- GBPUSD Analysis: a weekly uptrend ceiling is being approached near 1.2730

- Upcoming CPI metrics are awaited on Wednesday to confirm a 3-month downtrend streak

- BOE Governor Bailey’s speech on Tuesday is awaited to clarify the rate cut timeline

Latest statements from Governor Andrew Bailey reflected the bullish potential of the UK economy, as he claimed that markets have not yet priced in the full impact of the coming rate cuts below the 16-year highs.

The optimism of the BOE will be confirmed by the consumer price inflation results on Wednesday if the metrics revealed a 3-month downtrend streak.

From an investment perspective, the latest BOE release highlighted an underperformance in productivity growth and business investment. In terms of the Final Purchasing Manager’s Index, the previous manufacturing PMI remained below expansion levels with the latest result at 49.1. Meanwhile, the services PMI increased further to 55, reflecting a generally mixed signal.

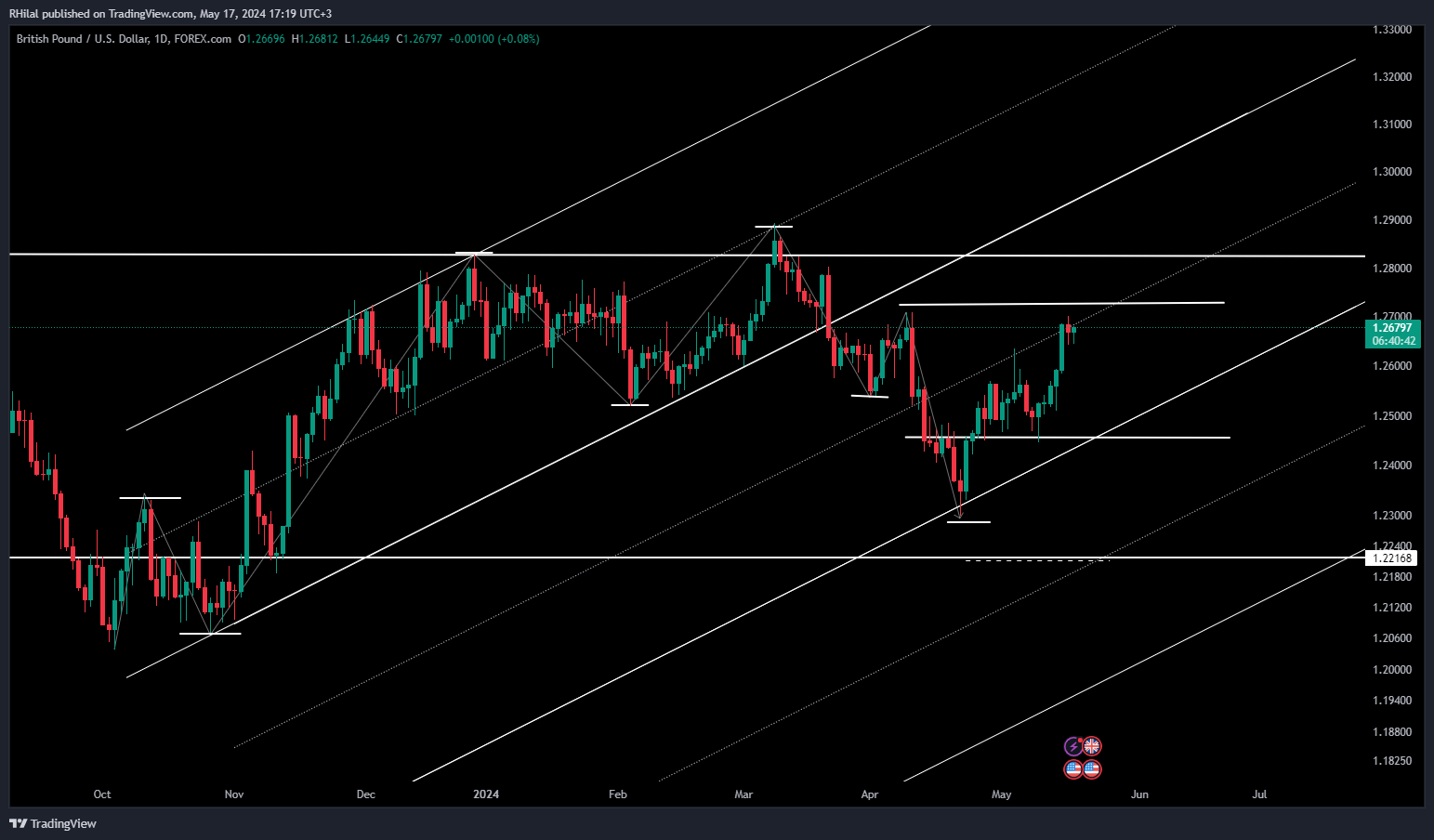

GBPUSD Analysis – Daily Timeframe – Logarithmic Scale

The downward duplicate of this year’s up trending parallel channel remained valid this week, with the 1.27 resistance lying in the mid-channel range. A break above 1.2730 zone is needed to confirm further uptrends toward the upper end of the channel near March highs. The resistance near march highs can be encompassed in a range between 1.2830 and 1.2880. On the downside, the lower end of the duplicated channel is expected to potentially hold support near 1.2450, given the initial break below 1.25.

Another factor to consider on the GBPUSD charts is the FOMC minutes and insights. The pair’s uptrend this week was boosted by a weaker dollar amid lower U.S inflation rates, and related news can impact the chart once again.