting monetary policy." However, the risk balance continues to be presented as balanced, in an apparent contradiction.

Doubts about fiscal targets

Expected impact on USDBRL: bullish

Discussions about fiscal policy management under Luiz Inácio Lula da Silva's government should continue this week after what seemed to be a careless statement by the President of Brazil in a press conference that the federal government would "hardly" meet the target proposed by the new fiscal framework for 2024, namely, a zero primary result, last week, an economic team was observed unable to reaffirm the maintenance of the target and several reports from specialized media stating that the Planalto was seeking the best way to make the change. So, it seems that on this Tuesday (07), the text of the rapporteur of the Budget Guidelines Law (LDO) project, Congressman Danilo Forte (União-CE), should be presented to the Joint Budget Committee (CMO) of the Chamber of Deputies still with the original goal. However, at some point before the final report vote, scheduled for the week between November 13 and 17, an amendment is expected to suggest changing the 2024 primary deficit target from 0% of Gross Domestic Product (GDP) to probably 0.5% of GDP. If this movement is confirmed, investors' requirement for risk premiums is expected to increase, harming the performance of Brazilian assets.

IPCA Moderation in October

Expected impact on USDBRL: bullish

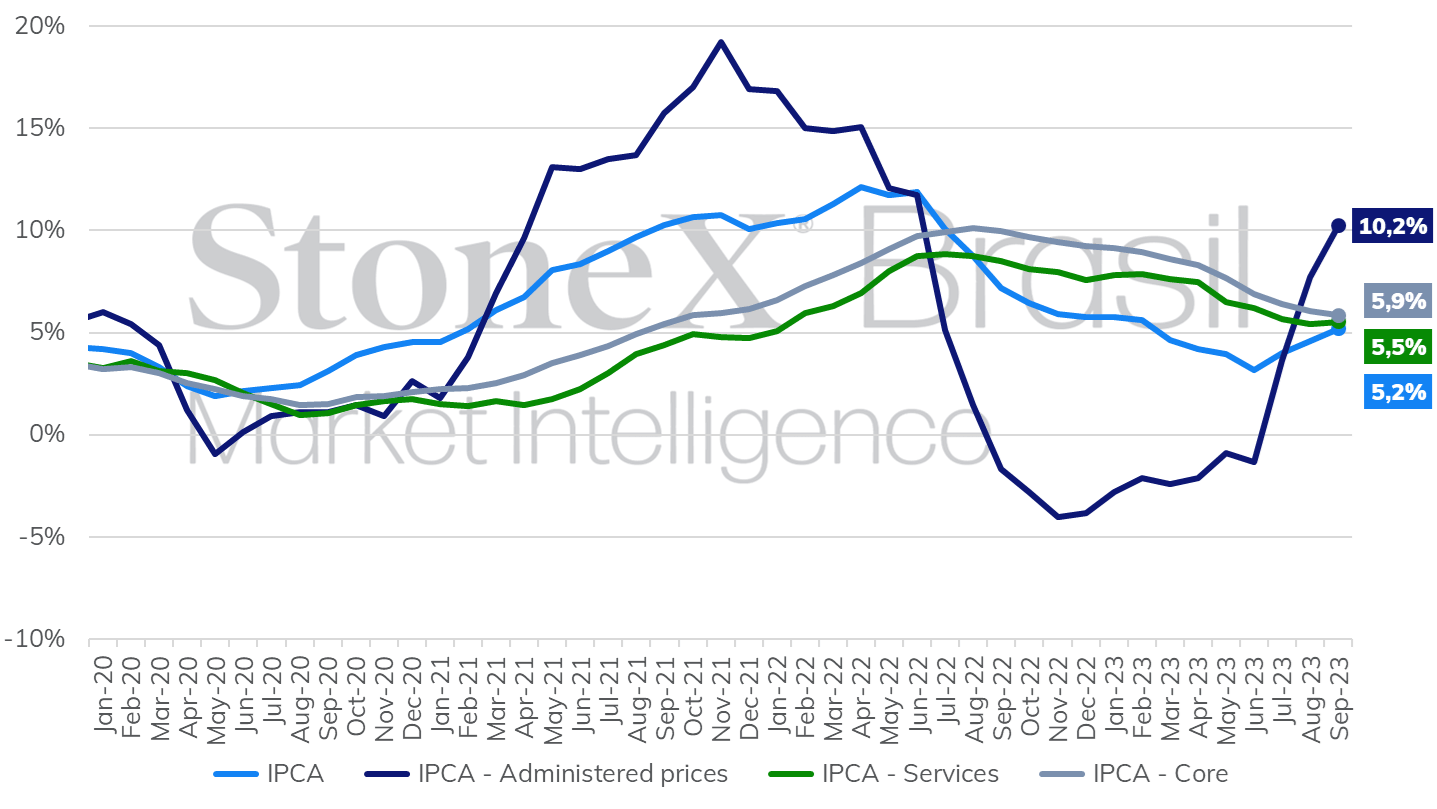

After a controlled IPCA-15 in October, with an increase of only 0.21%, the National Broad Consumer Price Index (IPCA) for the complete month is also expected to show moderate growth, around 0.3%. Food, industrial goods, and gasoline prices are expected to decrease compared to September, while airfare and service prices are expected to increase during this period.

12-month IPCA (%) according to selected groups

Source: Central Bank of Brazil. Design: StoneX.

Chinese economy data

Expected impact on USDBRL: bearish

This week, the Consumer Price Index (CPI) and Producer Price Index (PPI) for October in China and the trade balance data for the same month will be released. International investors are moderately more optimistic about the country's economic recovery after releasing some recent indicators that were better than anticipated, such as the Gross Domestic Product for the third quarter, the industrial production for September, and the retail sales for the same month. If the most favorable forecasts are confirmed, it should boost the performance of risky assets, such as stocks, commodities, and currencies of countries that export primary products, like Brazil.

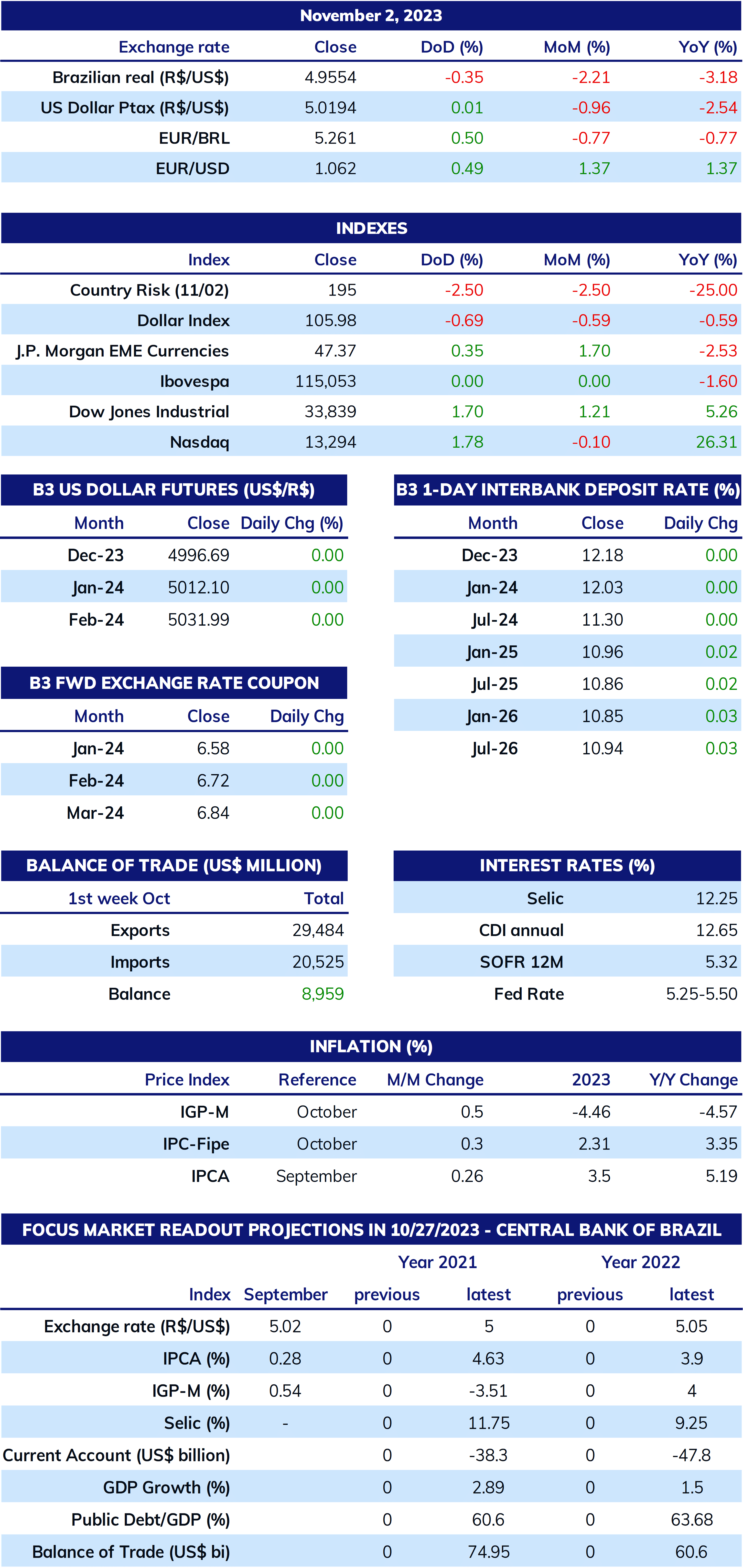

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos (leonel.mattos@stonex.com), Alan Lima (alan.lima@stonex.com), and Vitor Andrioli (vitor.andrioli@stonex.com).

Translation by Rodolfo Abachi (rodolfo.abachi@stonex.com).

Financial editor: Paul Walton (paul.walton@stonex.com).