(Click to enlarge charts)

(Click to enlarge charts)

What happened earlier/yesterday

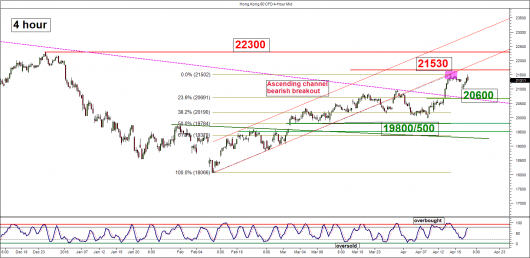

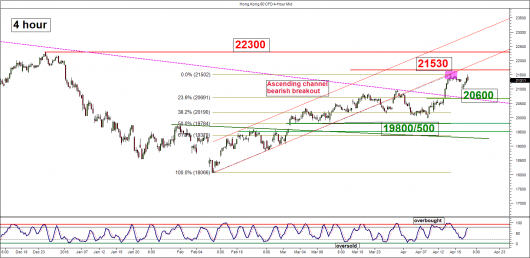

The Hong Kong 50 Index (proxy for the Hang Seng Index futures) has shrugged the earlier sell-off triggered by the failed Doha talks on oil production freeze between OPEC and non-OPEC nations. It has rallied but failed to surpass the 21530 resistance (upper range of medium-term neutral zone). Click here for more details on our latest weekly outlook/strategy.

Key elements

- Since the bearish breakout of its former ascending channel’s lower boundary on 31 March 2016, any advances seen in price action is being capped by its pull-back resistance at 21530.

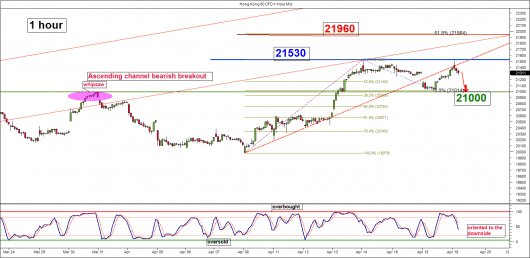

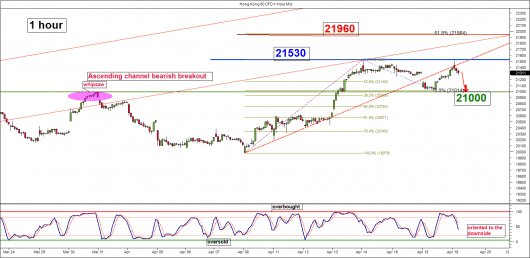

- This morning session rally has stalled again at the 21530 resistance which also coincides with the pull-back resistance of a former trendline support (in dotted red) from 08 April 2016 low @9am (see 1 hour chart)

- The hourly (short-term) Stochastic oscillator is oriented to the downside and still has room before reaching its extreme oversold level. This observation suggests that downside momentum remains intact.

- The near-term support rests at yesterday’s swing low area at 21000 which has tested the former swing high area of 30 March 2016.

Key levels (1 to 3 days)

Pivot (key resistance): 21530

Supports: 21000

Next resistance: 21960

Conclusion

As long as the 21530 pivotal resistance is not surpassed, the Index is likely to see a short-term decline towards the 21000 support.

On the other hand, a break above the 21530 pivotal resistance is likely to open up scope for an extension of the countertrend rally from 12 February 2016 low to target the next resistance at 21960 in the first step.

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.