H2 2024 EUR/USD Outlook: Will the Fed Deliver as Many Rate Cuts as the ECB?

EUR/USD Key Points

- After being constrained to a relatively tight 700-pip range over the last 18 months, traders are hoping for more volatility from EUR/USD in H2 2024.

- Stronger US growth and similar inflation on both sides of the Atlantic could lead to more aggressive interest rate cuts from the ECB, weighing on EUR/USD.

- Technically speaking, the 2023 range between 1.0500 and 1.1250 will be the key area to watch.

EUR/USD Q2 2024 in Review

In our Q2 2024 EUR/USD outlook report, we asked whether the European Central Bank (ECB) would start cutting interest rates before the Federal Reserve…and we’ve since learned that the answer was absolutely “yes.” The ECB cut interest rates from 4.50% to 4.25% back in early June, reducing interest rates before the Federal Reserve for the first time in its (relatively short) history.

However, perhaps because ECB President Christine Lagarde and company went to great pains to emphasize that that they likely wouldn’t follow up with another cut immediately, EUR/USD remained rangebound between 1.06 and 1.10 throughout the quarter

This low volatility trade offered fewer trading opportunities than usual for most traders, but on the bright side, volatility is cyclical, so periods of low volatility and minimal market movement tend to be followed by periods of higher volatility and bigger market movements.

Will that be the case in H2? Read on to see the key themes to watch!

EUR/USD H2 2024 Outlook: The Case for (Continued) Aggressive ECB Easing

After a torrid start to 2024, economic growth, inflation, and employment all showed signs of slowing in the second quarter, setting the stage for potential rate cuts at both the ECB and the Fed in the second half of the year.

As of writing in late June, traders are discounting a similar amount of easing on both sides of the Atlantic, with roughly two 25bps interest rate cuts fully discounted by the end of December. As a result, the performance of EUR/USD in the second half of the year is likely to hinge on how economic data evolves and the temperament of the central bankers in question, but basic economic analysis suggests that the odds are skewed toward the more interest rate cuts from the ECB than the Fed, and therefore elevated odds that EUR/USD could start to fall as we move through H2 2024.

To keep it as simple as possible, economic growth is likely to be higher and more resilient in the US than in the Eurozone, and inflation, the bogey that both central banks are trying to defeat, should be similar on both sides of the Atlantic over the next year.

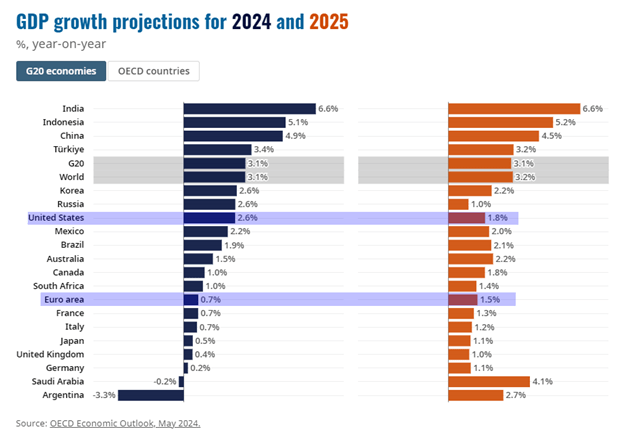

Starting with economic growth, the Organization for Economic Cooperation and Development (OECD) projects that the US economy will grow by 2.6% in 2024 and 1.8% in 2025. By contrast, the Eurozone is projected to see more anemic growth of just 0.7% and 1.5% in 2024 and 2025 respectively; these low growth figures leave the Eurozone more vulnerable to slipping into a recession if any negative economic shocks emerge:

Source: OECD

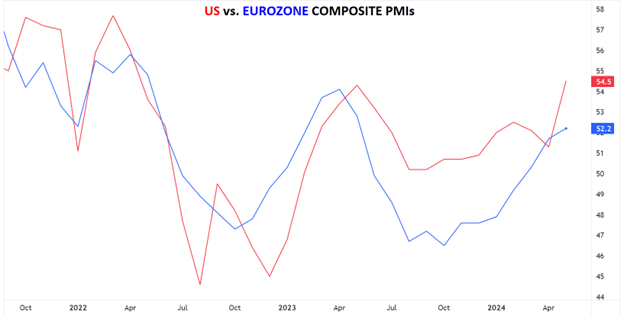

In perhaps a more timely, but less forward-looking, measure of economic activity, the US Composite PMI survey sits at 54.5 as of writing, meaningfully above the equivalent measure for the Eurozone (52.2), as it has been for 11 of the past 12 months. This persistent divergence highlights the relative robustness and resilience of the US economy in the current market environment, bolstering the case for more gradual rate cuts from the Fed relative to the ECB.

Source: TradingView, StoneX

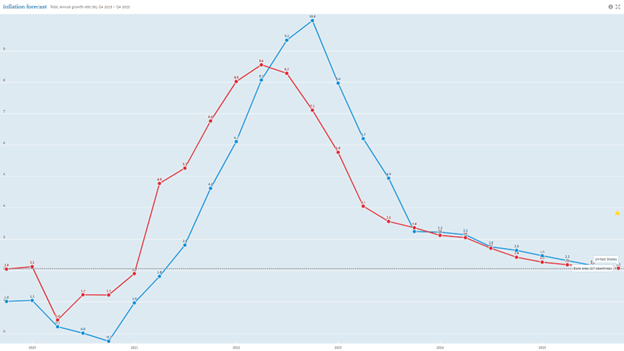

Shifting our focus to inflation, both the US and Eurozone are expected to see price pressures gradually recede toward the central banks’ 2% targets over the next couple of years. As the chart below shows, inflation in the Eurozone may be slightly lower than in the US over the next couple of years, marginally increasing the ECB’s confidence in cutting interest rates, especially against a backdrop of slow economic growth:

Source: OECD

When setting out a longer-term outlook, it helps to go back to basics, and from the most simple perspective, the European economy is growing more slowly than that of the US, with slightly lower price pressures. While both the ECB and Fed are likely to cut interest rates across the second half of the year, there is scope for more aggressive interest rate cuts from the ECB, a development that could weigh on EUR/USD as we move toward the end of the year… and that’s before the more Eurozone-proximate risks from ongoing conflicts in the Middle East and Ukraine that could contribute to more euro downside if they escalate.

Euro Technical Analysis – EUR/USD Weekly Chart

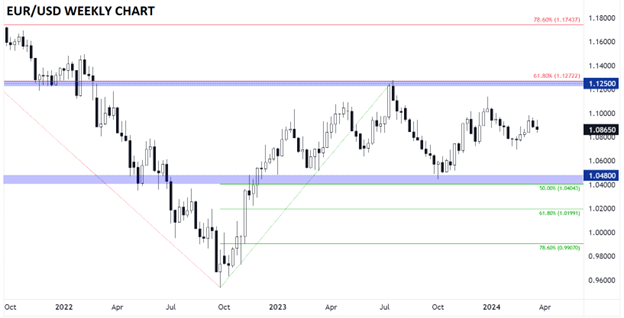

Source: TradingView, StoneX

Looking at the weekly chart, EUR/USD sits almost exactly in the middle of both its 2023 range and its 3-year range as we enter the second half of the year. After a year and a half of consolidation, the odds of a stronger trend and more volatility in the second half of 2024 have increased, but with no clear technical trend and tremendous uncertainty about the timing and quantity of interest rate cuts on both sides of the Atlantic, readers may want to wait for prices to break out one way or another before committing too strongly.

In terms of the key levels to watch, the 2023 range between 1.0500 and 1.1250 will be key. A bullish breakout above 1.1250 would expose the January/February 2022 highs in the 1.1500 area, followed by the 78.6% Fibonacci retracement of the whole 2021-2022 drop around 1.1750. Meanwhile, a bearish breakout below 1.0500 support could, in turn, have bears targeting the retracements of the 2022-2023 rally at 1.0200 (61.8%) and 0.9900 (78.6%), as well as the psychologically significant parity level at 1.00.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX