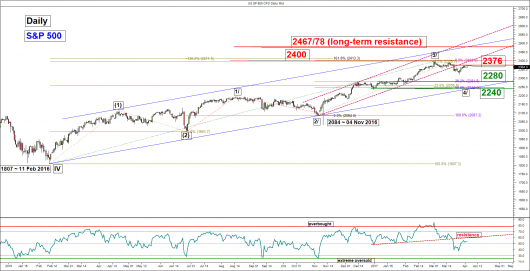

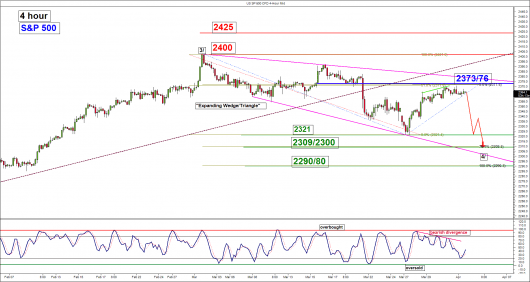

S&P 500 – Potential corrective decline remains in progress below 2373/76

(Click to enlarge charts)

(Click to enlarge charts)

Key Levels (1 to 3 weeks)

Pivot (key resistance): 2373/76

Supports: 2321, 2309/2300 & 2280

Next resistances: 2400 & 2425

Medium-term (1 to 3 weeks) Outlook

Last Monday, 27 March 201, the U.S. S&P 500 Index (proxy for the S&P 500 futures) had tumbled as expected to print a low of 2321 before it rebounded by 2.1% to print a high of 2370 on Thursday, 30 March 2017.

Even though, the price action of Index staged a recovery but it had remained below the 2373/76 medium-term pivotal resistance (click here for a recap on our previous weekly technical outlook report).

Current key technical elements are as follow;

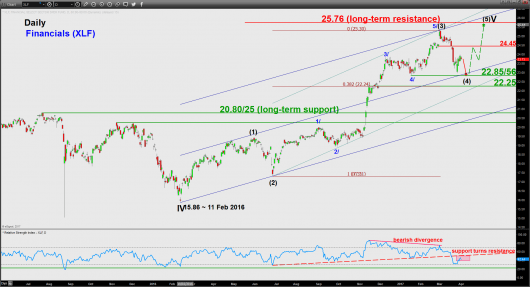

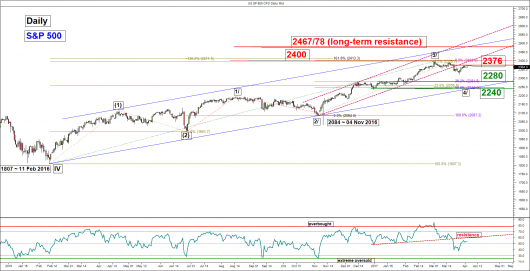

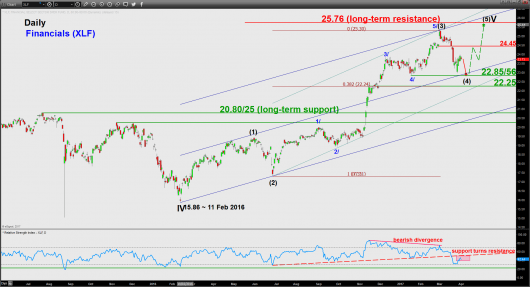

- The two leading sectors of the S&P 500, Financials and Technology (represented by their respective ETF; XLF & XLK ) are still exhibiting bearish technical elements below their respective medium-term resistances at 24.45 and 53.62. Therefore from a sector rotation analysis perspective, it can lead to further potential weakness in the S&P 500 (refer to the first two charts).

- Based on the Elliot Wave Principal and fractal analysis, we still view that the up move from 11 February 2016 low as a “melt-up” phase with potential end target of the primary degree impulsive wave V at 2467/78 before a potential 20% to 30% correction materialises to retrace the on-going multi-year uptrend from March 2009 low.

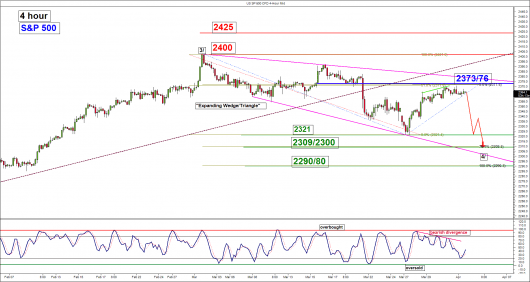

- From a medium-term horizon (1 to 3 weeks), the price action seen on 21 March 2017 (downside break of the ascending channel support from 04 November 2016 low) has triggered the start of a potential corrective immediate degree down move wave 4 which is still likely to be on-going at this juncture. From its current all-time high area of 2400 seen on 02 March 2017, the Index is now likely to be evolving in a potential “Expanding Wedge/Triangle” consolidation pattern.

- The lower boundary of the “Expanding Wedge/Triangle” now rests at the 2309/2300 zone with its upper boundary now confluences with the upper limit of medium-term pivotal resistance zone of 2373/76.

- The daily RSI oscillator of the Index remains bearish below its pull-back resistance coupled with a recent bearish divergence signal seen in the shorter-term (4 hour) Stochastic oscillator at its overbought zone. These observations suggest that last week’s upside momentum has started to abate.

Maintain bearish bias as long as the 2373/76 medium-term pivotal resistance is not surpassed, the Index is likely to see another potential downleg to retest 2321 before targeting the next support at 2309/2300 where a potential recovery may occur.

On the other hand, a clearance above 2376 may invalidate the preferred bearish tone to see the return of the bulls to retest the current all-time high area of 2400 and even open up scope for a further rally towards 2425 next.

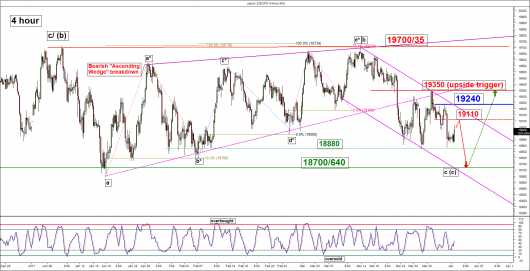

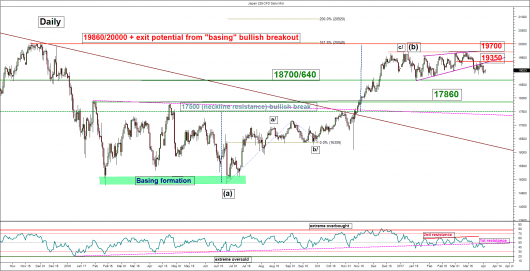

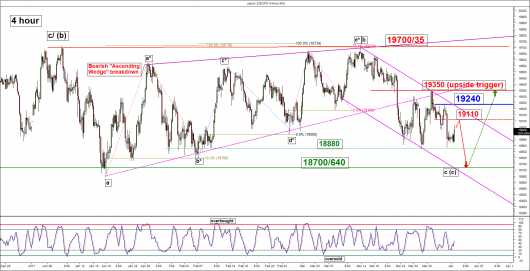

Nikkei 225 – Potential final push down towards 18700/640 before up move

(Click to enlarge charts)

(Click to enlarge charts)

Key Levels (1 to 3 weeks)

Intermediate resistance: 19110

Pivot (key resistance): 19240

Supports: 18880 & 18700/640

Next resistances: 19350 (upside trigger) & 19700/735

Medium-term (1 to 3 weeks) Outlook

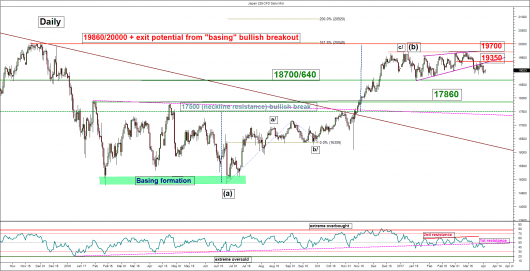

Last week, the Japan 225 Index (proxy for the Nikkei 225 futures) had continued to drop as expected below the 19400 medium-term pivotal resistance (printed a high of 19353 on 29 March 2017 in the U.S. session).

It managed to retest the 18880 minor swing low area of 27 March 2017 on last Friday, 31 March 2017 before it drifted sideways. Please click here for a recap on our previous weekly technical outlook report.

Current key technical elements are as follow;

- From the former “Ascending Wedge” range top high of 19708 printed on 14 March 2017 (U.S. session), the Index has started to evolve into a short-term bearish descending channel with its upper boundary now at 19240 and lower boundary at 18700/640.

- The significant medium-term resistance now stands at 19240 which is defined by the upper boundary of the aforementioned descending channel, minor swing high area of 31 March 2017 and the 76.4% Fibonacci retracement of the recent decline from 29 March 2017 high of 19353 to 31 March 2017 low (see 4 hour chart).

- Based on intermarket analysis, the USD/JPY has challenged the former range support of 111.60 on last Friday, 31 March 2017 in the Asian session (likely due to Japanese financial year-end window dressing) but does not have a daily close above it. Technical elements are still negative that advocate for a further potential decline towards the 109.10/108.40 medium-term support zone. Given its direct correlation with the Nikkei 225, further downside potential in the USD/JPY will reinforce further weakness in the Nikkei 225 (refer to the 3rd chart).

- The significant medium-term support of the Index rests at the 18700/640 zone which is defined by the 18 January 2017 swing low, a former congestion area from 09 September/15 December 2015, the 0.764 Fibonacci projection of the recent decline from 14 March 2017 high to 22 March 2017 low and now the lower boundary of the short-term descending channel as depicted in the 4 hour chart.

Therefore, we maintain the bearish bias below a tightened key medium-term pivotal resistance at 19240 for a potential final push down to target the 18700/640 before another up move materialises within range configuration.

However, a break above 19240 may negate the preferred bearish tone for a push up to retest 19350 and only a clearance above 19350 is likely to see a further up move to retest the 19700/735 range top in place since 09 January 2017.

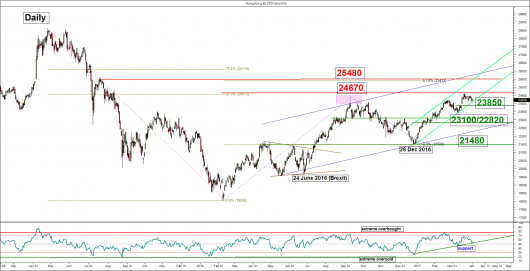

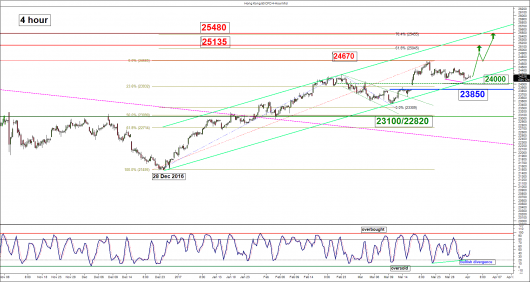

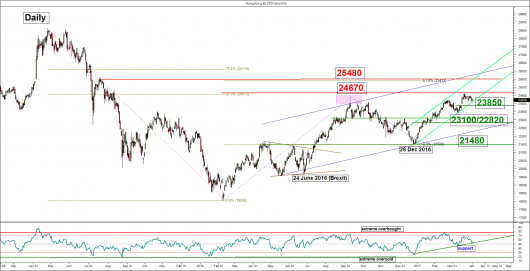

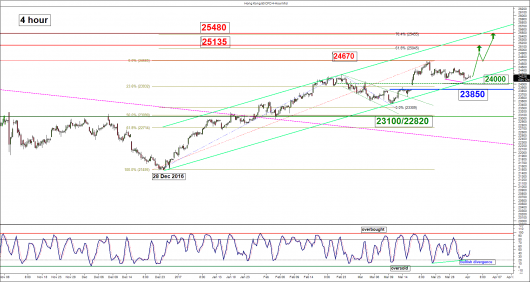

Hang Seng Index – End of pull-back, start of a new potential upleg

(Click to enlarge charts)

(Click to enlarge charts)

Key Levels (1 to 3 weeks)

Intermediate support: 24000

Pivot (key support): 23850

Resistances: 25135 & 25480

Next support: 23100/22820

Medium-term (1 to 3 weeks) Outlook

Last week, the Hong Kong 50 Index (proxy for Hang Seng Index futures) had staged the expected pull-back towards the 24000 intermediate support (printed a low of 24090 on last Friday, 31 March 2017).

Please click here for a recap on our previous weekly technical outlook report.

Current key technical elements are as follow;

- The recent decline from 24670 swing high area of 21 March 2017 has led the price action of Index to rest just above the lower boundary of its medium-term ascending channel now acting as support at 24000 (see 4 hour chart).

- The daily RSI oscillator is now also at its corresponding ascending trendline support in place since 28 December 2016. In addition, the shorter-term (4 hour) Stochastic oscillator has just flashed a bullish divergence signal at its oversold region. These observations suggest the las week’s downside momentum of price action has started to abate where a new potential upleg of the Index may materialise at this juncture.

- The significant medium-term resistance stands at 25135/480 zone which is defined by the upper boundary of the ascending channel and the 0.618/0.764 Fibonacci projection of the up move from 28 December 2016 low to 23 February 2017 high projected from 09 March 2017 low.

Maintain bullish bias and as long as the 23850 medium-term pivotal support holds, the Index is likely to form a potential new upleg to target the next resistances at 25135 and 25480.

However, failure to hold above 23850 may invalidate the bullish scenario to see a deeper decline towards the next support at 23100/22820.

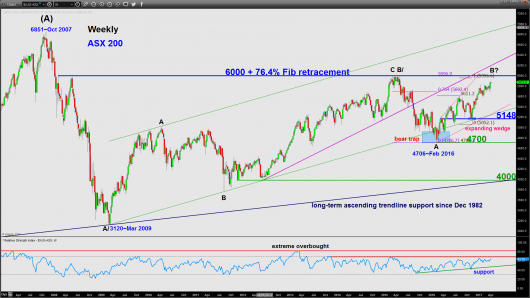

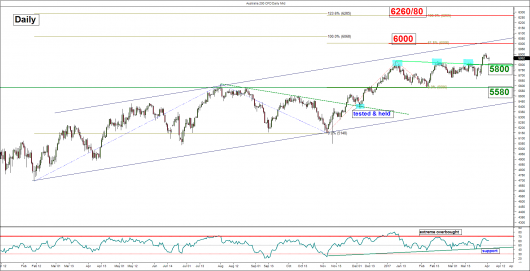

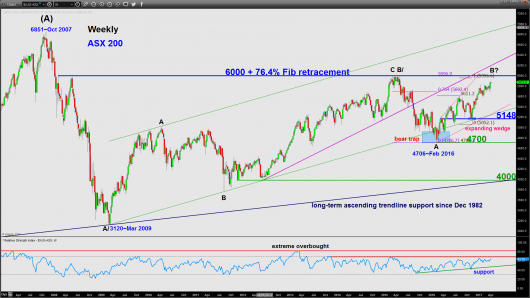

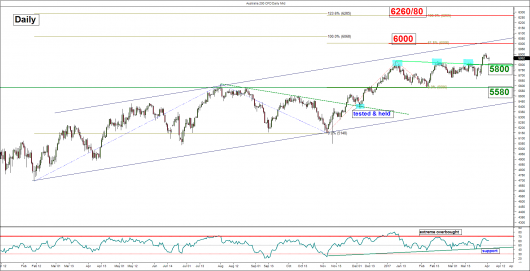

ASX 200 – Turn bullish towards 6000 key long-term resistance

(Click to enlarge charts)

Key Levels (1 to 3 weeks)

Intermediate support: 5817

Pivot (key support: 5800/772

Resistances: 5945 & 6000

Next supports: 5674 & 5580/70

Medium-term (1 to 3 weeks) Outlook

Last week, the Australia 200 Index (proxy for the ASX 200 futures) had traded higher and broke above the 5830/50 medium-term pivotal resistance.

Current key technical elements are as follow;

- The Index is now approaching the key long-term resistance at 6000 (see weekly chart).

- The daily RSI oscillator is now hovering just below an extreme overbought level but without any bearish divergence signal. In addition, the shorter-term (4 hour) Stochastic oscillator has just exited from its oversold region. These observations suggest that upside momentum of price action remains intact which reinforces a potential push up towards the 6000 long-term resistance.

- The significant medium-term support now rests at 5800/770 which is defined by the former range top from 09 January 2017 high and close to the 50% Fibonacci retracement of the recent rally from 22 March 2017 low of 5662 to last Thursday, 30 March 2017 high.

Therefore, as long as the 5800/772 medium-term pivotal support holds, the Index is likely to see a further potential up move to target 5945 before the 6000 key long-term resistance.

On the other hand, a break below 5772 may invalidate the bullish tone for a deeper decline to retest the minor swing low areas of 01 March/22 March 2017 at 5674 and even 5580 next.

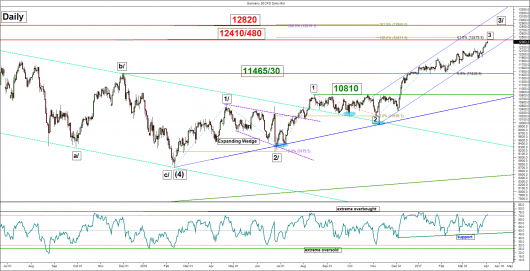

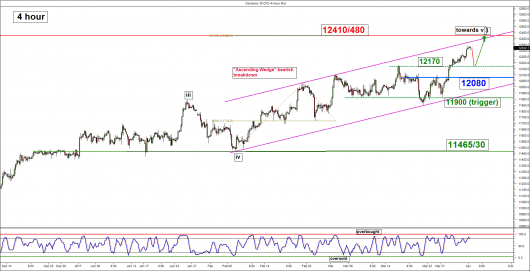

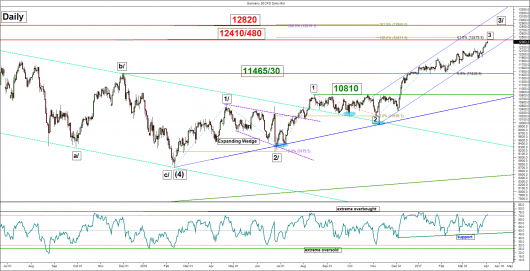

DAX – Turn bullish, now minor pull-back before new potential rise

(Click to enlarge charts)

(Click to enlarge charts)

Key Levels (1 to 3 weeks)

Intermediate support: 12170

Pivot (key support): 12080

Resistance: 12410/480

Next supports: 11900 & 11465/30

Medium-term (1 to 3 weeks) Outlook

The Germany 30 Index (proxy for the DAX futures) had failed to break below the 11900 downside trigger level and surpassed the 12280 medium-term pivotal resistance on last Friday, 31March 2017. Therefore, the preferred medium-term bearish scenario has been invalidated.

Current technical elements are as follow;

- The longer-term chart of the DAX continues to exhibit bullish elements with the next significant resistance zone at 13100/13260 as per defined by a Fibonacci projection cluster (see monthly chart).

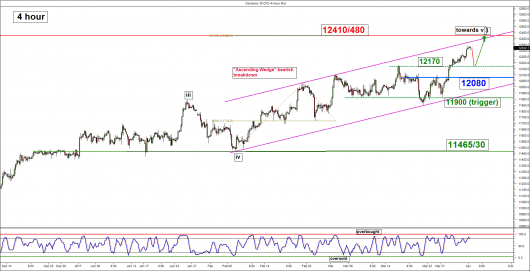

- The daily RSI oscillator has continued to inch upwards and still has some “room” left before it reaches an extreme overbought level. This observation suggests that there is still residual upside momentum left to support another potential round of push up for the Index (see daily chart).

- The shorter-term (4 hour) Stochastic oscillator has almost reached its extreme overbought level which highlights the risk of a minor pull-back in price action of the Index at this juncture (see 4 hour chart).

- The significant medium-term support now rests at 12080 which is defined by the former swing high/congestion area of 20 March/25 March 2017 and close to the 50% Fibonacci retracement of the recent rally from 22 March 2017 low of 11850 to last Friday, 31 March 2017 high.

- The significant medium-term resistance stands at 12410/480 which is defined by the current all-time high area seen in April 2015, a Fibonacci projection cluster and the upper boundary of a short-term ascending channel in place since 07 February 2017 low (see daily & 4 hour charts).

Therefore, the Index is now may see a minor pull-back first towards the 12170 intermediate support with maximum limit set the 12080 medium-term pivotal support before a potential new upleg materialises to target 12410/480 next.

However, failure to hold above 12080 may jeopardise the bulls to see a deeper pull-back to retest 11900 (lower boundary of the short-term ascending channel). Only a break below 11900 is likely to open up scope for a corrective decline to target the next support at 11465/30.

Charts are from City Index Advantage TraderPro & eSignal

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.