- Oil fell away from $80 last week

- Concerns over China overshadowed OPEC+’s supply cut extension

- US inflation data could be key driver this week

- OPEC’s monthly market report is to be released

- WTI tests the 200 SMA support

Oil ended the week around $78, as the price eased back from the psychological $80.00 a barrel, which it has struggled to break meaningfully above.

Oil has traded in a narrow range so far this year, with last week seeing even less volatility than usual. Brent traded in its narrowest range since September 2021.

OPEC+ extending voluntary cuts and rising tensions in the Middle East were offset by concerns over surging supply from non-OPEC producers and doubts over China’s demand outlook.

On Friday, China’s National Petroleum Corp’s Economic and Technology Research Institute warned that China’s oil demand had entered a low growth phase due to the increased use of EVs. It added that liquified natural gas will replace around 12% of China’s gasoline and diesel consumption this year alone. This news could continue to weigh on oil prices as the new week kicks off.

Looking out across this week, oil traders will monitor U.S. economic data, particularly inflation figures, which will provide further clues about when the Fed may cut rate, the OPEC monthly market report, and the weekly EIA inventory data.

OPEC monthly market report

Attention will also be paid to the OPEC monthly market report, which is due to be released on Tuesday. The report could offer support to oil prices if OPEC maintains its optimistic outlook on global oil demand growth in 2024 and 25. In its previous report, OPEC said that it expects the increase in oil demand to be far ahead of growth in non-OPEC supply.

Last month, OPEC estimated that the world's demand for oil would increase by 2.25 million barrels per day in 2024 and another 1.8 million barrels per day in 2025 due to a strengthening Chinese economy. The market will be watching closely to see whether the forecast holds in light of China's growth targets for 2024 and the lack of a significant stimulus.

Oil inventory data

Attention will also be on the weekly oil inventory data, which could provide clues on fuel demand for the upcoming driving season in the US.

Last week, the EIA’s weekly US inventory report was rather bullish, showing a larger-than-forecast drawdown. When inventories are larger or smaller than expected, these weekly reports can often impact the price of oil.

US inflation

Finally, the US inflation data will also be very much in focus. The USD trades at a 7-week low on bets that the Fed will loosen monetary policy sooner rather than later. Should US CPI cool it would further fuel bets of a Federal Reserve interest rate cut, which is likely to pull the dollar lower. This would support oil prices, making oil cheaper for buyers of our other currencies. The prospect of an interest rate cut is also good news for the oil demand outlook as economic growth is expected to increase.

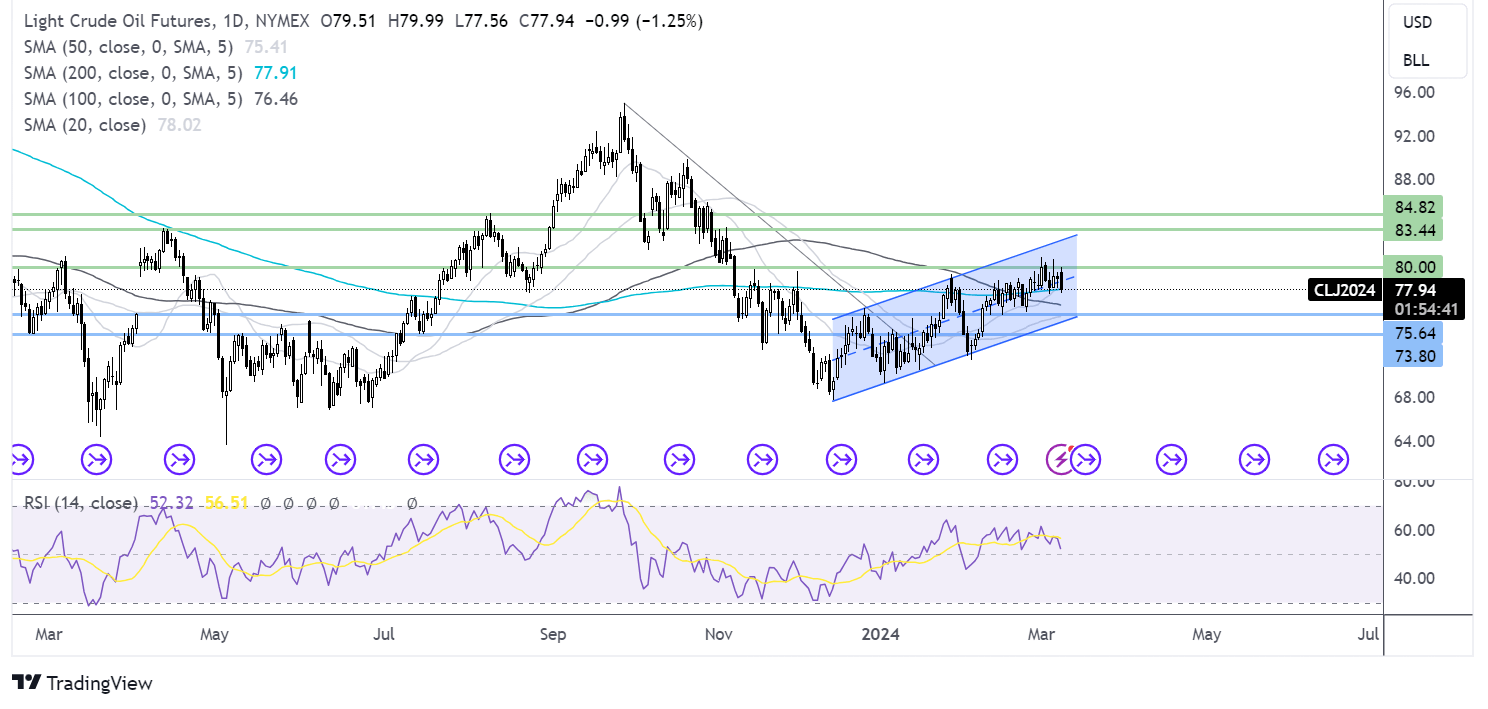

Oil (WTI) forecast – technical analysis

Oil trades within a rising channel. However, the price ran into resistance around 80.00 and has eased back, testing the 200 SMA.

A break below here will bring the 75.50 mid-February low into focus ahead of 73.80.

Should the 200 SMA support hold, buyers will look to test the 80.00 resistance ahead of 83.50, April 2023 high, and 84.65, the August high, ahead of 85.00.