Trading central bank meetings

Why trade central bank meetings with us?

Key central bank meetings

Learn more about the announcements that move the markets most – including when central banks are meeting next – with our series of comprehensive guides.

Leverage our experts

Our global research team identifies the information that drives markets so you can forecast potential price movement and seize trading opportunities.

Open an account today

Open an account today

What is a central bank?

A central bank is an institution that provides financial and banking services for a country's – or group of countries' – commercial banking system. It also implements a government's monetary policy and controls the production and distribution of money and credit.

Central banks and their responsibilities are usually kept separate from the government to ensure that monetary policy isn't influenced by changes in political regimes – as opposed to fiscal policy (government spending and taxes) which are set by government policies.

Central bank responsibilities can vary from country to country, depending on their jurisdictions, but in general, they have the capacity to:

- Control and manipulate money supply – by issuing currency and setting interest rates

- Regulate member banks – ensuring that certain capital requirements and reserves are held

- Act as a lender in emergencies – stepping in to help institutions and even the government

Why do we need central banks?

We need central banks to safeguard the economy and ensure financial stability. They work to ensure that monetary policies are maintaining economic growth while keeping inflation in check.

Some countries have developed financial systems without central banks. But maintaining price stability was a lot easier when currencies were pegged to gold. Since floating exchange rates have become more prevalent, greater resources are needed to stabilise economies.

Plus, without a centralised institution, individual banks can act without restraint, and this often leads to reckless lending.

How central banks control inflation

Inflation is the rate of price increases in an economy over a set period. It needs to be kept in check to ensure the purchasing power of a currency isn't diminished too much and consumers don't face unaffordable living standards.

There are two main ways central banks control inflation:

- Interest rates

- Monetary supply

Interest rates

Interest rates are the costs of borrowing, expressed as a percentage of the total loan. As central banks act as lenders for commercial banking institutions, they can use these rates to influence the flow of money and credit in the economy, and create price stability.

When individual consumers put money into a bank account, this capital is used to make long-term loans. So, when the original deposit is needed back – if the individual withdraws cash from their account – the bank can face liquidity issues and the bank may need a short-term loan. Central banks step in and act as a lender to ensure the financial system keeps running smoothly.

In order to take out a loan, commercial banks have to provide central banks with collateral – such as a government bond or corporate bond – and pay an interest rate.

It's this base rate that's passed down to commercial banks, and trickles down to consumers and impacts the economy. Although commercial banks are free to set their own interest rates, they're very much guided by the base rate set by central banks as it determines the costs they'll face as a business.

What happens when central banks increase interest rates?

If a central bank increases the base rate, commercial banks will increase their rates for consumers and the cost of borrowing goes up. This means that rates on mortgages and loans increase, so consumers have less money to spend elsewhere in the economy.

Rising interest rates also encourage saving to earn money on cash in an account. All of this creates an environment of lower consumer spending, lower demand and leads to slower economic growth.

If a central bank lowers the base rate, commercial banks tend to reduce their lending rates. This means it’s easier to get loans and mortgages, which is more favourable for buyers, but saving becomes less appealing. It leads to a risk-on environment, where consumers are more willing to spend their money causing higher demand, higher prices and faster economic growth.

Money supply

Money supply is the current availability of currency and other liquid assets present in a country's economy on a specific date or in a given timeframe.

Central banks can issue paper currency and coins – alongside the government's treasury department – to regulate money supply. In doing so, they directly influence consumer behaviour.

Increasing the level of cash available in an economy typically lowers interest rates, which puts more money in the hands of consumers and stimulates economic growth. The opposite occurs when money is withdrawn from the economy by selling treasuries, which removes cash from circulation.

Money supply is also influenced by currency reserves – the cash that central banks hold and isn't available for public use. They can increase their reserves by buying their currency, removing supply from the market, and decrease their reserves by selling currency to increase supply.

How do central banks intervene in foreign exchange markets?

Central banks intervene in forex markets by buying or selling their domestic currency on the open market to increase or decrease its value against other global currencies.

There are a number of ways a central bank can intervene in currency markets. Some actions can be as simple as talking about the currency's outlook publicly, while others are more operational in nature and involve altering the levels of supply via treasury reserves.

When a currency's price weakens too much it can raise the price of imports and create inflation. This in turn can cause the central bank to increase interest rates and risk an economic slowdown. So, a central bank can attempt to raise prices through buying large amounts of its currency, removing supply from the market, and increasing its reserves.

Countries can also face issues if their currency is too strong, especially if they're an exporting nation, as it makes it more difficult for other countries to afford goods and services. A central bank may intervene to increase supply and keep the currency closer in value to those of importing nations. They'd do this by selling a portion of their treasury reserves.

Central banks FAQ

How many central banks are there in the world?

There are over 170 central banks in the world, as very few countries have no central bank. Not all central bank meetings and policies have the same impact on the global financial system, so don't have market-moving consequences.

The most watched central bank announcements are from the Federal Reserve, European Central Bank, Bank of England and Bank of Japan.

Who owns central banks?

Central bank ownership is often complex. Although some central banks are nationalised and owned by the government a lot are independent bodies. Their privileges over setting monetary policy will be enshrined in law to protect this political independence.

However, most central banks are directly accountable to a government. For example, although the Federal Reserve’s Board of Governors is an independent body, they report to and are held responsible by Congress.

Learn more about the Federal Reserve.

How do central banks make money?

Central banks make money by purchasing securities on the open market and adding the corresponding funds to bank reserves. Central banks don’t simply print more money on machines, they stimulate the economy by making more money available for commercial banks to loan to consumers and businesses.

See the latest central bank news.

If you have more questions visit the FAQ section or start a chat with our support.

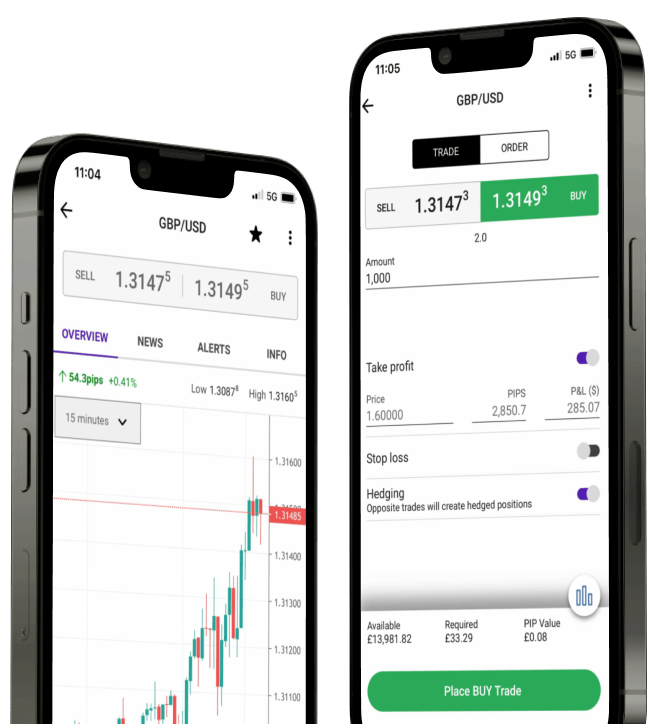

Want to test your trading strategies in a risk-free environment?

- £10,000 virtual funds on our award-winning platform

- Get the same access as full account holders to research and analysis

- Available on desktop, web, mobile or tablet