Reviewed by Patrick Foot, Senior Financial Writer.

How to trade CFDs in six steps - CFD trading for beginners

-

Learn how contract for difference work

Understand the basics behind contracts for difference and how they differ from other financial products.

-

Open a contract for difference account

Get started with a demo, or go straight to live markets.

-

Choose a contract for difference market

Decide which market you want to trade. Looking for inspiration? Head over to our research portal.

-

Click 'buy' if you think your market will increase in value, or 'sell' if you think it will fall.

-

Choose how many CFDs to buy or sell, and add a stop or limit order loss. Then open your position.

-

Now your position is open, you will see your profit/loss update in real time. You can exit it by clicking the close trade button.

Let's take a closer look at each step.

1. CFD trading process - how it works?

CFD trading is the buying and selling of contracts for difference, financial derivatives in which you agree to exchange the difference between the opening and closing price of a specific financial asset – such as a share, index or forex pair.

Unlike traditional investing, you don't take delivery of the asset. You never own the stock or currency you're trading.

For example, if you want to go long on oil, you could buy an oil CFD that makes or loses you $1 for every point oil moves. You won't take ownership of any oil, but you'll still earn a profit or a loss from its price movement.

If oil rises 100 points, you earn $100 as profit. If it falls 100 points, you lose $100.

This is a simple example, but there's a lot more you should understand about CFDs – including leverage, shorting and more. We'll cover these below, or for a complete explanation, take a look at our full guide to how CFDs work.

2. Opening a CFD account

To buy and sell CFDs, you'll need a trading account. This is what you'll use to research new opportunities, open and close positions, manage your risk, monitor your P/L and more.

You can open a demo CFD trading account to try things out with zero risk before you commit real capital. A City Index demo, for example, gives you £10,000 virtual funds to buy and sell our full range of markets. All the price movements are real, the only part that isn't is the money involved. So it's a great place to practise.

When you're ready to risk some real capital, you can open a live account. To open one with City Index, follow these steps:

- Fill out our quick online form

- We'll verify your details

- Fund so you can start trading

3. Choosing a CFD market

One major advantage of CFDs is the huge range of markets you can choose from.

At City Index, we offer contracts on 1,000s of individual markets including:

- Shares. We offer 1,000s of global shares, including extended hours on blue chips like Apple, Amazon and Tesla.

- Indices. You can trade major global benchmarks like the FTSE 100, Dow Jones and DAX 40 24 hours a day.

- Currencies. Forex is one of the world's most liquid markets, with major pairs like EUR/USD, GBP/USD and USD/JPY seeing massive volume.

- Commodities. Gold, oil and coffee markets are constantly on the move, offering a wealth of opportunities

- Interest rates and bonds. Trade directly on the changes in interest rates and bond prices from the UK and beyond.

With so many choices, it's important to find an opportunity that suits you. There are lots of research tools available in our platform to help you do just that:

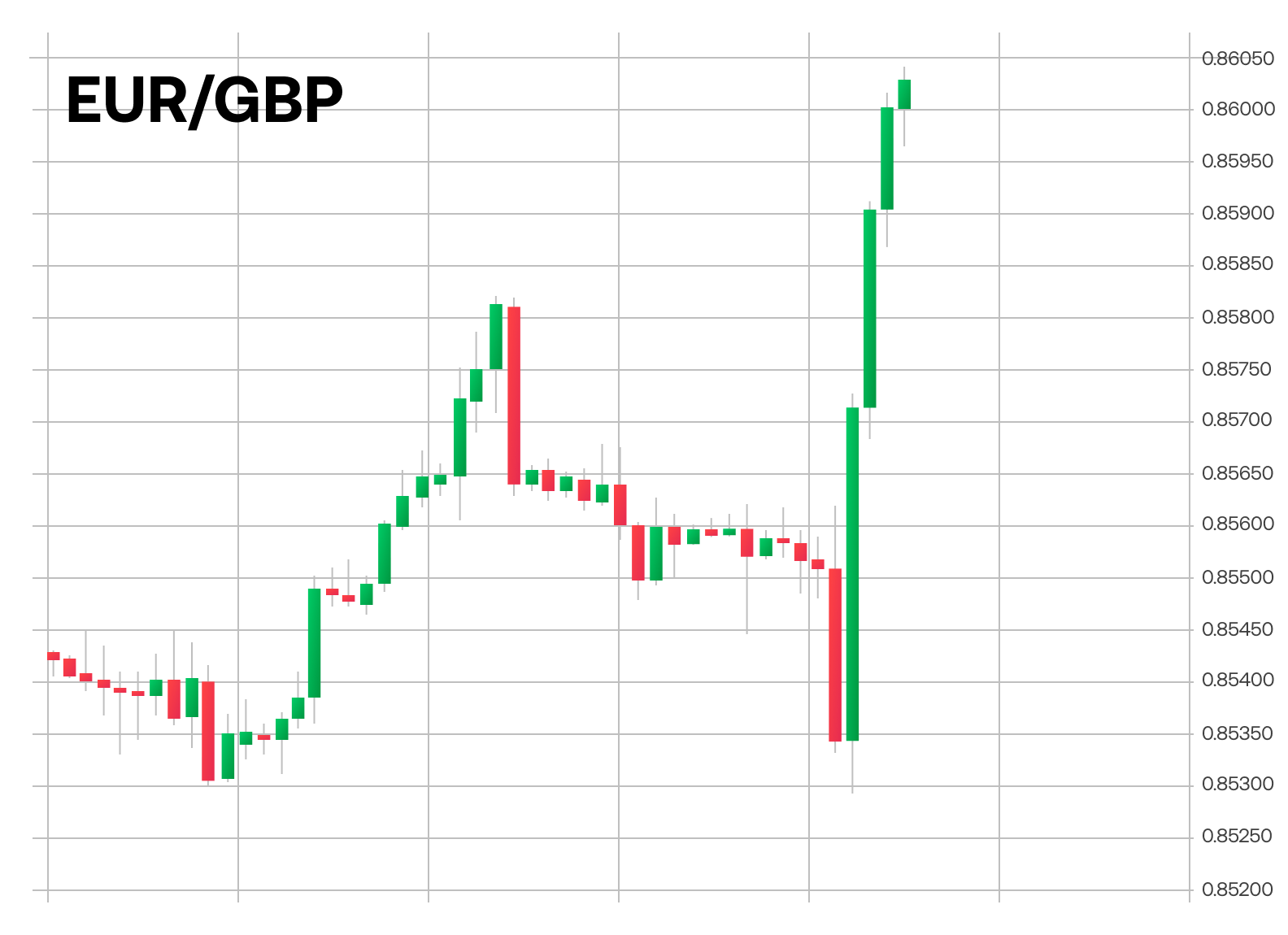

- Our platforms come with TradingView charts as standard, featuring a wealth of technical indicators, drawing tools and more.

- Our economic calendar enables you to plan your news trading around key macro events.

- Read the latest insight from our team of market analysts to see which assets are on the move.

Once you've chosen a market, use the search function on the web trading platform or mobile trading app to find it. You'll be able to see its live price, view a chart and look at all the information you need to know before taking your position.

4. Decide to buy contracts (go long) or sell (go short)

CFD markets have two prices. The first is the sell price (the bid), and the second price is the buy price (the offer). The difference between the two is known as the spread.

Both are based on the price of the underlying instrument. The sell price is always slightly lower than the market price, while the buy is slightly higher. If you believe your market will go up, you go long by trading at the buy price. If you believe it will fall, you can short it by trading at the sell price.

Shorting a market means you earn a profit if it falls in value, and a loss if it rises. Find out more about shorting.

5. Setting up and executing your order

You've chosen your market and decided whether to go long or short. Now, it's time to open your position.

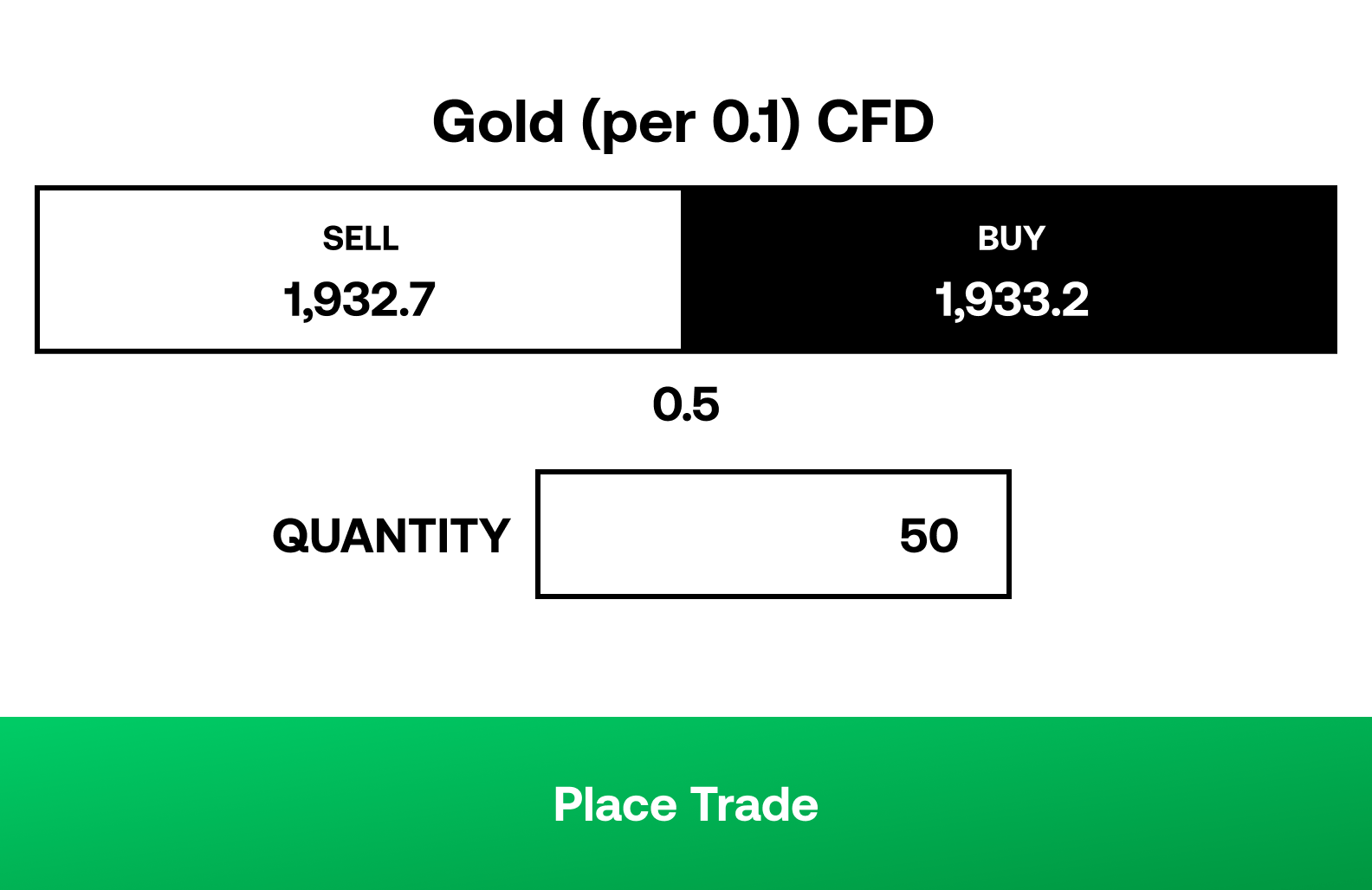

Once you've chosen to buy or sell your market on the City Index platform, you'll see the deal ticket. This is where you open your CFD trade.

Setting your position size

The first thing you'll need to set is the size of your position. With CFD trading, you set your size by deciding how many contracts to buy or sell.

Each contract represents a certain amount of its underlying asset. With stocks, one CFD is equivalent to one share. With FX, you will be trading per tick, therefore if you buy at 1.4305 and sell at 1.4306 you will make one times your stake. To see what a contract means for your market, look up the 'tick value' in the instrument's market information sheets.

CFDs are bought and sold in the base currency of the underlying market. So, if you're buying a US share, then your profit or loss will be calculated in US dollars.

How much margin?

Contracts for differences utilise leverage, which means you only need to have a small percentage of the overall trade value, known as margin, in your account to open a position. The larger the value of your trade, the more margin is required.

It is important that you have enough funds in your account to cover your margin. The margin calculator in the trading platform will automatically calculate how much you'll need to open a position.

You might have also noticed the 'Price tolerance' field in the ticket. This enables you to decide how much the market's price can move in the time it takes us to execute your order. If the market moves beyond your tolerance, the order will be cancelled.

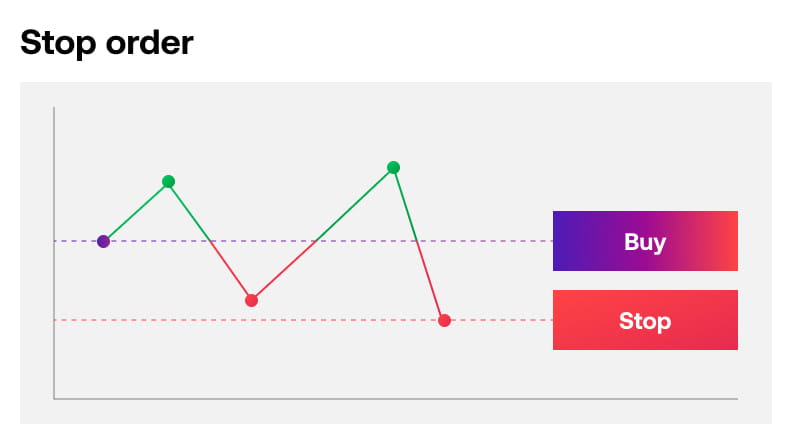

Adding stop and limit orders

Before you place your trade, you';ll want to consider your risk-management strategy.

As you can see on the deal ticket above, you have the option to add a stop loss and a take profit to your order. These are both useful tools for managing risk.

A stop-loss order is an instruction that tells your provider to close your position once it reaches a specific level set by you. This will, as the name suggests, be at a worse price than the current market level and can typically be triggered on losing positions to help minimise losses.

A take-profit order tells your broker to close your position at a better price and is used to capture a return automatically if the market reaches your profit target.

Standard stop losses and limit orders are free to use and can be placed in the dealing ticket when you first place your trade, or once it is open. They can, however, be subject to slippage – when your market moves beyond your stop loss before we can close your position. To ensure this doesn't happen, you can upgrade to a guaranteed stop loss order.

Once you've set up your risk management, you can execute by hitting 'Place Trade'.

6. Monitor and close your contract for difference trade

Now your position is live, your profit and loss will move as the underlying market goes up and down.

You can track market prices; see your profit/loss update in real time and edit, add to or exit your position from your computer, or by using our mobile app.

If you didn't select a stop or limit before opening the position, then it isn't too late – you can add them now. If you already have exit orders in place, meanwhile, you can move them to reflect changing conditions.

Closing your trade

To close a CFD, you need to trade in the opposite direction to when you opened it. If you bought 500 CFDs at the outset, then you sell 500 CFDs now. If you sold 30 contracts to open, you buy 30 contracts to close.

Alternatively, you can select the 'close position' option within the positions window.

Your net open profit and loss will now be realised and immediately reflected in your account cash balance.

To calculate your profit or loss manually, just subtract the opening price from the closing price (or the opposite for short positions), then multiply that figure by the size of your position. Just remember to take any costs into account.

How to trading: CFD trading examples

Finally, to illustrate how CFD trading works in practice here are two examples: buying the Wall Street index, and selling.

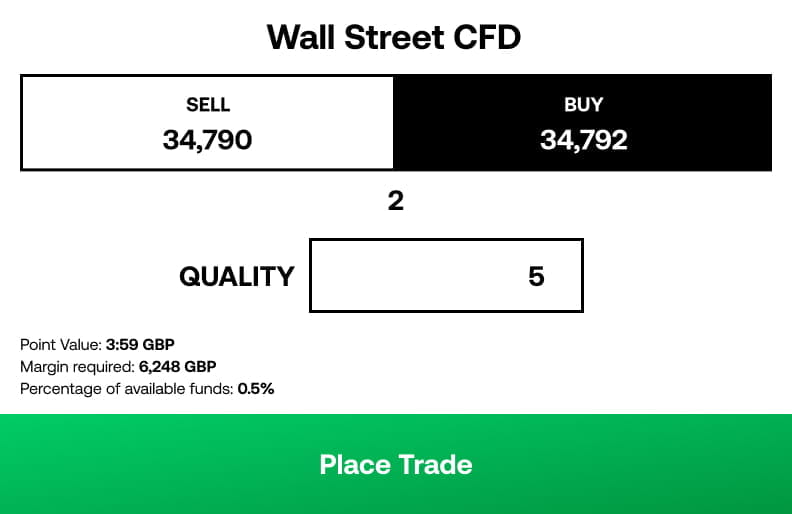

Contract for difference trade example 1: Wall Street

The Wall Street index is currently trading at 34,790.0 /34,792. The first figure is the sell price and the second is the buy price.

You think that US blue-chip stocks are in for a bull market, which would cause the Wall Street market to rise. So, you decide to open a long position by buying 5 Wall Street CFDs at 34,792.

Long CFD trade on the Wall Street index

City Index quotes you a spread of 34,790 / 34,792 for the Wall Street CFD. You decide to but 5 CFDs. This is known as going long.

Opening trade |

|

|---|---|

| Buy price of Wall Street | 34,792 |

| CFDs bought | 5 |

| Value of position | $173,960 |

| Margin requirement @ 5% | $8,698 |

Margin

To open your Wall Street position, you'll need to have enough margin in your account. In this example, let's say that Wall Street requires you to keep 5% of your position's total value in your account as margin.

Your position is worth (34,792*5) $173,960, so you'll need 5% of 173,960 to make the trade – $8,698.

The higher the value of your trade, the more money you'll need to deposit. Alternatively, you could reduce your margin outlay by reducing the size of your position. If you only buy one CFD, you would only need $1680.5 as margin.

Remember, though, that you'll also need enough free equity in your account to sustain any losses and cover any costs. Otherwise, you'll be at risk of a margin closeout.

Risk management

For this trade, you decide to target 75 points of profit, with a maximum loss of 25 points. You set a take profit at 34,867 and a stop at 34,767.

Winning on a long CFD

Let's take a look at what would happen if your trade was a success.

The Wall Street index rises as you predicted, climbing 57 points to a new price of 34,847/34,849. That's still a little off your target, but due to changing market conditions, you decide to close the position.

You bought 5 CFDs at the outset, so you sell 5 CFDs at 34,847 now to exit the trade.

34,847-34792 is 55 points. Your 5 CFDs earn you $5 for every upward point of movement, giving you a total profit of (55*5) $275.

If you had kept the position open over more than one day, your profit would be lower due to overnight financing.

Closing a CFD trade with a profit

You close out on your position of $174,235 with a profit.

Closing trade |

|

|---|---|

| Sell price of Wall Street | 34,792 |

| CFDs sold | 5 |

| Opening value | $173,960 |

| Closing value | $174,235 |

| Profit | $275 |

Losing Wall Street trade

But what would have happened if the Wall Street Index had fallen instead?

Supposing the Wall Street index falls to 34,767/34,769, which triggers your stop loss and closes the position.

Your stop will automatically sell 5 CFDs at the new sell price of 34,767. This represents a 25-point loss in your trade which, when multiplied by the 5 CFDs, leaves you with a $125 loss.

Closing a CFD trade with a loss

You close out on your position of $173,835 with a loss.

Closing trade |

|

|---|---|

| Sell price of Wall Street | 34,792 |

| CFDs sold | 5 |

| Opening value | $173,960 |

| Closing value | $173,835 |

| Loss | $125 |

Again, financing will be automatically debited from your account every night for the period that you hold your position.

Contract for difference trade example 2: shorting Alphabet

You believe that Alphabet shares will fall over the coming weeks as the company is set to report a disappointing set of earnings. You decide to short 50 CFDs.

City Index quotes an Alphabet price of 80.05/80.06. To open a short position, you trade at the sell price – so you sell 50 CFDs at 80.05, with a stop loss at 86.05.

Margin and commission

Alphabet has a margin requirement of 20%, so you'll need to deposit 20% of your position's full value ($800.50) to make the trade. And because Alphabet is an equity, you'll pay commission to open the position.

Commission on US stocks is 1.8 cents per CFD, or a minimum of $10. You're below the minimum commission, so you pay $10.

CFD equity trade: shorting Alphabet

You believe that Alphabet shares will fall over the coming weeks. You decide to sell 50 CFDs.

Opening trade |

|

|---|---|

| Alphabet sell price | $80.05 |

| CFDs sold | 50 |

| Value of position | $4,002.50 |

| Commission @ 1.8c per CFD (min $10) | $10 |

| Margin requirement @ 20% | $800.50 |

Profiting from your short CFD

You were right and Alphabet's share price falls to 72.09 / 72.10 over the next three days. At this point, you decide to lock in your profits and close the trade. To do so, you'd need to buy 50 Alphabet CFDs at 72.10.

80.05-72.1 is 8.4. Your 50 CFDs earn you $50 for each downward point of movement, so you've made $420 gross profit.

However, you have paid $20 commission on your position, which would reduce your overall profit to $400.

Keeping the position open for three days also means it will be subject to overnight financing. Financing on short positions is usually credited to your account, unless SOFR is below 2.5%. In these circumstances, it would be debited from you.

Closing your Alphabet trade at a profit

Alphabet falls to 72.09 / 72.10 and you close your trade.

Closing trade |

|

|---|---|

| Alphabet buy price | $72.10 |

| CFDs bought | 50 |

| Value of position | $4,002.50 |

| Commission @ 1.8c per CFD (min $10) | $10 |

Profit on trade |

|

|---|---|

| Opening value | $4,002.50 |

| Closing value | $3,605 |

| Net movement | $397.50 |

| Total commission | $20 |

| Overall profit | $377.50 |

Losing CFD trade

Now let's see what would have happened if Alphabet had risen instead.

Some hours after placing your trade you see that Alphabet has rallied. Thankfully, you had your stop loss in place which cut your losses at 86.05.

In this instance, your trade has lost 6 points, or $300. Taking commission into account, your overall loss is $320.

Closing your Alphabet trade at a loss

Alphabet rises to 86.04 / 86.05 and your stop closes the position.

Closing trade |

|

|---|---|

| Alphabet buy price | $86.05 |

| CFDs bought | 50 |

| Value of position | $4,302.50 |

| Commission @ 1.8c per CFD (min $10) | $10 |

Loss on trade |

|

|---|---|

| Opening value | $4,002.50 |

| Closing value | $4,302.50 |

| Net movement | $300 |

| Total commission | $20 |

| Overall loss | $300 |

Financing will be automatically debited or credited from your account every night for the period that you hold your position.