US futures

Dow futures -2.3% at 35035

S&P futures -1.7% at 4628

Nasdaq futures -1.06% at 16224

In Europe

FTSE -2.9% at 7093

Dax -2.96% at 15441

Euro Stoxx -3.5% at 4141

Learn more about trading indices

Rotation out of high growth tech after Powell re-nomination

US stocks are set to open sharply lower after the discovery of a new covid strain, which could prove to be resistant to the already developed covid vaccines. The new variant found in South Africa has prompted the British government to ban flights to six southern African nations . There are still a lot unknowns here. The big question is whether it is able to evade vaccines or not? Even so, given the thin market volumes due to Thanksgiving big swings on bad news is to be expected. The sell off does feel a little over done - this wouldn't be the first time that a strain has appeared disastrous on paper but then failed to really spread.

Even so, the covid trade is back on with airlines and oil stocks taking a hit, whilst stay at home tech stocks such as Peloton and Zoom are sharply higher. The Nasdaq has fallen less than its peers.

In addition to risk off, the market is starting to doubt the Fed's ability to raise interest rates sooner rather than later. As a result the USD is dropping and banks trade under pressure.

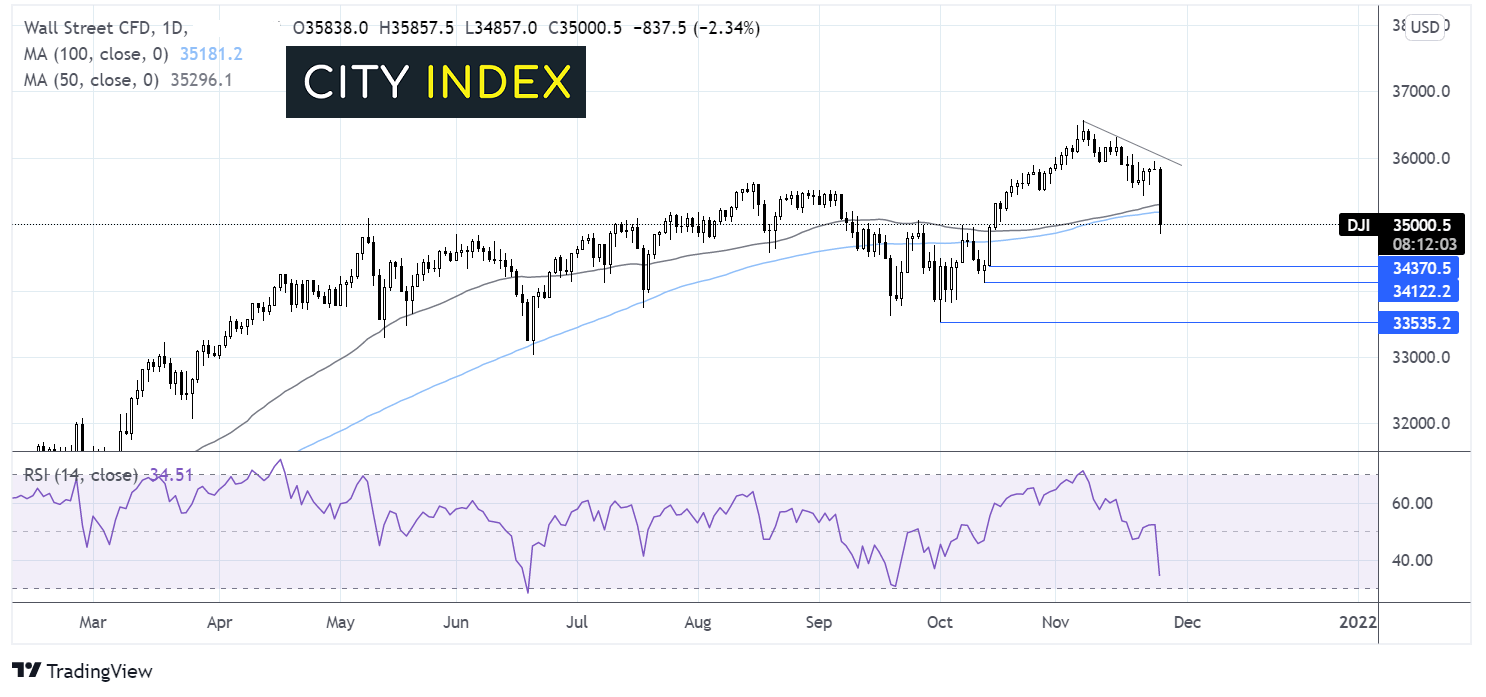

Where next for the Dow Jones?

The Dow has been trending lower since hitting the all time high on 8th November. Today’s selloff has take the price below the 50 & 100 sma. The RSI suggests that there is more downside to come. Sellers could look to target 34370, 34100 ahead of 33535. Buyers will need to retake the 50 sma at 35300 for any hope of a recovery.

FX – USD falls amid doubts over Fed tightening

The USD is falling despite risk off trade. Investors are actually selling out of the safe haven USD and this is because they are re-assessing the likelihood of a rate hike by the Fed. The US central bank is unlikely to tighten interest rates if there is another potential lockdown around the corner.

EUR/USD is surging as the ECB doesn’t look so dovish as before amid growing doubts of the Fed ability to hike rates. The apparent convergence of monetary policy is supporting the common currency even as covid cases rise across the EU.

GBP/USD +0.16% at 1.3344

EUR/USD +0.73% at 1.1290

Oil holds most of yesterday’s gains

Oil prices have tumbled over 5% on news of the new South African virus strain. Renewed travel restrictions and the prospect of more lockdowns is hurting the demand outlook. This is particularly the case given rising cases in Europe.

In addition to demand outlook concerns, there are growing supply side fears as the US and other oil consuming countries plan to release emergency oil reserves, even as OPEC warn of a supply glut next year.

WTI crude trades -5.3% at $73.72

Brent trades -5.44% at $76.72

Learn more about trading oil here.

Looking ahead

N/A