Interest rates trading

-

Competitive pricing

Trade interest rate markets from just 0.02pts

-

Range of markets

Speculate on Eurodollar, Euribor and Short Sterling rates

-

Go long or short

Trade both rising and falling interest rates

Why trade interest rates with City Index?

-

No commissions

Trade interest rates commission-free and trade with margin from just 20% on interest rate markets. -

Trade on leverage

Take advantage of leveraged trading products to speculate on future interest rates. -

Diversify your portfolio

Trading on price movements in interest rates allows you to diversify your investment portfolio.

Interest rates news and analysis

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

What interest rate markets can I trade?

With your City Index account, you can trade CFDs or spread bet on three short-term interest rate markets: short sterling, Eurodollar and Euribor. All come with margin of 20% and spreads starting at just 0.02 points.

Learn more about interest rate CFDs or spread betting on rates.

Ways to trade interest rates

What are interest rates?

Interest rates are one of the financial world's most trusted safe havens in times of volatility, with competitive spreads from just 0.02pts.

Learn more about interest rates

What are interest rate announcements?

Interest rate announcements are key events in any trader's economic calendar, as they’re the dates that central banks report changes to their base rate. Both the build-up to these days, and the day itself, can see significant movements in financial markets as trades are opened, closed or adjusted.

Interest rate announcement frequencies change between central banks. For example, the Bank of England has 8 annual rate announcements, while the People’s Bank of China has 12.

Here’s a rundown of the announcements for each of the major central banks.

Region/Currency |

Central Bank |

Committee |

Number of members |

Annual Meetings* |

|---|---|---|---|---|

| UK/GBP | Bank of England | BoE Monetary Policy Committee | 9 | 8 |

| Eurozone/EUR | European Central Bank | Governing Council of the ECB | 25 | 8 |

| US/USD | Federal Reserve | Federal Open Market Committee | 12 | 8 |

| China/CNY | People’s Bank of China | PBoC Monetary Policy Committee | 14 | 12 |

| Switzerland/CHF | Swiss National Bank | SNB Governing Board | 3 | 4 |

| Japan/JPY | Bank of Japan | BoJ Policy Board | 9 | 8 |

| Australia/AUD | Reserve Bank of Australia | Reserve Bank Board | 9 | 11 |

*Monetary policy meetings only.

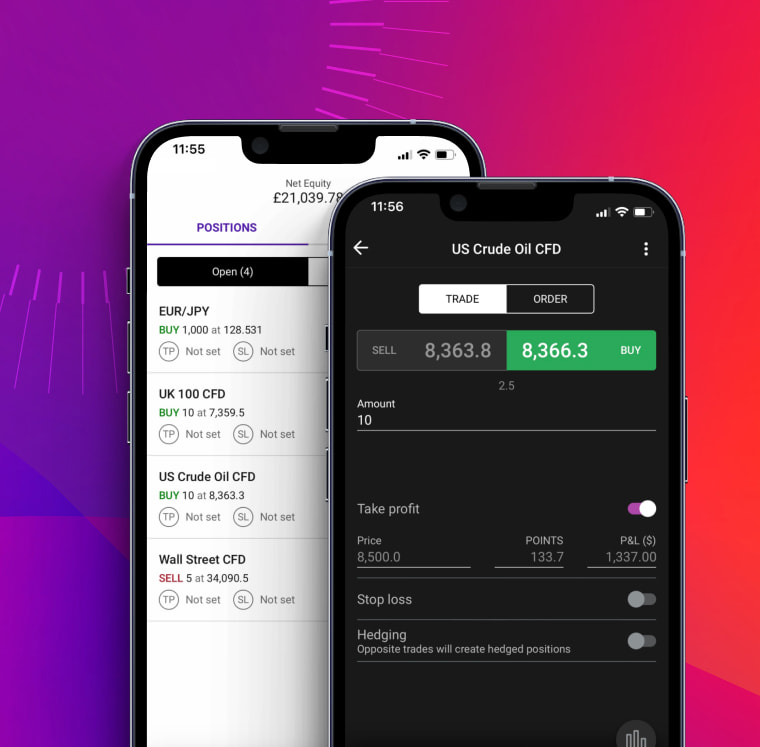

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

Interest rates trading FAQ

How do you trade interest rates?

To trade interest rates, you need to follow these five steps.

- Open a trading account. Getting a City Index account is free and usually takes minutes

- Add some funds, so you can start trading interest rates immediately

- Choose the interest rate market that you want to trade and decide whether to go long or short on it

- Decide how much you want to risk on your position, and set up your stop loss and take profit orders accordingly

- Execute your order

If the interest rate market moves in your chosen direction, you’ll make a profit. If not, you’ll make a loss. You can also trade interest rates with zero risk to your capital using our free demo trading account.

What interest rate markets can I trade?

With your City Index account, you can trade CFDs or spread bet on three short-term interest rate markets: short sterling, Eurodollar and Euribor. All come with margin of 20% and spreads starting at just 0.02 points.

Learn more about interest rate CFDs or spread betting on rates.

What does it mean to trade interest rates?

Trading interest rates means opening a short or medium-term position that makes money if rates rise (if you’re long) or fall (if you’re short). Interest rate trading is based on the prices of interest rate futures, which reflect where the markets expect rates to head next.

As with any form of trading, you’ll earn a profit if the underlying market moves in your favour, and a loss if it moves against you. Many traders use interest rates as a ‘safe haven’ market to protect their portfolio against volatility.

If you have more questions visit the FAQ section or start a chat with our support.