CFD futures trading

- Multi-asset financial service provider with 40 years’ of experience

- Trade CFD futures in the UK using spread bets or CFDs

- Access markets outside regular hours

- Automatically roll over positions with no overnight financing charge

- Multi-asset financial service provider with 40 years’ of experience

- Trade CFD futures in the UK using spread bets or CFDs

- Access markets outside regular hours

- Automatically roll over positions with no overnight financing charge

Award-winning provider

Over one million account holders* use us to trade the financial markets. Here's why.

*StoneX retail trading live and demo accounts globally in the last 2 years.

Get access to hundreds of futures contracts as a CFD or spread bet from one account

City Index offers spread betting and CFD trading for futures markets. Typically, UK traders choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*.

With City Index, spread bet futures are available for forex, commodities, indices, individual stocks, bonds and some exchange-traded funds (ETFs). CFD futures include commodities, indices and bonds.

City Index offers spread betting and CFD trading for futures markets. Typically, UK traders choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*.

With City Index, spread bet futures are available for forex, commodities, indices, individual stocks, bonds and some exchange-traded funds (ETFs). CFD futures include commodities, indices and bonds.

See our CFD futures trading cost

*For non-US equities, minimum spread is 10 bps either side of the underlying market spread. For US equities, minimum spread is 1.5c either side of the market spread.

There’s no commission to pay when you spread bet. Instead, all the costs to open and close your position are covered in the difference between the buy and sell prices (known as the spread). If you keep a daily funded bet open overnight, you’ll pay overnight funding.

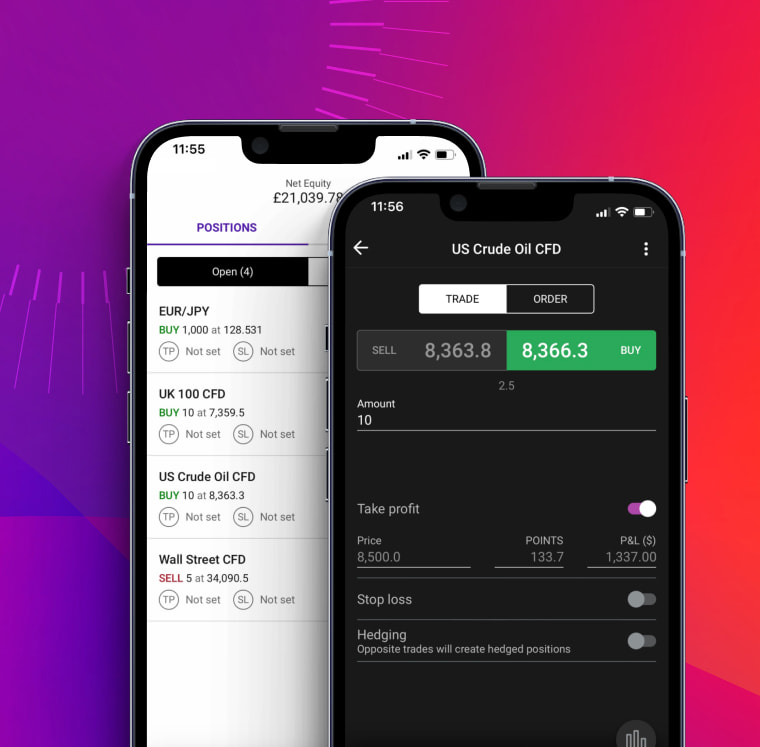

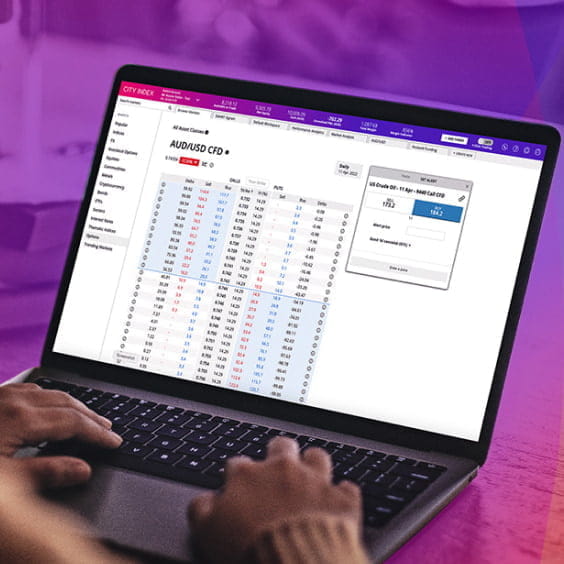

Trade wherever you are, on our fast, reliable platforms

Customisable charts

16 chart types with 80+ indicators designed to help you pinpoint your next opportunity.

Award-winning platform

Our intuitive technology is designed to suit traders of all levels.

Actionable trade ideas

Our research portal highlights trade ideas using fundamental and technical analysis.

Insightful data

Receive all the latest market news and expert commentary direct from Reuters in-app.

Open an account with the best spread betting provider*

-

Applyfor an account

-

Fundusing card or bank transfer

-

Tradeon powerful platforms

Open an account with the best spread betting provider*

What are futures?

Futures are a tradable contract that serves as an agreement by one party to take delivery of an asset at a date sometime in the future. By trading futures via spread bets and CFDs, you have the option to settle the contract in cash at maturity or to roll over the contract to the next delivery date. This is especially useful when trading commodity futures. Futures are considered better for longer held positions, as although they have wider spreads, you won’t pay any overnight funding charges.

While futures trading is most commonly done in the commodities market to speculate on the price of physical goods without needing to take physical ownership of the assets, you can also use futures to trade indices, individual stocks, government bonds, ETFs and major and minor forex pairs.

Futures trading FAQ

Do you pay tax on CFD futures trades in the UK?

Paying UK taxes on futures trades depends on whether you trade futures contracts via spread bets or CFDs. For most UK residents, both are free from UK stamp duty; however, you may have to pay UK Capital Gains Tax on CFD trades and remember tax laws are subject to change and depend on individual circumstances.

Can I trade CFD futures on any stock?

You can trade futures contracts on hundreds of stocks when trading spread bet futures with City Index. Sign up for a free demo trading account today to access hundreds of stock futures and practice trading with three, six and nine-month delivery dates available.

How do you trade futures as a CFD in the UK?

You can trade CFDs or spread bets on the futures price in an underlying market like indices and commodities. By trading futures prices as a CFD or spread bet, you’ll be able to speculate on underlying market conditions, either by buying (‘going long’) when you think prices will rise or selling (‘shorting’ or ‘going short’) when you think they will fall.

Trading futures as a CFD gives you full market access that might otherwise be out of reach, but remember leverage will act to increase both your profits or your losses, so it’s important to take steps to manage your risk before opening any leveraged position.

If you have more questions visit the FAQ section or start a chat with our support.