US futures

Dow future -0.16% at 39065

S&P futures 0.02% at 5478

Nasdaq futures -0.01% at 19744

In Europe

FTSE -0.08% at 8222

Dax 0.22% at 18204

- Continuing jobless claims rise to the highest level since 2021

- Stocks muted ahead of tomorrow’s inflation data

- Micron Technology's outlook disappoints dragging chip stocks lower

- Oil rises as geopolitical tensions offset demand concerns

Continuous jobless hit multi-year high

U.S. stocks are pointing to a higher start as investors digest the latest jobs and GDP data from the US and disappointing guidance from Micron Technologies. The mood is cautious ahead of tomorrow’s core PCE data tomorrow.

Initial jobless claims came in weaker than expected at 233K, down from 236K. Continuing claims, which are a proxy for the number of people receiving benefits, rose to 1.84 million in the week ending June 15th, their highest level since the end of 2021. This data is considered a warning sign that it takes longer for unemployed people to find a job.

The data suggests that hiring has slowed significantly as unemployment ticked up to 4% for the first time in two years. San Francisco Fed President Mary Daly warned of labour market risk. She considered the labour market to be reaching a crucial point where further softening could lead to a rise in joblessness.

A weaker jobs market could encourage the Federal Reserve to cut interest rates sooner rather than later. The data comes as US households’ pandemic savings are dwindling and delinquencies are rising.

Meanwhile, Q1 GDP was revised higher to 1.4% annualised, up from 1.3%, and the core PCE index was also revised higher to 3.7%, up from 3.6.

Corporate news

Micron Technologies is set to open 6% lower after the chipmaker unveiled a disappointing current quarter outlook. Given the surge in enthusiasm surrounding AI, the company faced high expectations.

Levi Strauss is expected to open over 16% lower after the jeans manufacturer posted a miss in Q2 revenue amid weak demand at dockers for its Chino's brand.

Walgreens Boots is set to open almost 5% lower after the pharmacy chain cut its fiscal 2024 guidance amid a deteriorating retail environment and said that it would close more stores.

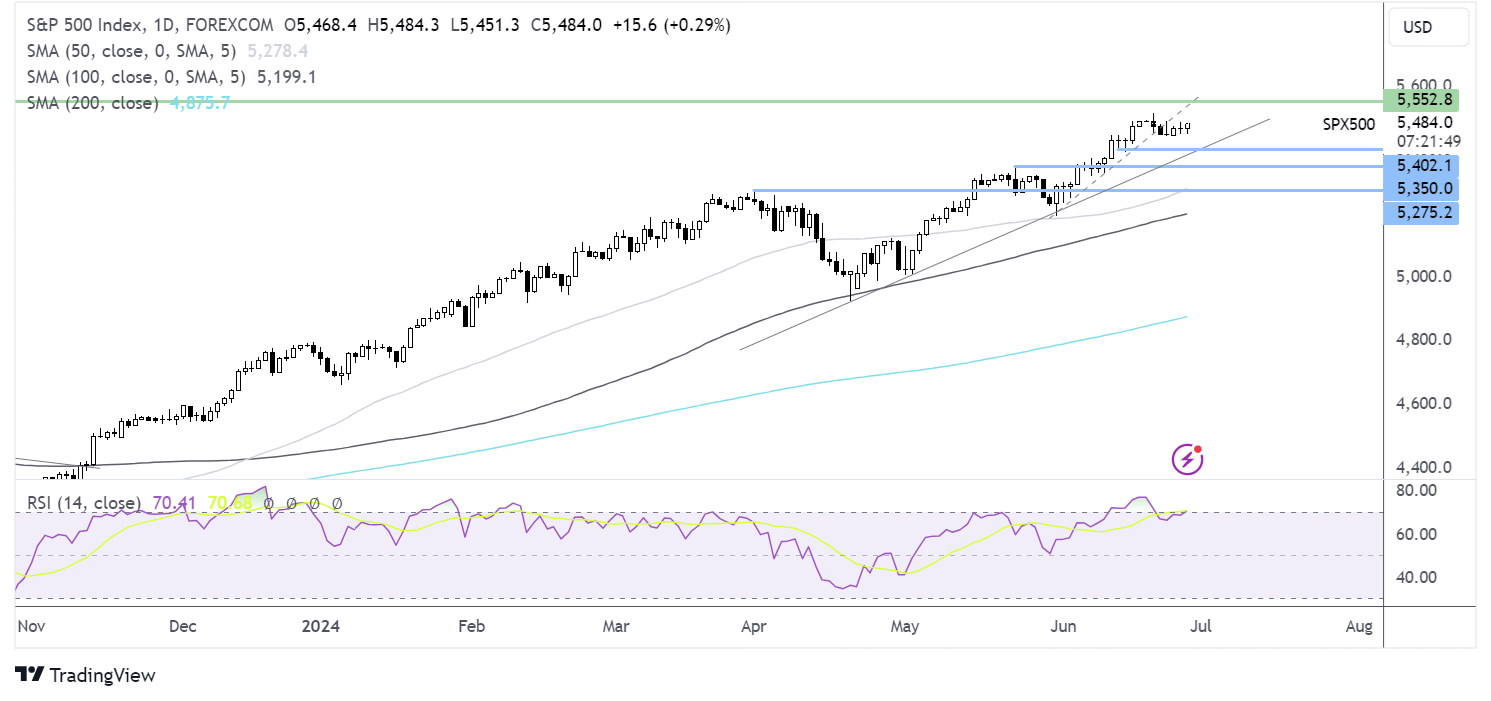

S&P 500 forecast – technical analysis.

The S&P 500 is consolidating below its record at 5516. The consolidation has brought the RSI out of overbought territory. While the index has fallen below its near-term rising trendline, the longer-term trendline remains intact. Buyers will look to rise above 5500 and 5516 to fresh record highs. Support can be seen at 5400, the mid June low and the rising trendline support.

FX markets – USD falls, GBP/USD rise

The USD is falling after mixed data. Continuing claims point to a weakness in the labour market. However, Q1 core PCE was hotter than expected at 3.7%.

EUR/USD is rising amid a weaker USD and despite eurozone economic sentiment coming in weaker than expected. Economic sentiment in the region softened in June to 95.9, down from 96. The data comes after weak data from Germany this week, which raised concerns over the outlook for the region and its economic recovery.

USD/JPY is falling from the 38-year high of 169.90 reached overnight. Stronger-than-expected Japanese retail sales have helped to boost the yen, although it remains in intervention territory. The pair has risen to levels last seen in 1986 on Fed-BoJ divergence.

Oil hovers around a 2-month high

Oil prices are inching higher on Thursday as concerns over supply disruption as geopolitical tensions rise in the Middle East offset demand worries after a surprise build in US inventor ease.

According to the US Energy Information Administration, stockpiles rose by 3.6 million barrels, well above the expected drawdown of 2.9 million barrels. Gasoline stockpiles also rose by 2.7 million barrels, compared with an expected 4 million drawdown.

The ramping up of geopolitical risk in the Middle East has pushed demand worries lower. Tensions between Israel and Lebanon's Hezbollah have escalated in recent weeks amid fears that the war could start to draw in other major oil producers, such as Iran.