If we look at data over the last couple of weeks, it is hard to argue that the US economy is not slowing. Core PCE and super core PCE surprised to the downside last week, and the soft ISM services report is the latest to bring into question whether the Fed can be more aggressive with their rate cuts. This makes tomorrow’s NFP report all the more important, as it could confirm the warning signs elsewhere and become a serious drag on the US dollar if the data disappoints.

However, traders would do well to remember that the headline NFP figure has a tendency to outperform the consensus around 2 times out of three. Not for the first time, we are once again heading to NFP report on expectations for it to soften. Should NFP have another upside surprise up its sleeve, it could provide an opportunity for bears to fade into the US dollar rally anticipation of lower prices in the coming weeks.

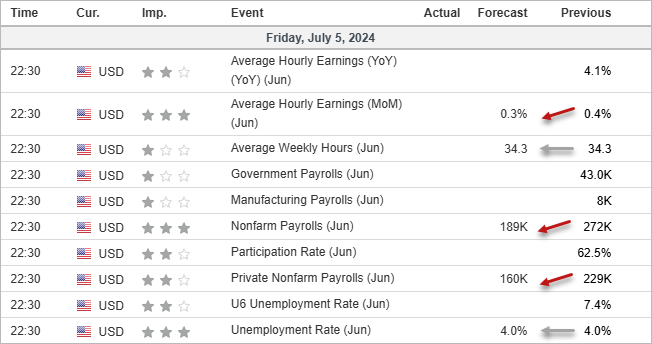

But expectations for a weak NFP report are not without merit, even if recent history suggests it is no slam dunk. Consensus estimates for tomorrow’s NFP report have pencilled in a weaker job growth figure of 189k, down from 272k, and softer average hourly earnings of 0.3% compared with 0.4% prior. Unemployment is expected to remain flat at 4% (which Jerome Powell referenced as “low” earlier this week)

Recent economic data has raised expectations for a weak NFP report

- ISM services contracted at its fastest pace since the pandemic

- New orders slumped, employment contracted at a faster pace and prices paid were softer

- ADP employment fell to a 5-month low

- Jobless claims rose 1.7% and have been trending higher since the January low

- Layoffs fell to a 6-month low

- Core PCE slowed to 0.1% m/m and 2.6% y/y

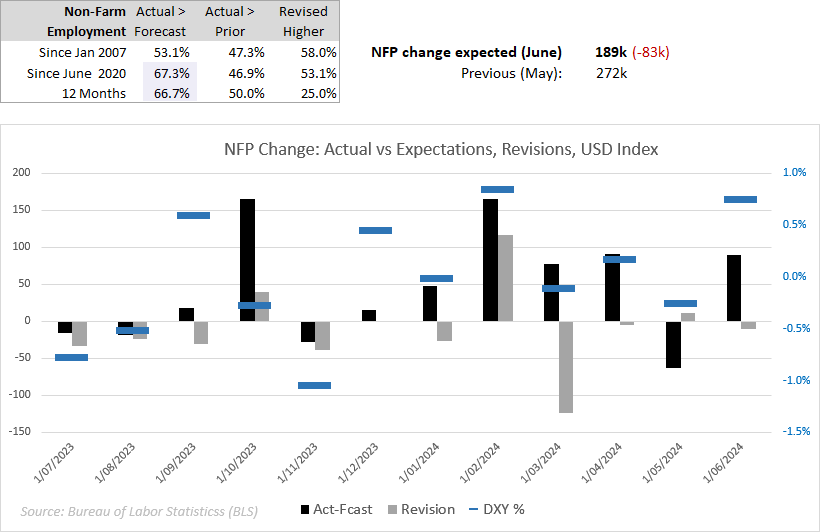

Nonfarm payroll change vs expectations, USD Index

- NFP change has exceeded expectations ~67% of the time since June 2020 (over the past 12 months)

- Since January 2007, NFP has beaten expectations just 53.1% of the time

- However, is has been lower than previous 53.1% of the time since June 2020

- Over the past year, the prior NFP has been revised lower 75% of the time

- The USD index tends to close the day relative to whether NFP has been expectations (bullish USD) or was below them (bearish USD)

- USD tracked NFP actual-expectations 11 times over the past 12 months (only one month did they diverge)

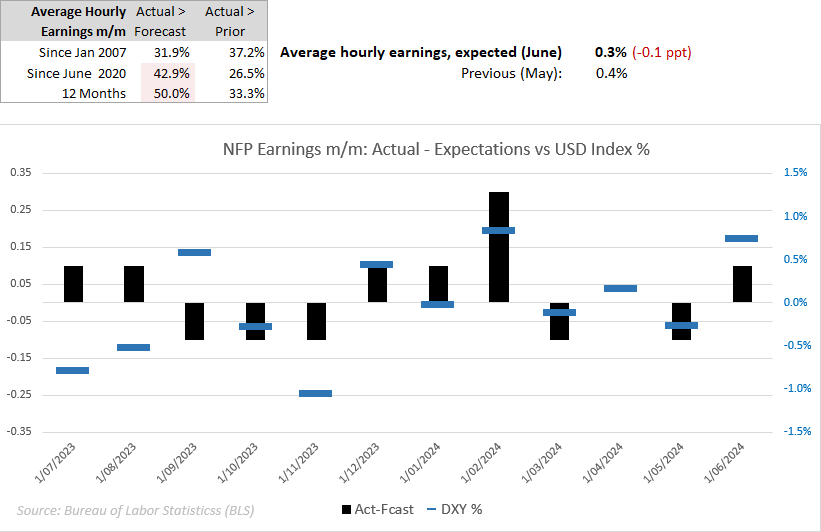

This suggests that more recently, actual NFP relative to expectations can be a decent gauge for USD direction on the day, even though the prior read tends to get revised lower and it tends not to exceed the previous read anyway. Although the stronger reactions tend to be when NFP change and average hourly earnings beat or miss expectations in tandem.

- The USD index only tracked earnings-expectations 7 times over the past 12 months

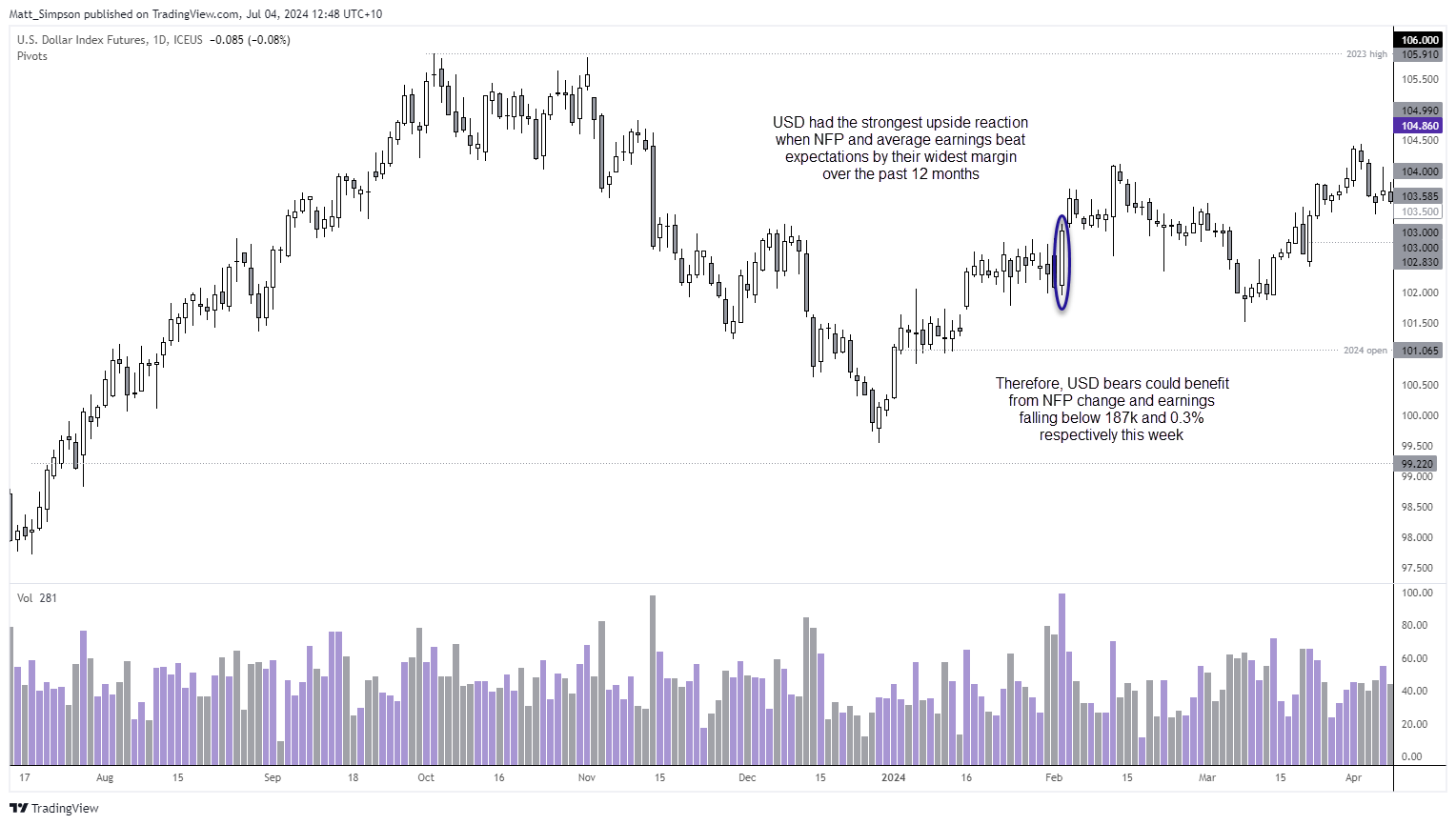

- The most bullish USD reaction landed in March (February’s NFP report) when both earnings and NFP change beat expectations by their widest margins

- Earnings tends to come below expectations ¬60-70% of the time, although over the past months it has been a coin flip at 50%

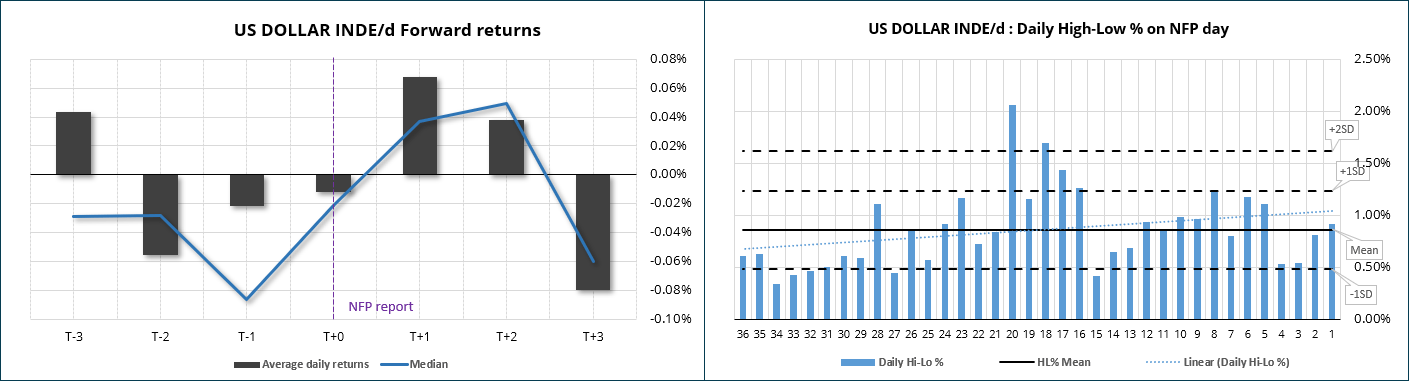

Looking at how the USD has reacted over the longer-term shows that it tends to benefit the following Monday (T+1) and Tuesday (T+2) before bearish momentum returns on the Wednesday (T+3). And this could play out nicely with the tendency for NFP to surprise to the upside and support the USD on the day, before bears seek to fade into rallies.

As mentioned previous USD analysis, the bias is to fade into rallies should NFP beat expectations in anticipation of a move down to the 1.4 and 1.3 handles over the coming weeks. And if unemployment throws a curveball into the mix with a print of 4.1% or higher, bears could get to work much sooner than later.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade