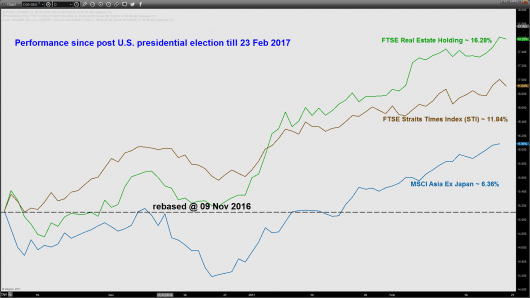

Since post U.S. presidential election, 09 November 2016, the Singapore stock market has rallied in line with its global peers even outperformed the regional MSCI Asia ex Japan benchmark Index (11.84% versus 6.36% – refer to chart 1)

One of the best outperforming sector till to date is the property developers where the FTSE Real Estate Holdings Index that comprises led the benchmark Straits Times Index (STI) by a margin of around 4%. This current outperformance of Singapore property stocks can be attributed to these main reasons as follow;

- Stabilisation in private residential property prices – Based on the latest data from Urban Redevelopment Authority (URA), the Singapore Private Residential Price Index has recorded a decline of 3% y/y in 2016 where the current slide in private property prices has started to abate as compared to the -3.7% seen in 2015 and -4.0% in 2014. Overall, the Index has declined by 11.2% from its peak printed in September 2013.

- Reduction in property supply that supports prices and reduce vacancy rates – According to URA, there were 26,288 completed private residential and executive condominiums in 2016 and the number of such completed projects are forecasted by URA to decline to 18,307 units in 2017 and further slide to 13,785 units in 2018.

- Low valuation – The price to book (P/B) ratio of the FTSE Real Estate Holdings Index stands at around at 0.70 which is still 18% below its long-term P/B ratio average of 0.83.

Chart 1 – Performance of Singapore Property Developers

(Click to enlarge chart)

(Click to enlarge chart)

However, there are several fundamental factors that may put a pause to the current rally as follow;

- Interest rates – The 3-month Singapore Interbank Offered Rate (SIBOR) has increased by around 7bps since post U.S. presidential election to 0.94% as at 17February 2017. Singapore’s interest rates track U.S. interest rates, thus the movement of SIBOR is dependent on U.S. monetary policy In past one week, Fed’s speeches from key officials such as chairwomen Janet Yellen, Loretta Mester (Cleveland) and Patrick Harker (Philadelphia) have indicated a higher tolerance of higher interest rates given the current state of the U.S. economy where its labour market continues to improve. These recent hawkish comments from these Fed officials have increased the prospect of a Fed’s interest rate hike in the next FOMC meeting on 15 March 2017. As at 23 February 2017, the Fed Fund futures market has priced in a 22% probability of a 25bps hike in the upcoming March FOMC meeting, the probability of a rate hike has increased from 13% around a week ago. Thus, if SIBOR, a benchmark interest rate for housing loans continues to inch upwards in line with a tightening U.S. monetary policy, the demand for Singapore private properties may be lesser going forward.

- Property cooling measures – Singapore central bank, MAS had introduced a set of cooling measures back in 2013 to stabilise the Singapore property market from the risk of forming a similar “bubble-liked” environment in 1996. The latest government Budget for 2017 announced on last Monday, 20 February 2017, did not contained any “sweeteners” for the private property market and several key ministers have reiterated that the current set of cooling measures are expected to stay for now.

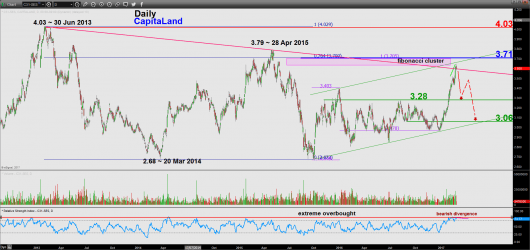

Now, let us examine the technical elements of one of the major property developers, CapitaLand

Technical Outlook on CapitaLand (SGX: C31)

(Click to enlarge chart)

Key technical elements

- The recent 23% rally from its 27 December 2016 low of 2.96 to the 23 February 2017 high of 3.65 has stalled right at a major descending trendline resistance from 30 June 2013 high.

- The aforementioned major trendline resistance also confluences closely with other elements; the upper boundary of the ascending channel in place since September 2015 low and a Fibonacci cluster level at 3.71.

- Interestingly, bearish exhaustion signs have started to emerge at this juncture. Firstly, the stock has formed a daily “Spinning Top” candlestick pattern on 23 February 2017. Secondly, the daily RSI oscillator has traced out a bearish divergence signal at its extreme overbought level. These observations suggest that the current upside momentum of price action has started to wane and the stock faces the risk of at least a mean reversion to the downside.

- The significant supports rests at 3.28 (former swing high areas of 01 August/11 August 2016) follow by 3.06 (the lower boundary of the ascending channel).

Key levels (1 to 3 weeks)

Pivot (key resistance): 3.71

Supports: 3.28 & 3.06

Next resistance: 4.03 (30 June 2013 high)

Conclusion

The recent rally seen in CapitaLand has appeared to be overextended and as long as the 3.71 pivotal resistance is not surpassed, CapitaLand is likely to see a potential multi-week mean reversion decline to target the 3.28 and a break below 3.28 may trigger a further downleg towards the next support at 3.06.

However, a clearance above 3.71 (a daily close is required) may invalidate the bearish bias to see a further squeeze up towards the next resistance at 4.03.

Charts are from eSignal

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.